Loans (US)

PNC Bank Personal Loans review: Up to $25,000!

Discover the ins and outs of PNC Bank's Personal Loans in our comprehensive review. Unveil their features, application process, and borrower benefits to make an informed financial decision!

Advertisement

PNC Bank Personal Loans review: Good rates!

Embarking on a financial journey often requires a reliable partner, especially when seeking flexible solutions tailored to diverse needs. So, read our PNC Bank Personal Loans review to learn more!

Also, PNC Bank stands at the forefront of this landscape, offering a suite of personalized lending options, prominently among them their Personal Loans. So, read on!

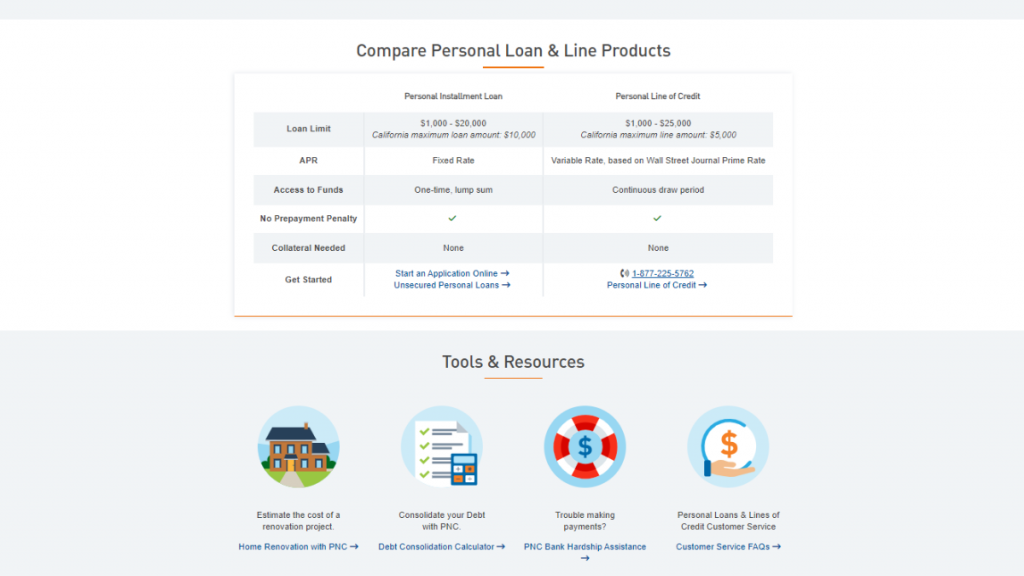

- APR: The rates vary from 7.89% to 30%;

- Loan Amount: You can borrow from $1,000 to $25,000;

- Loan Purpose: Installment loans of line of credit;

- Credit Needed: At least a good credit score;

- Origination fee: There can be an origination fee;

- Late Fee: There will be late fees if you don’t make your loan repayments on time;

- Terms: You’ll be able to get terms that range from 6 to 60 months;

- Early Payoff Penalty: There are no prepayment penalties.

PNC Bank Personal Loans: A Complete Overview

In today’s blog post, we delve deep into the realm of PNC Bank’s Personal Loans, uncovering their array of features, advantages, and more!

Also, we’ll talk about the unique offerings that set them apart in the realm of personal finance.

So, whether you’re navigating unexpected expenses, consolidating debt, or pursuing your aspirations, join us as we explore how this could serve as the key to unlocking your finances!

Amounts and rates

Therefore, the loan amounts can vary, providing options for both small and large financial requirements.

Also, borrowers may find fixed or variable interest rate options, enabling them to choose a repayment structure that aligns with their financial preferences.

Moreover, PNC’s online application process is generally straightforward, allowing applicants to apply conveniently from the comfort of their homes.

In addition, the bank’s personalized approach and commitment to customer service often lead to a streamlined experience.

However, once approved, borrowers can expect prompt access to funds to address their financial needs.

Overall, the combination of competitive rates, varied loan options, flexible terms, and a customer-centric approach positions PNC Bank as a viable choice for individuals seeking loans.

