Credit Card

Apply for the Chase Freedom Unlimited®: Fraud protection and much more!

In this Chase Freedom Unlimited® application guide you will learn how to apply for this card to start enjoying its 1.5% cash back reward.

Advertisement

Get a Card with Cashback Rewards, No Annual Fees, and Exclusive Perks: A Step-by-Step Guide to Apply Online

The Chase Freedom Unlimited® card offers cash back rewards on all purchases, and you can apply for it online. Earn a flat rate of 1.5% on every purchase with no annual fee!

The card has no annual fee, provides fraud protection, and offers purchase protection, extended warranty, and roadside assistance. Also, no minimum redemption.

As a cardholder, you’ll enjoy exclusive perks such as discounts on travel, dining, and entertainment. Access to a 24/7 customer service team and free credit score monitoring.

Are you ready to apply for the Chase Freedom Unlimited® card? Follow our step-by-step card application guide to simplify the process and become a cardholder today.

Chase Freedom Unlimited® Online application process

Are you prepared to become a Chase Freedom Unlimited® cardholder? The Chase Freedom Unlimited® application process for this card is very simple, and you can do it entirely online.

Begin by visiting Chase’s main page and clicking on the “Credit Cards” icon. Next, select the “Explore Credit Cards” tab to go to the credit card page.

Once there, scroll down to find the Chase Freedom Unlimited® card and click on the “Learn more” button.

You can choose to apply as a guest or sign in to apply faster. We recommend applying as a guest for simplicity, but the choice is yours.

After clicking to apply as a guest, the website will take you to the application form page. Enter your personal information, including your first and last name, date of birth, mother’s maiden name, and Social Security Number.

Scroll down to provide your address information, email address, and phone number.

Check the box to provide your electronic signature, which will authorize the Social Security Administration to disclose your social security number verification.

Next, indicate your type of residence, employment status, and gross annual income. You can also choose to receive your billing digitally instead of through mail and add an authorized user.

Finally, scroll down to read the pricing and terms document. If you agree with the terms, check the box, hit submit, and you done! You have finished the Chase Freedom Unlimited® application process.

Now just lay back and relax. The issuer will give you a response in just a few minutes, possibly less.

Then, if you get approved, you will get your card on the mailing address you’ve provided in a couple of business days.

Another great option: Upgrade Triple Cash Rewards Card

If you’d like to have a look at other offers before deciding, we have another card that you might like. Check out the Upgrade Triple Cash Rewards Card.

This is a credit card that packs a punch with its one-of-a-kind combination of benefits for consumers. Get ready to earn a whopping 3% cash back on your home, auto, and health expenditures!

Not only that, you’ll also receive 1% cash back on all other transactions, making it the go-to option for anyone who frequently makes purchases in these areas.

If this sounds like an interesting offer to you, click the link below and read our complete review to learn all you need to know about it.

How to get your Upgrade Triple Cash Rewards Card

In this Upgrade Triple Cash Rewards Card application guide you will see how you can get this card in just a few minutes.

About the author / Danilo Pereira

Trending Topics

Mission Lane Visa® Credit Card review

Read this review to discover all the features and benefits of the Mission Lane Visa® Credit Card and see if it’s the right fit for you!

Keep Reading

Upgrade Card review: No annual fee, foreign transaction fee; reports to credit bureaus

Want to earn 1.5% cash back on all purchases? Then this card might just be for you. Check our Upgrade Card review.

Keep Reading

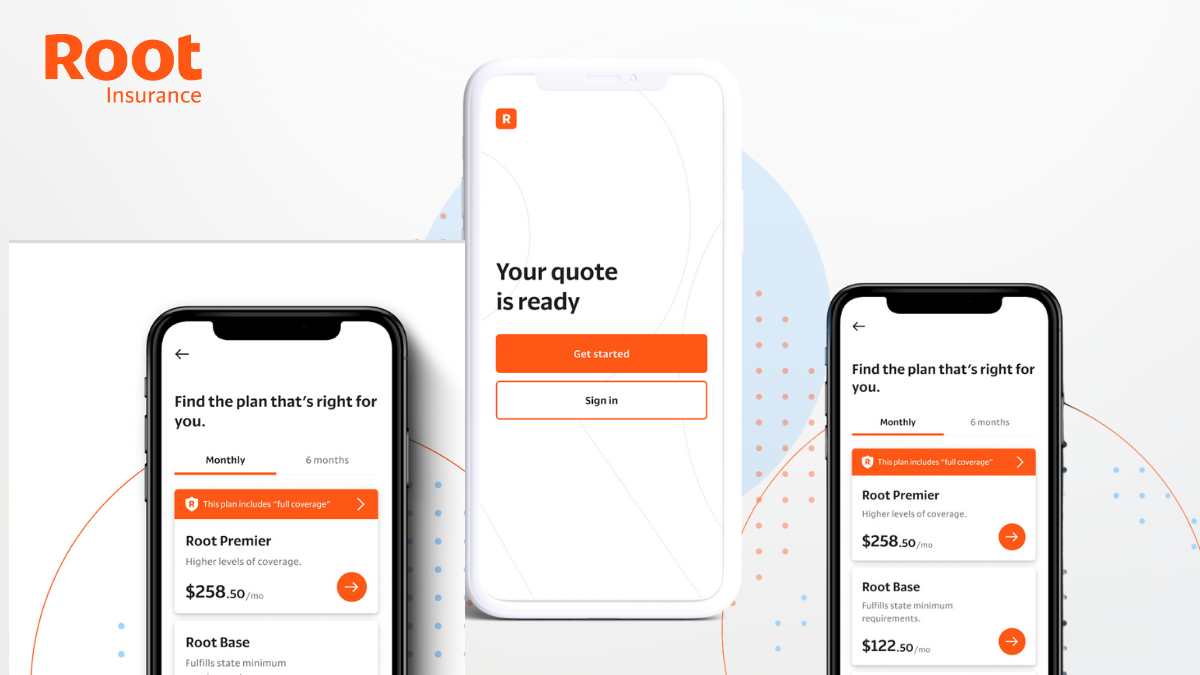

Root Car Insurance: Drive Smart, Save Big

Uncover the innovative approach of Root Car Insurance as we dive into its transparent pricing model and mobile app convenience.

Keep ReadingYou may also like

LendingClub Personal Loans: how does it work?

Learn everything you need to know about how LendingClub Personal Loans works and make an informed decision about it for your future.

Keep Reading

Streamlining Finances: PayPal Prepaid Mastercard Review

Discover the pros and cons of the PayPal Prepaid Mastercard® in our in-depth review. Uncover the benefits and limitations of this card!

Keep Reading

How to apply For The Destiny Mastercard®

Learn how to apply for the Destiny Mastercard® with no security deposit and pre-qualification available. Here's how!

Keep Reading