Credit Card

How to apply for the Sable Secured card

Follow this Sable Secured card application guide and get this card to start earning up to 2% cash back!

Advertisement

Get Cash Back and Build Credit with a No Credit Check, No Annual Fee Secured Card Offering Generous Rewards

Learn how to apply for the Sable Secured card in this post! This card offers unlimited 2% cash back on purchases made with Amazon, Hulu, Netflix, Spotify, Uber Eats, and Whole Foods.

It also gives you 1% cash back on all other purchases. Additionally, as a cardholder you will receive a dollar-for-dollar rewards match at the end of their first year.

The card also allows you to enjoy benefits like cell phone protection, rental car insurance, extended warranty coverage, and much more.

Ready to apply for the Sable Secured card? Follow our Sable Secured card application guide to make the process quick and easy. Click to get started today.

Apply for the Sable Secured card through the app

It’s time to jump into the application process for the Sable Secured card. Using either the company’s Android or iOS app, you can enroll for the card for free.

The procedure is quick and straightforward, taking no more than five minutes. As long as you are at least 18 years old and a U.S. citizen, you are eligible for the Sable Secured card and may also apply for a secured credit card.

After downloading the app, you must provide your email address and generate a password with a minimum of eight characters that includes one digit.

Subsequently, you will go through a few screens where you’ll need to provide your legal name, date of birth, phone number, and residential address.

To finalize your registration, you must verify your identity, and the app will ask for your Social Security Number and nationality.

Once you’ve done that, sit tight and wait for an email notification that your account is live. It’s that simple!

Don’t forget to make prompt and complete payments each month to build your credit score, enabling you to apply for superior cards and account deals later.

Immediately following the activation of your account, you’ll receive the particulars for your virtual credit card. This allows you to access and utilize your bank account instantly.

The virtual card also adds an extra level of security if one of your cards is compromised. Not only have a zero liability policy, but you can also lock and unlock your physical and virtual cards at any moment.

And there you have it! You have finished your Sable Secured card application.

Another great option: Chase Freedom Unlimited®

If you would like to check out another offer before making up your mind, we have another recommendation for you. Have a look at the Chase Freedom Unlimited®.

This card presents an outstanding deal with a sign-up bonus valued at a maximum of $300. It also gives you a 0% introductory APR for balance transfers and purchases during a 15-month period, and a $0 annual fee.

The card also provides 5% cashback for Chase travel bookings. Not to mention its 3% cashback for drugstore and restaurant purchases, and 1.5% cashback for all other purchases.

Sounds like a fit? Then click the link below and learn more about it.

How to apply for the Chase Freedom Unlimited®?

Check out this Chase Freedom Unlimited® application guide to learn how to get this card in just a few minutes

About the author / Danilo Pereira

Trending Topics

The best credit cards with 0% APR: save your money for better things!

Using a credit card can be expensive if you carry a balance. But not with one of the best credit cards with 0% APR!

Keep Reading

Sanlam Personal Loans application: Easy access to the funds you need

Say yes to financial possibilities with the Sanlam Personal Loans application: Empowering you to live life on your terms.

Keep Reading

Cigna Healthcare review: Exploring Coverage and Care

Uncover the strengths and considerations of Cigna Healthcare in our review. Find affordable plans and wide coverage!

Keep ReadingYou may also like

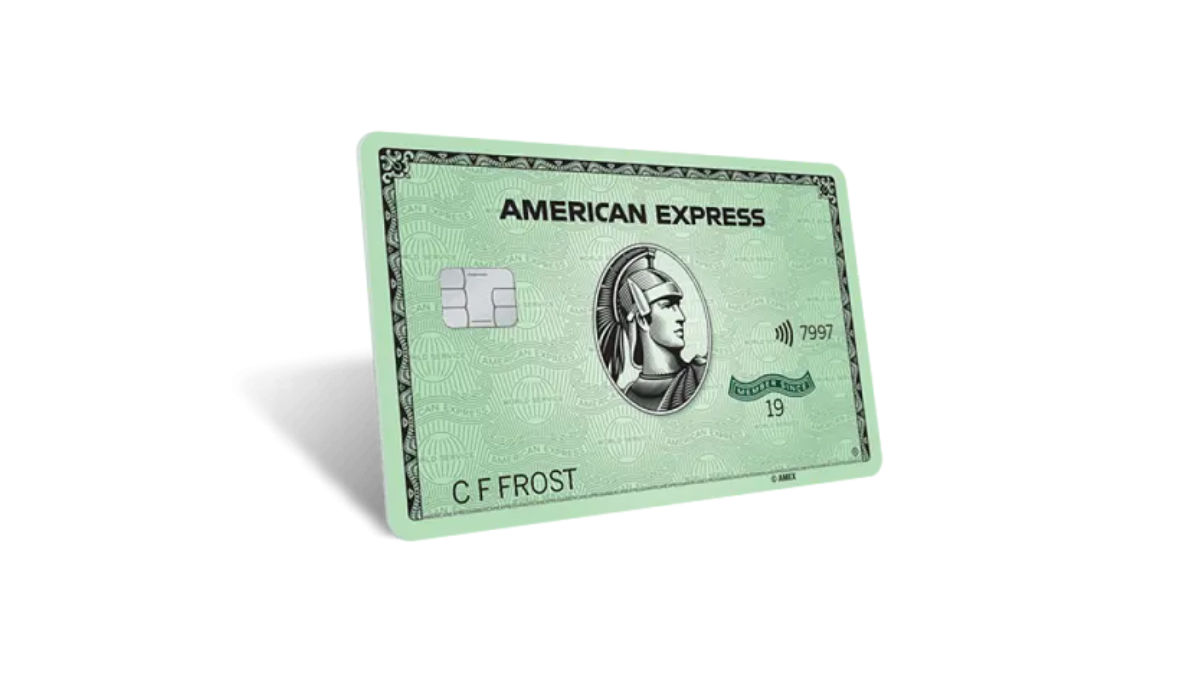

Get the best travel perks with the Amex Green Card!

Is the Amex Green Card right for you? Our review breaks down its travel benefits - earn up to 3 points on purchases and 40K bonus points!

Keep Reading

Credit Card Security: How to Protect Yourself from Fraud and Identity Theft!

Explore credit card security measures, from safeguarding your financial data to recognizing and avoiding common credit card scams!

Keep Reading

Apply For The Chase Freedom Flex℠: No annual fee and cashback rewards for everyday purchases

Ready to start enjoying high cashback rates at a $0 annual fee? So just follow this post walkthrough and apply for the Chase Freedom Flex℠.

Keep Reading