Credit Card

Get the best travel perks with the Amex Green Card!

Discover the Amex Green Card: A detailed review of its perks, and why it's the ultimate choice for eco-conscious travelers! Earn 40K bonus points!

Advertisement

Pre-qualify with no credit harm: Amex Green Card!

Welcome to the world of extraordinary perks and boundless possibilities with the Amex Green Card! So, read on to learn all about this card’s pros and cons and see if it is the best for your needs!

Also, if you’re on the hunt for a credit card that not only offers a wide array of benefits but also aligns with your eco-conscious lifestyle, you’re in for a treat.

- Credit Score: Excellent;

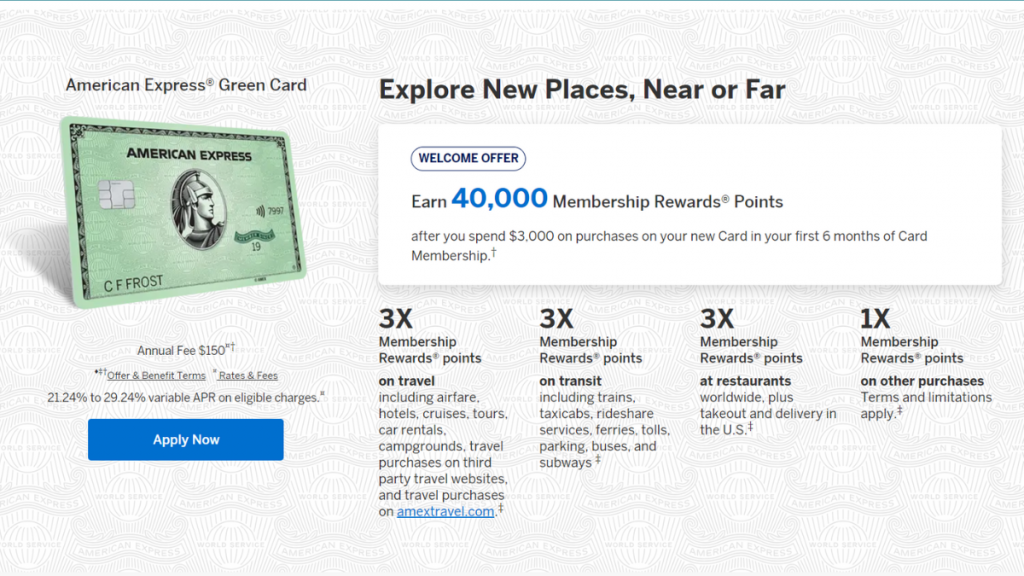

- APR: 21.24% to 29.24% variable APR on eligible charges and 29.99% variable APR for cash advances (See Rates & Fees);

- Annual Fee: $150 (See Rates & Fees);

- Fees: Cash advances: Either $10 or 5% of each cash advance amount, whichever is greater; There are no foreign transaction fees; Late payment and returned payment fee: Up to $40 (See Rates & Fees);

- Welcome bonus: Earn 40,000 Membership Rewards® Points after spending $3,000 on purchases in your first 6 months;

- Rewards: 3x Membership Rewards® Points on eligible travel purchases; 3x Membership Rewards® Points on eligible transit purchases; 3x Membership Rewards® Points at restaurants worldwide, including takeout and delivery in the U.S.; 1x Membership Rewards® Points on any other eligible purchases;

- Terms apply.

Amex Green Card: A Complete Overview

The Amex Green Card is your ticket to a wealth of travel, dining, and lifestyle advantages, all while being a responsible steward of the planet.

Moreover, in this blog post, we’ll delve deep into the world of the Amex Green Card.

Also, we’ll do this, uncovering its remarkable perks and showing you why it’s the must-have card for savvy individuals who value both luxury and sustainability.

In addition, imagine jetting off to your dream destination, enjoying exclusive access to airport lounges, and relishing delectable cuisine at renowned restaurants.

Moreover, you can do all of this while earning rewards and reducing your carbon footprint.

Also, this card combines the best of both worlds. So, it offers an array of travel-related benefits and eco-friendly features.

