Loans (US)

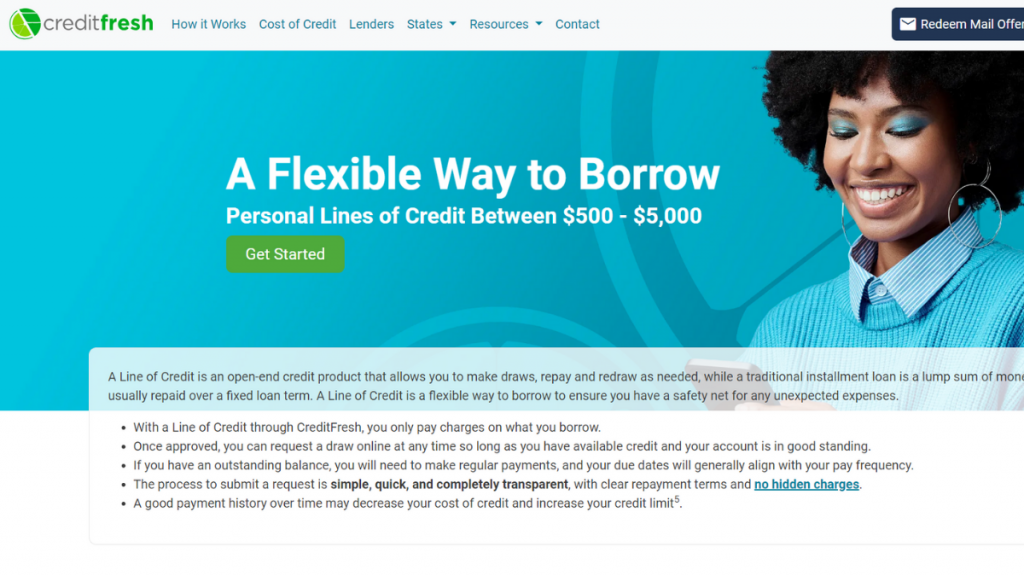

CreditFresh review: Flexible Loans!

Considering a loan from CreditFresh? Our review covers it all – transparent fee structures, quick approvals, and potential pitfalls. Dive into the details to determine if CreditFresh Loans align with your financial needs!

Advertisement

CreditFresh review: Quick application!

In the ever-evolving landscape of online lending platforms, you can read our CreditFresh review! They offer a range of loan solutions aimed at addressing diverse financial needs.

As we delve into this comprehensive review of CreditFresh Loans, we’ll explore both the advantages and disadvantages of this lending platform!

- APR: It depends on your finances;

- Loan Amount: Up to $5,000 credit limit;

- Loan Purpose: Personal line of credit;

- Credit Needed: All scores;

- Origination fee: Yes, it depends on your finances;

- Late Fee: There can be severe late fees if you miss any payments;

- Terms: It depends on your loan options;

- Early Payoff Penalty: N/A.

CreditFresh: A Complete Overview

CreditFresh stands out in the crowded lending marketplace with its commitment to flexibility and transparency.

Also, with the ability to make multiple withdrawals within an approved credit limit, borrowers gain the freedom to navigate a variety of financial scenarios.

However, as with any financial service, CreditFresh is not without its drawbacks. So, read below the pros and cons of this lender!

Reasons you may want it

There are many reasons you may have to get a loan from this lender. Therefore, you can read the main ones below!

Flexible lending

With its flexible borrowing strategy, CreditFresh gives consumers a distinct edge by enabling multiple withdrawals within their authorized credit limit.

Also, this feature allows borrowers to take out loans as needed, which simplifies and adapts to a range of financial conditions.

No unexpected costs

The platform’s straightforward pricing strategy demonstrates CreditFresh’s dedication to transparency, which is one of its standout advantages.

Moreover, borrowers don’t have to worry about unforeseen expenses because they can securely handle their financial obligations.

No collateral needed

CreditFresh offers unsecured loans, in contrast to traditional lenders that often need security for loans. This distinguishes them from each other.

Also, this enables borrowers to receive the money they want without committing any assets, increasing loan availability and equity.

Fast approval

In terms of offering a quick and easy loan approval procedure, CreditFresh excels.

Also, modern technology is used by the platform to expedite application evaluations, which enables loan requests from borrowers to be approved swiftly.

Why maybe you wouldn’t choose it

Even though it seems that there are many reasons to get a loan from this lender, there can be many downsides.

Therefore, you can read our list below to see the main cons,

Not in all states

One of CreditFresh’s biggest shortcomings is its restricted accessibility since not all states in the union permit loans are made through the website.

Debt collectors

Although CreditFresh aims to provide financial solutions, some users may find the platform’s debt collection strategies excessively severe and can even resort to using unlawful techniques.

High fees

One of the biggest drawbacks of CreditFresh loans is the hefty costs involved.

