Insurance

Root Car Insurance: Drive Smart, Save Big

Are you ready to protect your card at affordable prices? Then don't miss the Root Car Insurance! Keep reading and discover more!

Advertisement

Drive with Confidence: Trust Root Car Insurance to Protect You

Are you looking for an innovative car insurance option? Root Car Insurance may be the perfect fit for you! This company has been around since 2015.

It provides customers with modern technology to customize their coverage. In this detailed review, we’ll explore what sets Root apart from other insurers.

Root Car Insurance: how does it work?

Root Car Insurance provides drivers with customizable coverage options at competitive prices. What sets Root apart is its use of technology to determine rates.

Instead of relying on age, gender, or location to set premiums, Root analyzes driving behavior through a mobile app.

This means that safe drivers are rewarded with lower rates, regardless of other demographic factors that may influence traditional insurers.

Getting a quote and managing your policy is easy through the user-friendly app, and customers can rest assured knowing that Root is backed by top-rated insurance carriers.

Significant benefits and disadvantages you may find

When shopping for car insurance, you should always take a closer look at every aspect of the insurance you’re considering.

To help you in this task, we’ve made this list with pros and cons you can find in Roor Car Insurance:

Benefits

- Transparent Pricing: It aims to be transparent about how rates are determined. The app provides drivers with insights into their driving behavior, allowing them to understand how it impacts their rates and potentially improve their driving habits;

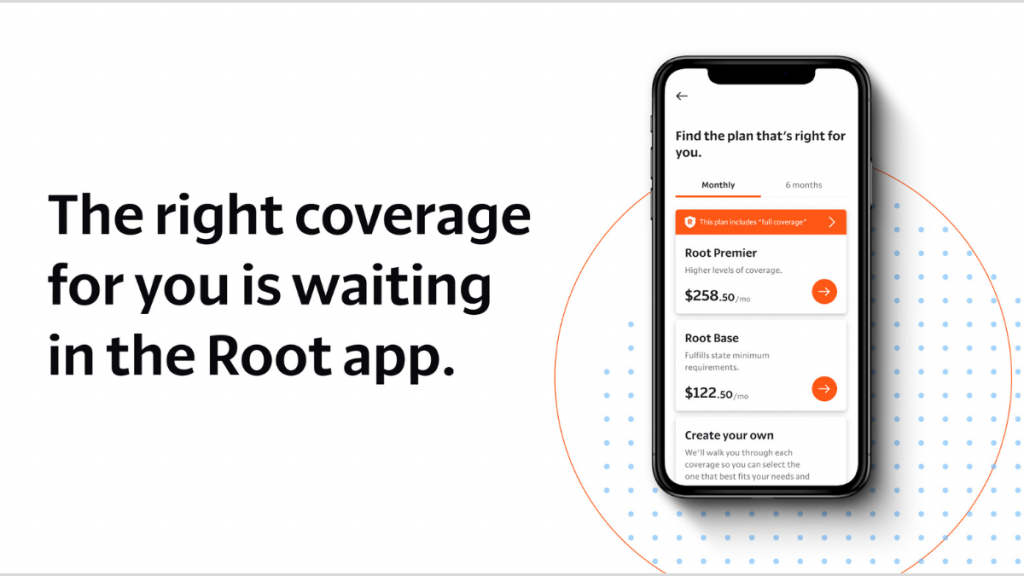

- Mobile App and Ease of Use: This company offers a mobile app that allows users to easily manage their policies, track driving behavior, and receive personalized feedback;

- Quick and Easy Sign-Up: The sign-up process can be completed entirely through the mobile app, making it convenient for customers to get coverage without visiting a physical location or speaking with an agent.

Disadvantages

- Lack of Additional Coverage Options: It focuses primarily on providing coverage for personal vehicles. If you are looking for additional coverage options like homeowners or renters insurance, you may need to consider other insurance providers to fulfill those needs;

- Claim Handling: Some customers have expressed dissatisfaction with the claim handling process, including delays in claim resolution or difficulties in getting their claims approved.