Plus, you’ll have many opportunities to accumulate Membership Rewards points that can be redeemed for unforgettable experiences.

Therefore, whether you’re a seasoned traveler or someone who enjoys the finer things in life, this card has something to offer everyone.

Reasons you may want it

This credit card can have many reasons for you to want to use it. Also, you may want this card if you care about the carbon footprint since it’s a green card that keeps track of the carbon footprint.

Moreover, this card offers the most incredible and high rewards for those who love to travel.

So, you’ll be able to get up to 3x Membership Rewards points for eligible purchases on travel, transit, dining at restaurants, and more!

Why maybe you wouldn’t choose it

This card may not be a good option for those who don’t have a good credit score.

Also, if you don’t have the means to pay for this card’s fees and spend to earn points, you may not be able to get this card and enjoy it!

Apply for the Amex Green Card

You can easily apply for this incredible card. So, you’ll need to first make sure that you’ll be able to pay for this card’s fees and live up to the lifestyle required to have this card.

Moreover, you’ll need to know that you’ll need to have at least a good credit score going up to excellent to have any chance of qualifying.

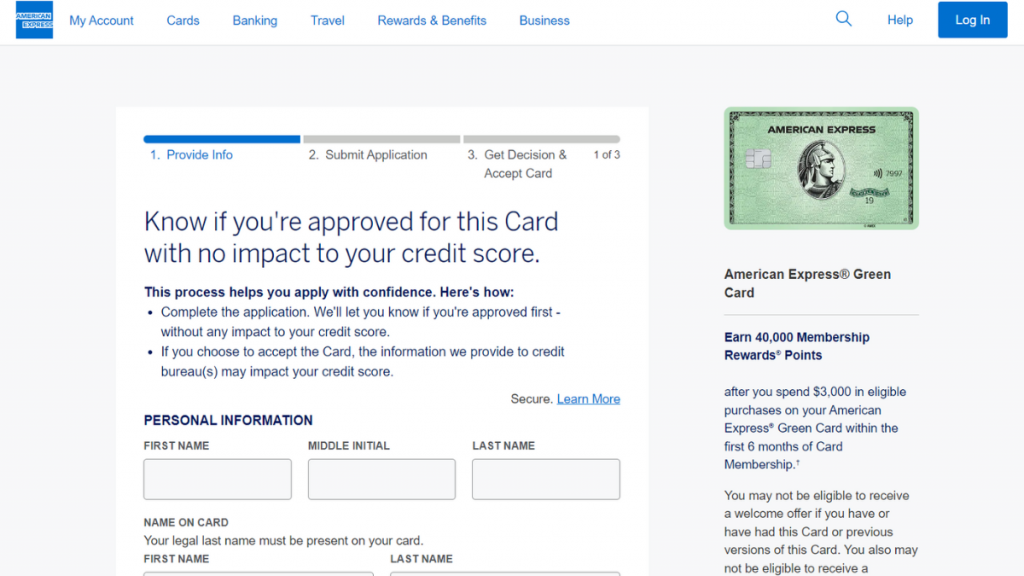

In addition, if you don’t want to harm your score to see if you want this card, you can pre-qualify with no credit score harm!

So, read on to learn a bit more about how the application for this incredible Amex card works!

Online application process

To apply online for this incredible Amex card, you’ll need to go through the pre-qualification process on the official website.

Therefore, you’ll need to have your Amex account and provide the required personal information.

After that, you’ll need to get a response to see if you’ve been pre-approved with no score impact.

Then, if you’re approved, you’ll need to complete the application process and wait for a more definitive response.

Is there an app for applying?

You’ll be able to use Amex’s mobile app to manage your account from anywhere you are.

However, you’ll need to follow the steps to apply through the official website!

Another great option: The Platinum Card® from American Express

Are you looking for another type of Ame card with more perks? If so, you’ll love the Platinum Card® from American Express!

With this card, you’ll be able to get up to 5 points per dollar on eligible flight purchases and much more!

Therefore, read our post below to learn more about this exclusive card and see how to apply!

