Loans (US)

CashNetUSA review: Get an immediate decision!

Uncover the truth about CashNetUSA loans with our in-depth analysis. Learn how this lender caters to those with no credit or credit issues, the speed of fund disbursement, and the potential pitfalls such as location-based fees!

Advertisement

CashNetUSA review: Same-day deposit!

In the ever-evolving landscape of personal finance, finding a reliable and flexible lending solution can be a daunting task. So, you can read our CashNetUSA review!

So, whether it’s unexpected medical expenses, car repairs, or other unforeseen circumstances, having access to quick and convenient financial support can make all the difference.

- APR: Can range from 201.32% to 1,140.63%, depending on your financial situation;

- Loan Amount: Maximum loan amount of $3,000, depending on where you live in the U.S.;

- Loan Purpose: Payday loans, installment loans, and lines of credit;

- Credit Needed: CashNetUSA can accept your application even if you have a low credit score;

- Origination fee: There can be an origination fee;

- Late Fee: You’ll need to pay relatively high late fees if you miss any loan repayments;

- Terms: You can get your loan as fast as on the same day of approval, and the loan terms vary depending on the state you live in;

- Early Payoff Penalty: N/A.

CashNetUSA: A Complete Overview

In this blog post, we delve into the world of CashNetUSA loans, exploring their features, application, and suitability for those navigating the waters of financial uncertainty.

CashNetUSA has emerged as a prominent player in the online lending sphere, offering a range of financial products designed to meet the diverse needs of consumers.

Also known for its quick and hassle-free application process, CashNetUSA aims to provide a lifeline for individuals facing urgent financial challenges.

Reasons you may want it

There can be many reasons for this loan option to be the best one for your needs. Therefore, read below to learn more about them:

Low scores accepted

The fact that loans are offered to everyone, including those with bad credit or no credit history, is one of CashNetUSA’s strongest features.

Also, accessing financial aid might be more challenging for those with poor credit since traditional lenders occasionally have strict eligibility restrictions.

Quick funding

Speed is essential in financial situations, and CashNetUSA excels in this regard. After being approved, borrowers may expect to receive their payments quickly—sometimes the next business day.

Therefore, if you need cash fast, this can be an incredible loan option for your needs at the moment.

Fast application process

In today’s fast-paced digital age, convenience is essential, and CashNetUSA recognizes the need for a streamlined application process.

Also, the speed and convenience of the online application platform allow customers to conveniently and quickly submit their loan requests from the comfort of their homes.

Why maybe you wouldn’t choose it

Even though this loan option offers incredible perks to its users, there are also some downsides.

So, you can read our list below to learn the downsides of this lender.

High-interest rates

While borrowers with a range of credit histories can apply for CashNetUSA loans, one significant disadvantage is the potential for exceptionally high-interest rates.

And this can be particularly detrimental to individuals in less fortunate financial situations.

Fees based on where you live

The regional variation in fees and rates associated with CashNetUSA loans is another disadvantage.

Also, the costs attached to these loans depend on where the borrower is located in the United States.

So, due to this regional disparity, residents of various states could pay varying prices for the same credit product.

Not available in all states

Even though CashNetUSA wants to provide financial solutions to a wide spectrum of customers, it’s vital to keep in mind that not all states in the US have the same accessibility.

Credit score harm

One potential downside is the potential impact the CashNetUSA loan application process may have on an individual’s credit score.

Apply for CashNetUSA

To apply for a loan through this lender, you’ll need to understand the requirements and much more.

Therefore, you can read below to learn more about the application process to get a loan through this lender!

