Loans (US)

Evolve Home Loans Review: Smart Choices, Strong Foundations!

Want to empower your journey to homeownership? Explore affordable home financing solutions with Evolve Home Loans. Find out how their innovative mortgage options can work for you.

Advertisement

Evolve Home Loans, a name synonymous with transparency and personalized solutions stands ready to accompany you on your path to homeownership. Find out how they transcend the ordinary!

With an unwavering commitment to making the mortgage process seamless and accessible, Evolve offers competitive rates and the guidance required to turn your homeownership dreams into reality.

Discover how they’ve evolved traditional home financing into a modern, client-centric experience, empowering you to embark on the next chapter of your life with confidence and financial convenience.

- APR: N/A;

- Loan amount: N/A;

- Loan purpose: Purchases, refinances, and home equity loans;

- Income needed: The income needed can vary based on your financial situation;

- Origination fee: N/A;

- Late fee: N/A;

- Terms: Common loan terms include 15-year and 30-year fixed-rate mortgages, but they also provide adjustable-rate mortgages and other specialized options;

- Early payoff penalty: Evolve Home Loans provides options both with and without early payoff penalties.

Evolve Home Loans: a complete overview

Firstly, at Evolve Home Loans, the journey to homeownership is marked by innovation, flexibility, and client-centered solutions. They offer competitive rates and ensure complete transparency.

Besides, they work closely with clients to understand their specific financial goals. To provide tailored mortgage solutions, they conduct a thorough assessment of the client’s financial situation.

Then, based on the information gathered, they present a range of suitable mortgage options to the client. Once a loan option is chosen, the client formally applies for the mortgage.

When all documents are signed, the loan funds are disbursed. These funds can be used to purchase a home, refinance an existing mortgage, or achieve the purpose you specified during the application process.

Plus, their mortgage experts are available to address questions, provide guidance, and assist with any changes or refinancing needs that may arise throughout the life of the mortgage.

Reasons you might find it a good choice

By securing a mortgage with Evolve Home Loans, you can potentially save a substantial amount over the life of your loan. Plus, they understand that each individual’s financial situation is unique.

This is why they provide personalized financing solutions with cutting-edge tools and innovative mortgage options. This makes the application process smoother and more user-friendly.

Moreover, Evolve Home Loans takes pride in its commitment to transparency. When you choose them, you won’t encounter any hidden fees or surprises along the way. Other benefits include:

- Comprehensive range of loan options;

- Expert guidance every step of the way;

- Continuous support and partnership throughout the life of your mortgage;

- Freedom to customize your mortgage with or without early payoff penalties.

Why you might consider other options

While Evolve Home Loans offers numerous advantages, like any financial institution, there are potential disadvantages to consider. For example, they have limited physical branches.

So, if you prefer in-person interactions, you might find it inconvenient. This could make face-to-face consultations or support less accessible.

Besides, depending on your location, Evolve might not have as deep a presence or local expertise compared to larger, more established lenders. This could affect their understanding of regional real estate markets.

The emphasis on personalized solutions may lead to a more thorough application process, potentially taking longer to complete compared to streamlined, automated lenders. Check out other cons below:

- Potentially limited availability in certain regions;

- Limited educational resources;

- Varying customer service experiences.

Let’s talk about the application process for Evolve Home Loans

Securing a mortgage is a significant step towards realizing your dream of homeownership. So, if you’re considering applying for a mortgage with Evolve Home Loans, you need to understand the process.

Explore below the steps to apply for Evolve Home Loans, ensuring that you’re well-prepared to embark on your journey toward owning the home you’ve always envisioned!

Learn how to apply online

Whether you’re a first-time homebuyer or someone looking to refinance, the application process with Evolve Home is designed to be transparent and efficient.

- Visit the website: Start by going to the official Evolve Home Loans website. Then, choose between the option “Purchase” or “Refinance.”

Answer questionnaire: You’ll need to answer some questions about your financial status and about the property. - Complete the form: Fill out the inquiry form with your accurate personal details, including your name and contact information. Once you’ve completed the form, submit your inquiry.