Apply For The Platinum Card® from American Express

If you enjoy travel airport lounge access and other luxury perks, follow our The Platinum Card® from American Express application guide to get your card today!

About the author / Victória Lourenço

Trending Topics

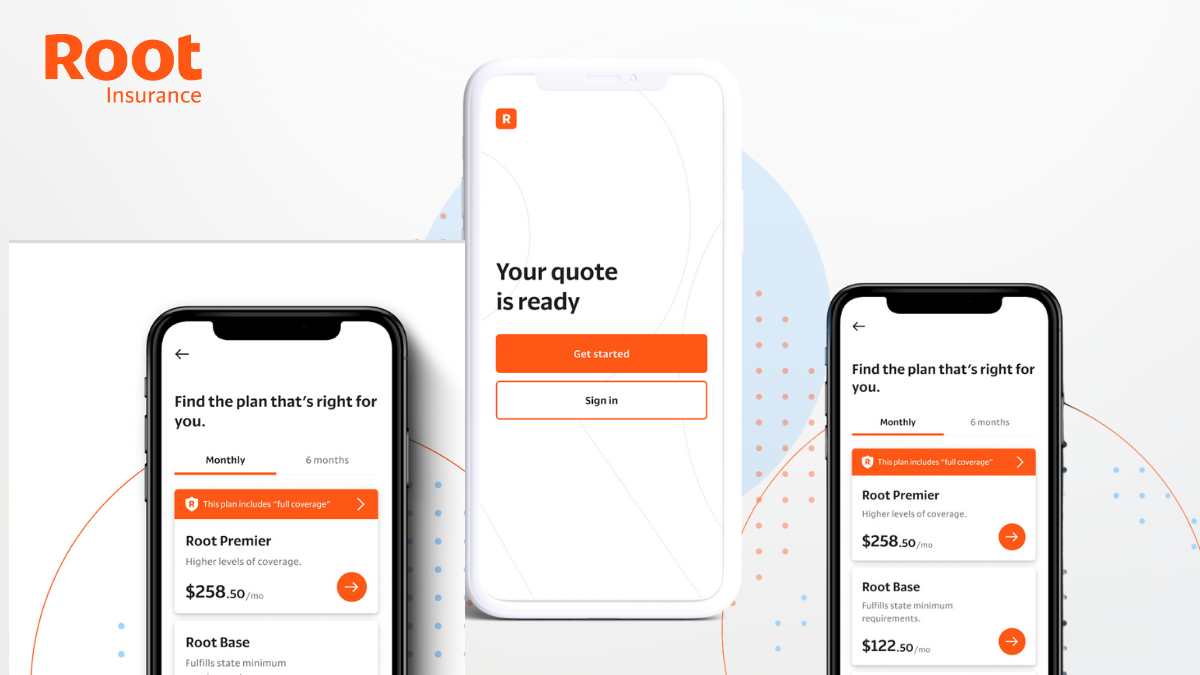

Root Car Insurance: Drive Smart, Save Big

Uncover the innovative approach of Root Car Insurance as we dive into its transparent pricing model and mobile app convenience.

Keep Reading

The best credit cards with 0% APR: save your money for better things!

Using a credit card can be expensive if you carry a balance. But not with one of the best credit cards with 0% APR!

Keep Reading

Streamlining Finances: PayPal Prepaid Mastercard Review

Discover the pros and cons of the PayPal Prepaid Mastercard® in our in-depth review. Uncover the benefits and limitations of this card!

Keep ReadingYou may also like

Enhance your Pictures With the Best Apps to Edit Your Photo Like a Pro!

From basic adjustments to advanced filters and effects, these photo editing apps are your key to unlocking endless possibilities!

Keep Reading

How to apply For The Destiny Mastercard®

Learn how to apply for the Destiny Mastercard® with no security deposit and pre-qualification available. Here's how!

Keep Reading

First Access Visa® Credit Card review

Get the full scoop on the First Access Visa® credit card with this comprehensive review. Find out about benefits, fees, and resources!

Keep Reading