Debit Cards

Navigating Your Finances: A Review of the Brink’s Prepaid Mastercard®

Unveiling the Brink's Prepaid Mastercard®: Your ticket to smarter, fee-friendly money management. Dive into our review today and make your finances more convenient!

Advertisement

Savings and Spending Simplified: Is the Brink’s Prepaid Mastercard® Right for You?

Are you tired of dealing with traditional banks and their hidden fees? Want a convenient and flexible way to manage your finances? Look no further than the Brink’s Prepaid Mastercard® review!

Also, in this blog post, we’ll provide an in-depth review of this prepaid card, sharing insights on its features, benefits, and potential drawbacks.

And this will help you make a decision about whether it’s the right financial tool for you.

The Brink’s Prepaid Mastercard® is designed to offer you control over your money without the hassles of a traditional bank account.

Moreover, with features like no credit checks, direct deposit options, and a user-friendly mobile app, it promises to simplify your financial life.

Also, let’s dive into the details and explore how this card could be your ticket to a more convenient and fee-friendly financial future.

Brink’s Prepaid Mastercard®: A Complete Overview

Routine transactions are the intended purpose for prepaid cards such as the Brinks Mastercard.

Moreover, it is perfect for those who want to load money in person at any of the more than 130,000 Netspend Reload Network sites across the US.

Or even those who want early access to government benefits or wages.

Regretfully, there is a lengthy charge table included with the card. Every time you use your card, there is a cost if you select the standard Pay-As-You-Go plan.

Should you want to sign up for one of the premium plans, there will be a monthly fee. Every time you take out cash from a domestic ATM, you will be charged $2.50.

Moreover, you can have a maximum amount of $15,000 on your Brink’s Prepaid Mastercard.

Also, it could be time to invest your money and place it in an interest-bearing account.

For example, such as a money market account, savings account, or certificate of deposit, if you frequently find yourself coming close to the maximum amount.

Reasons you may want it

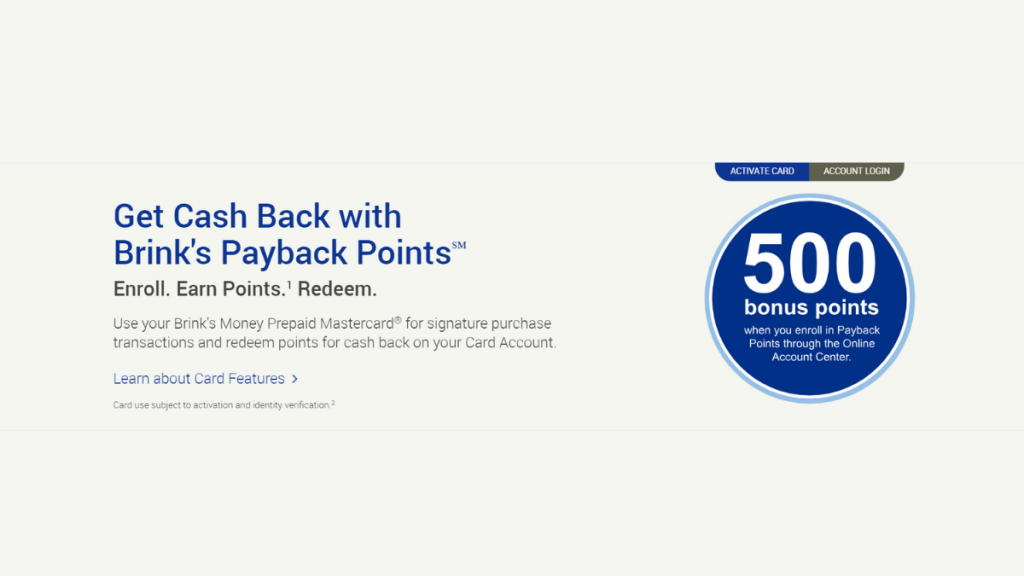

You will earn qualifying discounts when you shop at participating merchants, and Brinks will credit your account with money when you return items.