What are the requirements to get Root Car Insurance?

If you are in search of affordable car insurance that fits your lifestyle and budget, Root Car Insurance might be exactly what you’re looking for.

To qualify, applicants should be at least 18 years old, have a valid driver’s license, and own a smartphone.

Yes, you read that right – a smartphone! It uses technology to personalize every car insurance policy and ensure that you get the best possible rates.

Learn how to get your Root Car Insurance quote online

To get a quote from Root Car Insurance, you can follow these general steps:

- Visit the Root Car Insurance website or download their mobile app: You can create your account and start the process on their website. However, you’ll need to download the mobile app either way to complete the application;

- Sign up and create an account: You’ll need to create an account by providing some basic information about yourself, such as your name, contact details, and driver’s license information;

- Enable location and driving permissions: Root Car Insurance utilizes telematics technology to assess driving behavior. To receive an accurate quote, you must grant the app permission to access location services and driving data on your mobile device;

- Complete the driving test: Root Car requires you to take a test drive to evaluate your driving behavior. The app will guide you through the process, which typically involves recording your driving habits for a specified period;

- Receive your quote: Once Root Car Insurance has collected sufficient data on your driving behavior, they will provide you with a personalized quote based on their assessment. The quote will include details such as coverage options, deductible amounts, and premium rates.

Why do you need to download Root Car mobile app to get their service?

Root Car Insurance wants you to download their mobile app! Why? Because it’s integral to their telematics-based insurance model.

Once you’re in, the app will start tracking your driving behavior through cutting-edge technology.

This personalized approach means that you will be getting rates that are tailored to your very own habits behind the wheel.

By tracking crucial factors such as speed, braking, and mileage, Root Car can easily assess risk and determine premiums that customize to you.

So, don’t miss out! Get downloading, and join the millions who are getting the coverage and peace of mind they need.

What about another recommendation: American Home Shield Repair Insurance

Just like your car, your home also deserves good insurance. When it comes to home insurance, American Home Shield stands out as a reliable and reputable provider.

With a strong track record in the industry, American Home Shield offers comprehensive coverage for homeowners, protecting against unexpected events such as property damage, theft, or natural disasters.

Their policies often include coverage for dwelling protection, personal property, liability, and additional living expenses.

American Home Shield’s commitment to customer satisfaction is evident through its responsive claims handling and dedicated customer support.

To learn about AMHS costs, features, and how to apply for it, check the following link. It will take you to our full review to help you make an informed decision.

American Home Shield Repair Insurance: Say Goodbye

Find out everything you need to know about American Home Shield Repair Insurance, including how it can help protect your home and save you money. Read on!

Trending Topics

Amazon Prime Rewards Credit Card Review

Read more in the Amazon Prime Rewards review and see how you can start earning cash back rewards without hassle.

Keep Reading

Apply for the Wells Fargo Active Cash® Card

Learn how you can easily apply for a new Wells Fargo Active Cash® Card and enjoy all the benefits it has to offer. Get started today!

Keep Reading

Chase Freedom Unlimited® review: Enjoy a lengthy 0% intro APR period

In this Chase Freedom Unlimited® review you are going to learn about this card's 1.5% cash back rewards and much more!

Keep ReadingYou may also like

Financeiro Consulte recommendation – Sanlam Personal Loans

Simplify your borrowing experience with Sanlam Personal Loans: Accessible, transparent, and customer-centric solutions.

Keep Reading

How to apply for the OpenSky® Secured Visa® Credit Card

Get this credit card easily and start improving your credit. Here's how to apply for the OpenSky® Secured Visa® Credit Card.

Keep Reading

Evolve Home Loans Review: Smart Choices, Strong Foundations!

Discover the future of mortgage lending with Evolve Home Loans. Tailored solutions that make buying your dream home a reality!

Keep Reading