Loans (US)

MoneyLion Loans review: No overdraft fees!

Our in-depth review of MoneyLion Loans unpacks the convenience of immediate cash advances and their impact on your financial well-being!

Advertisement

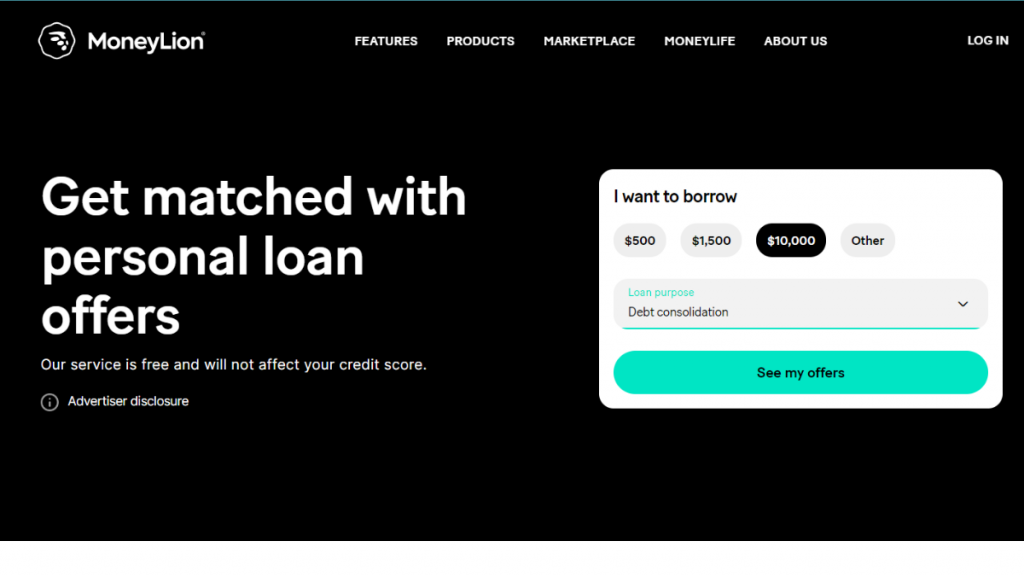

MoneyLion Loans review: Check eligibility!

Looking for financial flexibility at your fingertips? Enter the MoneyLion Loans review.

Whether you’re bridging gaps between paychecks or tackling unexpected expenses, MoneyLion Loans promises convenience and ease.

- APR: 5.99% to 29.99% variable APR;

- Loan Amount: $500, $1,000, $10,000 or other amounts depending on analysis;

- Loan Purpose: Pay off debt, home improvement, large purchases, pay off credit cards, and other personal reasons;

- Credit Needed: No minimum credit score;

- Origination fee: There is a monthly membership fee;

- Late Fee: There can be late fees if you don’t make your payments on time;

- Terms: They depend on your loan type;

- Early Payoff Penalty: None.

MoneyLion Loans: A Complete Overview

MoneyLion Loans offer quick access to up to $500 in advances, easing immediate financial strains. With no mandatory fees and the ability to extend repayment, they provide flexibility.

Moreover, these loans also report payments to major credit bureaus, aiding in credit score improvement.

However, they have limitations, such as smaller loan amounts and potential delays in receiving funds, along with a monthly membership fee.

Reasons you may want it

There are many reasons for you to choose this lender to solve your financial problems. So, you can read below the main benefits it offers:

No hard credit checks

A distinctive feature of MoneyLion Loans is that a hard credit check is not required.

Also, this feature is crucial since it allows customers to obtain cash without negatively affecting their credit scores.

In addition, this service allows people to research loan options without worrying about it adversely affecting their creditworthiness.

Improve your credit score

A significant benefit for clients looking to raise or preserve their credit scores is MoneyLion’s payment reporting to three major consumer credit bureaus.

Moreover, borrowers may be able to improve their credit history and, later on, be eligible for better loan conditions and lower interest rates if they make their payments on time.

Pay no mandatory fees

The fact that MoneyLion Loans have no upfront costs is a significant advantage.

So, unlike many traditional lenders that tack on extra costs for processing, late payments, or annual fees, MoneyLion eliminates these unnecessary financial headaches.

Extend your repayment date

MoneyLion gives customers the option to extend their payback date if necessary since the company recognizes that financial circumstances might change.

Also, this flexibility is essential since it allows borrowers to adjust their payments in line with their current financial situation.

No overdraft fees

The fact that there are no overdraft fees is one of the best aspects of MoneyLion Loans.

Also, this is a great offering for those who could occasionally run into financial difficulties.

Therefore, by removing the worry of further fees or penalties that typically accompany overdrawing accounts, it provides comfort and keeps the already poor financial position from getting worse.

Up to $500 in advances

With MoneyLion’s loan service, customers may easily obtain advances up to $500, giving them quick access to financial help when they need it.

Also, this feature helps to avoid the trouble of qualifying for a typical loan and comes in useful when unexpected needs or short-term financial gaps need to be covered.

Moreover, it may assist in reducing stress and act as a safety net during difficult times to have this rapid cash injection available for unforeseen auto repairs or others.

Why maybe you wouldn’t choose it

Although there are many reasons for you to get a loan through this lender, there are also some downsides. So, check out below the main ones to see if this is the best option for your finances!