Moreover, the total cost of borrowing is increased by these charges, which might include origination, maintenance, and additional costs.

High credit limit

While CreditFresh offers a flexible borrowing method, the platform’s credit constraints might not be enough for some users.

Potential robocalls

One drawback of utilizing CreditFresh is the possibility of receiving robocalls, which might disturb and bother debtors.

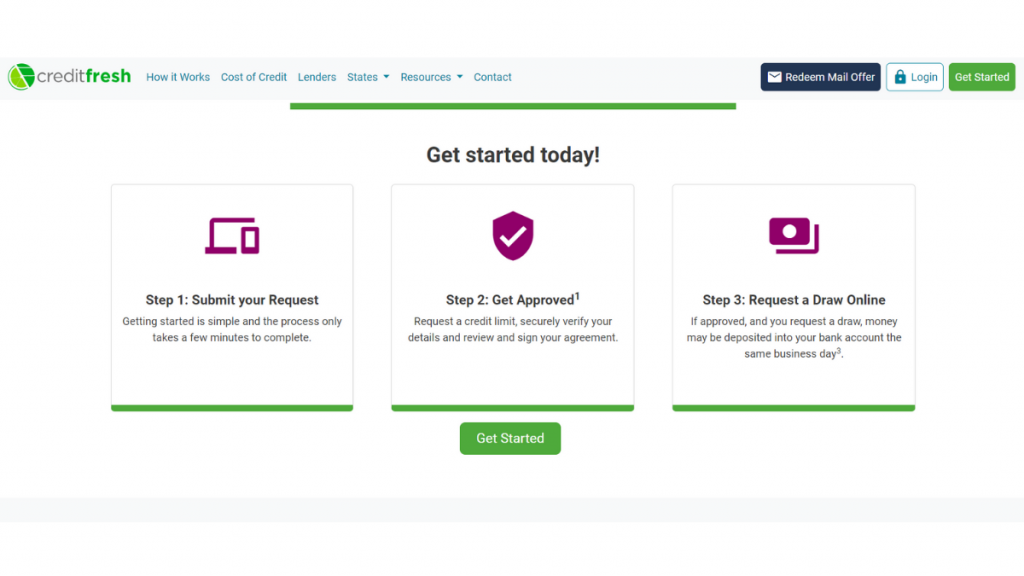

Apply for CreditFresh

You can find many ways to apply for a loan through CreditFresh. However, we can give you some tips on how to apply.

Therefore, keep reading below to find out.

Online application process

To apply online for a loan, you’ll need to go to the official website online and click to submit your request.

Moreover, you’ll need to provide the personal information required and some documents.

Then, you’ll need to read the terms and conditions to see if this is the best loan for your needs.

After all of this, you’ll need to wait for a quick response.

Is there an app for applying?

There is not much information about a mobile app to manage your CreditFresh Loans. However, you can apply online through the website!

Another great option: Upstart Loan

If you’re not so sure about getting a loan through CreditFresh, we can help you find a different option for your financial needs.

Also, you’ll be able to apply for a loan through Upstart Loans! Moreover, with this lender, you’ll be able to get loans from $1,000 to $50,000!

In addition, you’ll be able to get personal loans with incredible terms from 36 to 60 months to repay your loans.

Moreover, you won’t need to pay any early repayment fees if you need to repay your loan early!

Also, another great thing about this lender is that you’ll be able to have a chance to get this loan even with a low credit score.

Therefore, if you want to learn more about this lender and how to apply for it, you can read our blog post below!

Upstart Loan: up to $50,000 quickly

This lender can be your partner on the path to financial success! Read on and discover what Upstart Loan offers and its application process!

About the author / Victória Lourenço

Trending Topics

Apply for the Mission Money™ Visa® Debit Card

Discover how easy and secure it is to apply for a Mission Money™ Visa® Debit card and read more about its special benefits!

Keep Reading

Top Credit Report Apps to Trust with Your Information

Unlock financial control and security with the best apps to check your credit report! Trustworthy, user-friendly, and secure. Learn more!

Keep Reading

Root Car Insurance: Drive Smart, Save Big

Uncover the innovative approach of Root Car Insurance as we dive into its transparent pricing model and mobile app convenience.

Keep ReadingYou may also like

Apply for the Petal® 1 Visa® Credit Card

Get access to rewards with the Petal® 1 Visa® Credit Card. Find out how to easily apply and learn more about this unique credit offering.

Keep Reading

Wells Fargo Active Cash® Card review

Discover why the Wells Fargo Active Cash® card is worth considering for your next credit card. Learn about fees, rewards, and more!

Keep Reading

Apply for the Upgrade Triple Cash Rewards Card: Cash Back on Home, Auto, and Health Purchases

This post tells you how to apply for the Upgrade Triple Cash Rewards Card. You will see how you can get this card in just a few minutes.

Keep Reading