Reasons you may want it

There are many reasons for you to choose this lender. So, read below the main ones:

Varied loan amounts

Whether you require a smaller sum for immediate expenses or a more substantial amount for a major investment, PNC’s loans typically come with varying borrowing limits.

Also, this allows customers the freedom to select an amount that precisely aligns with their financial requirements.

Wide variety

Borrowers can choose from various repayment periods, spanning shorter terms for those aiming for quicker debt clearance to longer durations that offer more manageable monthly payments.

Joint loan option

Applying jointly can often enhance the chances of approval, as it combines the financial strengths of both applicants, potentially resulting in a higher loan amount or more favorable terms.

Discount on rates

By setting up automatic payments from their PNC account, borrowers can enjoy a reduced interest rate on their loans.

Why maybe you wouldn’t choose it

There can be incredible perks to getting this loan. However, there are also drawbacks. So, read below for the main ones!

Location variation

The discrepancy in product availability depending on location can potentially limit access to certain loan products or result in varying rates and terms depending on the applicant’s location.

Low amounts

For individuals seeking exceptionally large sums for significant investments or major expenses, the maximum loan amounts offered by PNC Bank might fall short of their requirements.

Apply for PNC Bank Personal Loans

Before you start applying for a loan through PNC, you should know some more information.

So, check out the below to understand the requirements for this lender. Then, check out how to apply online and through the mobile app!

Requirements

You should know that PNC likely considers various elements such as an individual’s income, debt-to-income ratio, employment history, and overall creditworthiness.

Also, applicants with higher credit scores tend to receive more favorable terms, including lower interest rates and larger loan amounts.

Moreover, having a solid credit history, a stable income source, and a manageable debt load can significantly bolster one’s chances of securing a personal loan from PNC.

Additionally, meeting the minimum credit score requirement is crucial.

However, other qualitative aspects might also be assessed during the application process to ensure a good evaluation of an applicant’s financial stability and repayment capacity.

Online application process

To apply online, you’ll need first to create your PNC Bank account. Then, you’ll be able to apply for a loan amount that you need by sending them the personal information required!

Is there an app for applying?

You’ll be able to use the app to manage your loan’s features at all times. However, you’ll need to apply online through the website.

Another great option: Upstart Loan

If you’re still looking for loan options for your finances, we can help! So, you can check out the loan options offered by Upstart Loan!

Also, with this lender, you’ll be able to get loan amounts from $1,000 to $50,000!

Therefore, check out our list below to learn more!

- APR: 4.6% to 35.99%;

- Loan Amount: From $1,000 to $50,000;

- Loan Purpose: This loan is for personal needs;

- Credit Needed: No minimum credit score is required;

- Origination fee: Up to 10%;

- Late Fee: $15 or 5% of the late payment amount;

- Terms: From 36 to 60 months;

- Early Payoff Penalty: None.

So, if Upstart has all the features you need, you can read our blog post below to learn more about this lender and find out how to apply!

Upstart Loan: up to $50,000 quickly

This lender can be your partner on the path to financial success! Read on and discover what Upstart Loan offers and its application process!

About the author / Victória Lourenço

Trending Topics

Discover the Best Apps to Learn Spanish and Master the Language

Looking for the best apps to learn Spanish? Discover our top recommendations for the best apps to learn Spanish!

Keep Reading

How to apply for the OpenSky® Secured Visa® Credit Card

Get this credit card easily and start improving your credit. Here's how to apply for the OpenSky® Secured Visa® Credit Card.

Keep Reading

Walmart Money Card review: Cashback & Fees Decoded

Discover the perks and costs of the Walmart Money Card in our review. From cashback rewards to fees, make an informed choice!

Keep ReadingYou may also like

Credit Card Security: How to Protect Yourself from Fraud and Identity Theft!

Explore credit card security measures, from safeguarding your financial data to recognizing and avoiding common credit card scams!

Keep Reading

SoFi Personal Loans: Learn how it works in this full review!

Discover the ins and outs of SoFi Personal Loans and how it works. You’ll get access to the funds you need to achieve your goals.

Keep Reading

Apps and Strategies for Financial Freedom: Ultimate Guide to Build Wealth

Discover game-changing apps and savvy strategies in our guide to financial freedom. From budgeting tools to investment platforms!

Keep Reading