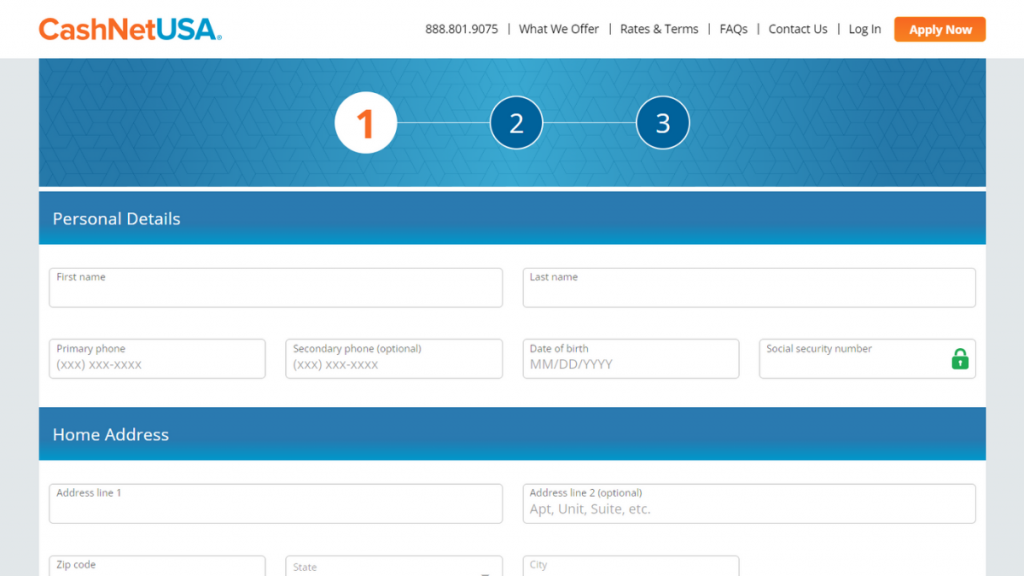

Online application process

To apply online, you’ll need to be at least 18 years old and have a residency at the state in the U.S. you’re applying for.

Also, all the fees and rates can change depending on the state you live in. However, this lender doesn’t offer loans in all of the states.

So, to apply, you’ll need to go to the official website and find the application button.

Then, you’ll be able to select the state you live in. After that, you’ll go to the application page and provide the personal information and documents required.

After all of that, you’ll be able to complete the application process and wait for a quick response.

Moreover, you’ll even be able to get your loan funds as soon as the same business day if you get your approval!

Is there an app for applying?

There is not much information about the CashNetUSA app for its borrowers. Therefore, all the application process needs to be done through the official website online.

Therefore, you can read our topic above to see our online application tips!

Another great option: MoneyLion Loans

If you’re looking for another loan option, we can help you out! So, you can try applying for the MoneyLion Loans!

Also, with this loan option, you’ll be able to get incredible perks to pay off your debt, make home improvements, make large purchases, and much more.

Moreover, there are no overdraft fees or origination fees. Also, you won’t need to pay any early payoff fees!

Therefore, you can read our blog post below to learn much more about this lender and find out how the application process works!

MoneyLion Loans review: No overdraft fees!

Discover the ins and outs of MoneyLion Loans in our comprehensive review! Explore the benefits of quick access to flexible repayment options!

About the author / Victória Lourenço

Trending Topics

Delivery Apps with Lowest Fees: Save Money and Profit More!

Say goodbye to high delivery fees! Check out our roundup of 5 delivery apps with the lowest fees, offering cost-saving solutions.

Keep Reading

NetFirst Platinum Card review

Check out this NetFirst Platinum Card review to learn how you can get an unsecured merchandise credit line with no credit checks!

Keep Reading

Apply For The Chase Freedom Flex℠: No annual fee and cashback rewards for everyday purchases

Ready to start enjoying high cashback rates at a $0 annual fee? So just follow this post walkthrough and apply for the Chase Freedom Flex℠.

Keep ReadingYou may also like

US Bank Altitude® Go Visa Signature® Card Review

Know how you can earn points quickly in this US Bank Altitude® Go Visa Signature® Card review. See now about more.

Keep Reading

Streamlining Finances: PayPal Prepaid Mastercard Review

Discover the pros and cons of the PayPal Prepaid Mastercard® in our in-depth review. Uncover the benefits and limitations of this card!

Keep Reading

Group One Platinum Card: See the best perks!

Unlock the power of the Group One Platinum Card! Dive into our review and discover this exclusive card - no APR or complications!

Keep Reading