- Await a response: An Evolve Home Loans representative will review your inquiry and then get in touch with you. Then, they’ll provide information about the next steps in the application process.

- Evaluate offers: After discussing your mortgage needs with an Evolve Home Loans representative, you’ll receive loan offers that align with your requirements.

- Accept the offer: Finally, if you find a suitable loan offer, follow the instructions provided to accept it.

Another great option: Check out the Sanlam Personal Loans!

Evolve Home Loans stands as a beacon of financial flexibility and innovation in the world of home financing. Yet, if you’re exploring alternative financing options, consider the merits of Sanlam Personal Loans.

Sanlam opens up an intriguing alternative avenue for realizing your homeownership aspirations. They provide an attractive option for those considering a different approach to home financing.

To delve into the details of Sanlam Personal Loans and understand how they can make your path to homeownership unique, you can access a complete review below. Embark on a journey of financial exploration!

Sanlam Personal Loans application

Say yes to financial possibilities with the Sanlam Personal Loans application: Empowering you to live life on your terms.

About the author / Vinicius Barbosa

Trending Topics

Apply for the Capital One Venture Rewards

If you're looking for a credit card that helps manage your finances and rewards your purchases, Capital One Venture Rewards is an option.

Keep Reading

Amazon Prime Rewards Credit Card Review

Read more in the Amazon Prime Rewards review and see how you can start earning cash back rewards without hassle.

Keep Reading

Maximize Your Efficiency: Best Apps for Productivity

Discover the ultimate productivity arsenal! Explore the best apps for productivity, apps for task management, time tracking, and more!

Keep ReadingYou may also like

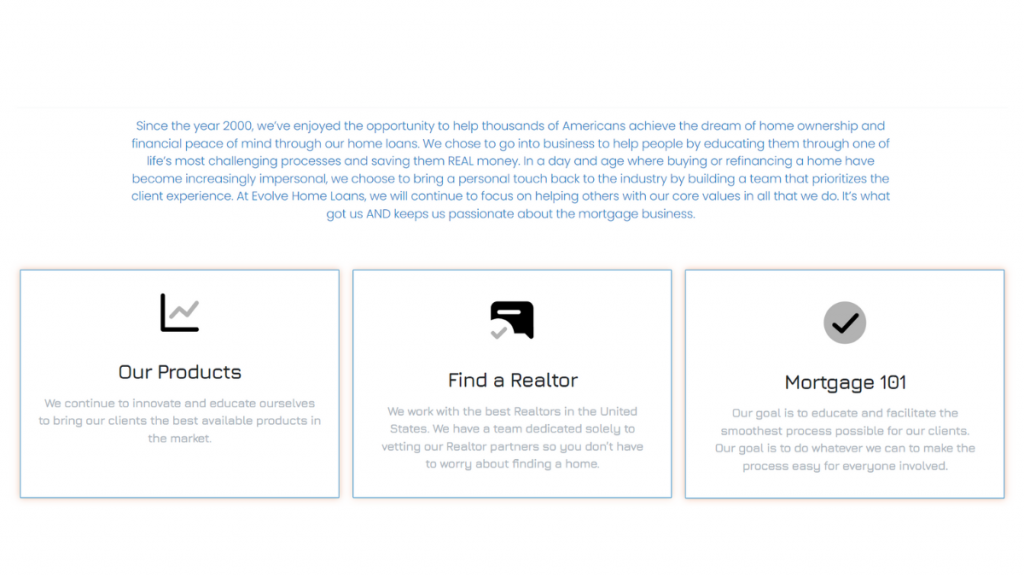

Apply for the Applied Bank® Gold Preferred® Secured Visa®

Get security and financial power even without credit history with Applied Bank® Gold Preferred® Secured Visa® apply.

Keep Reading

What Are the 3 Credit Bureaus? How Do They Work?

What are the 3 credit bureaus? You can learn all about your score in our blog post and see how you can improve it!

Keep Reading

How to apply for the Sable Secured card

Ready to start earning up to 2% cash back with a single credit card? Then just follow our guide to apply for the Sable Secured card.

Keep Reading