High fees

The whole cost of borrowing is increased by the substantial fast-funding costs linked to MoneyLion Loans.

Also, while the service provides quick access to cash, cost-conscious customers could find the associated fees off-putting.

Advances take longer

One such possible disadvantage is not getting paid in advance. It can take a few days for the MoneyLion Loan to show up in the user’s account.

Moreover, because it doesn’t provide the required immediate treatment, this delay might be a big issue for those who need quick access to money in order to get out of a sticky financial position.

Loan funds can go to the reserve account

A significant drawback of MoneyLion’s loan distribution procedure is the possibility of having the money kept in reserve until the loan is paid back.

Moreover, those who want instant access to the entire loan money may find this arrangement problematic.

Small loan amounts

One of the disadvantages of MoneyLion Loans is the relatively small loan amounts.

So, while having $500 on hand might be useful in an emergency, greater costs or more serious situations can call for additional funds.

Membership fee

The monthly membership fee is one drawback for some customers of MoneyLion Loans.

Also, access to several financial services and advantages is provided by the charge, but it also adds a recurrent expense that may not be within everyone’s means.

Apply for MoneyLion Loans

You can easily apply for a loan through this lender. Also, you’ll be able to do it all online. However, you’ll need to know about some of the requirements before you apply.

So, you’ll need to be at least 18 years old and have the necessary income and credit score. So, read below for more information on the application.

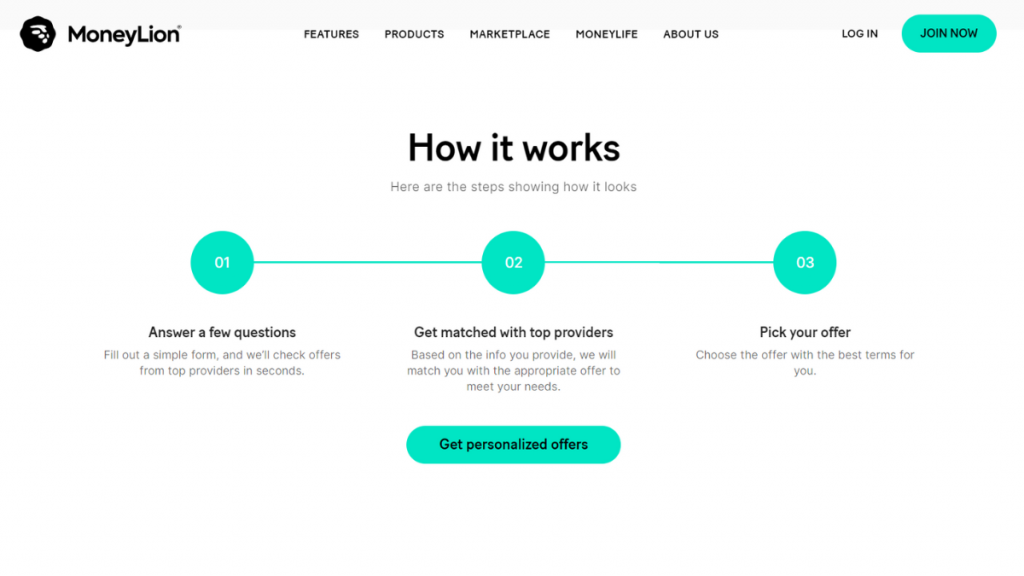

Online application process

To apply online, you’ll need to go to the official website and provide the personal information and documents required. Then, you’ll need to choose the lender with the best offer for your needs.

So, after all of this, you’ll be able to complete the application and get a response to get your funds or not.

Is there an app for applying?

You’ll be able to download the app and use it to manage all your finances through MoneyLion.

However, you’ll need to apply online to complete the application process.

Another great option: PNC Bank Personal Loans

You can find other loan options through a bank! So, you can try applying for a PNC Bank personal loan!

Also, with this lender, you’ll be able to get incredible terms and up to $25,000 in loan amounts with good rates.

Therefore, read our blog post below to learn more and find out how the application process works!

PNC Bank Personal Loans review: Up to $25,000!

Don't miss our PNC Bank's Personal Loans review! Borrow up to $25,000 quickly and secure the money you need! Read on!

About the author / Victória Lourenço

Trending Topics

Can ChatGPT be a financial advisor?

Is ChatGPT the financial advisor of tomorrow? Get insights into its potential, limitations, and key factors to consider.

Keep Reading

CreditFresh review: Flexible Loans!

Discover the ins and outs of CreditFresh Loans in our review. From flexible withdrawal options to potential drawbacks - up to $5,000!

Keep Reading

Navigating Your Finances: A Review of the Brink’s Prepaid Mastercard®

Discover the pros and cons of Brink's Prepaid Mastercard® in our in-depth review. Is it the right financial tool for you? Find out now!

Keep ReadingYou may also like

The best credit cards with 0% APR: save your money for better things!

Using a credit card can be expensive if you carry a balance. But not with one of the best credit cards with 0% APR!

Keep Reading

Discover the Best Apps to Learn Spanish and Master the Language

Looking for the best apps to learn Spanish? Discover our top recommendations for the best apps to learn Spanish!

Keep Reading

Apply for the Capital One Venture Rewards

If you're looking for a credit card that helps manage your finances and rewards your purchases, Capital One Venture Rewards is an option.

Keep Reading