Also, you do receive cash back, even if it’s not precisely the same as a credit card rewards program.

The Brinks Prepaid MasterCard offers you a choice of three distinct plans.

Moreover, you can also open a high-yield savings account with an annual percentage interest rate of up to 5.00% if you choose the Brinks Reduced Monthly Plan.

So, this is a thoughtful feature that will assist you in creating better routines.

Additionally, if your friends or relatives have a NetSpend account, you may send them money for free.

So, they just need to have a prepaid card that is under NetSpend’s management; they don’t need to have the same one as you.

Why maybe you wouldn’t choose it

The largest disadvantage of utilizing Brink’s Prepaid Mastercard® is, without a doubt, the fees. Even though this card has a lot to offer, you should be mindful of the fees associated with it.

Moreover, the default plan, Pay-As-You-Go, levies fees for nearly all transactions, including checking your account balance and making ATM withdrawals.

Also, these costs can mount up rapidly and deplete your hard-earned cash.

So, it’s important to look at other options that could better fit your spending habits in order to avoid the high fees; they are covered in the paragraph that follows.

Moreover, the Pay-As-You-Go Plan’s automatic enrollment is another feature that some may find unpleasant. It’s possible that a large number of people are ignorant of this and wind up paying fees unintentionally.

So, you must proactively seek the change in order to transfer to a different plan, such as the Monthly Plan, which may be a more affordable choice for frequent card users.

Although switching plans isn’t very difficult, the fact that it’s not automated may cause some difficulty.

Apply for Brink’s Prepaid Mastercard®

It can be easy to apply for this card and start using it. Therefore, you can read our tips below to learn more about how the application process works for this incredible prepaid card!

Online application process

You can easily apply for this card online through the official website. Therefore, you’ll need to find the right website and click on apply now.

You’ll need to open your account with Brinks. You’ll be able to open a high-yield savings account to have this card.

Therefore, you’ll need to provide the information required and some personal documents. Then, you’ll need to read the terms and conditions and complete the application.

After all of this, you’ll be able to get a quick response about your card application!

Is there an app for applying?

You’ll be able to download the mobile app for this card. Also, with the app, you’ll be able to manage your finances and card features!

However, to open your account and apply for the card, you’ll need to follow our tips on the topic above to complete the application!

Another great option: Extra Debit Card

If you’re not so sure about getting Brink’s card, you can try applying for the Extra Debit Card! Also, with this card, you’ll be able to build your credit score and get more perks!

Moreover, you’ll be able to get up to 1% cash back on all your eligible purchases you make with the card. Therefore, this card has different features from similar cards!

Therefore, you can read our blog post below and learn much more about this card. And you can find out all about how the application works, too!

How to apply for the Extra Debit Card online!

Looking for a debit card that can help build your credit? See the Extra Debit Card apply way may be the right option for you! Read on.

About the author / Victória Lourenço

Trending Topics

Wesbank Personal Loans: flexibility that fits your budget

Take control of your financial journey with Wesbank Personal Loans. Explore convenient loan options for unique circumstances.

Keep Reading

Smart Loan Review: Empowering Borrowers with Intelligent Loan Decisions

Discover why Smart Loan stands out from the crowd with its commitment to transparency and customer-centric approach in this full review.

Keep Reading

Freedom Gold Card review

Get the inside scoop on the pros and cons of the Freedom Gold Card with our comprehensive review. Find out if it's right for you!

Keep ReadingYou may also like

Apply for the SavorOne Cash Rewards Credit Card

Learn how to apply for the SavorOne Cash Rewards Credit Card today and take advantage of all the great benefits it has to offer!

Keep Reading

Apply for the US Bank Altitude® Go Visa Signature® Card

Apply for the US Bank Altitude® Go Visa Signature® Card: it may be a great option for you. Read on to learn how to get yours!

Keep Reading

Find the best apps for budgeting in our guide!

Are you looking for the best way to manage your finances easily? If so, you can read our post to learn about the best apps for budgeting!

Keep Reading