Loans (US)

SoFi Personal Loans: Learn how it works in this full review!

Ready to take control of your finances with SoFi Personal Loans? Gain a clear understanding of how they work and discover how this lending option can empower you to reach your dreams.

Advertisement

See how to achieve your financial goals and how easy it is to apply for the SoFi Personal Loans!

Do your financial goals and aspirations often seem out of reach? Luckily, you’re in the right place. Get ready to know SoFi Personal Loans solutions and how it works to get what you need.

Having a trusted and reliable partner by your side can make all the difference. We’ll review features, benefits, and unique advantages that SoFi Personal Loans bring to the table

- APR: Fixed rates varying between 8.99% APR to 25.81% APR.

- Loan Amount: You can ask from $5,000 to $100,000. However, the amount approved will depend on your creditworthiness.

- Loan Purpose: SoFi offers loans to support all of your dreams, including consolidating debt, travel, medical expenses, wedding, home repair, and much more.

- Credit Needed: You need preferably a good credit score to apply for a personal loan, but other financial aspects will also be evaluated.

- Origination fee: None

- Late Fee: None

- Terms: You’ll have from 2 to 7 years to repay your loan, according to the offer you get approved.

- Prepayment penalty: None

- Early Payoff Penalty: You can pay your loan early with no fees!

SoFi Personal Loans: a complete overview

Unlock the possibilities with SoFi Personal Loans! Say goodbye to financial barriers and hello to your dreams. And you don’t need to pay expensive fees or variable rates for this!

With SoFi, you can effortlessly access the funds you need, whether it’s for home improvements, debt consolidation, or that long-awaited adventure.

Their competitive rates and flexible terms ensure that you’re in the driver’s seat of your financial journey. You’ll know exactly how much and for how long you must pay.

No complicated paperwork or endless wait times—SoFi’s streamlined process makes it a breeze to apply online.

Take charge of your future and experience the joy of reaching your goals with SoFi Personal Loans by your side.

Reasons why you might find it a good choice

It is important to understand how SoFi Personal loans works before you apply for it. There are several compelling reasons why SoFi Personal Loans could be the perfect choice for you:

- Fixed Rates: SoFi Personal Loans offer the advantage of fixed interest rates. This means that your monthly payments will remain consistent throughout the life of the loan, providing stability and predictability.

- Autopay Discount: SoFi rewards responsible borrowers by offering an interest rate reduction of 0.25% when you enroll in autopay. This discount not only helps you save money but also ensures that your payments are always made on time.

- No Fees: SoFi Personal Loans come with no origination fees or prepayment penalties. This means you can borrow with confidence, knowing that you won’t encounter any unexpected charges or be penalized for paying off your loan early.

Why you might consider other options

While SoFi Personal Loans offer many attractive features, it’s important to consider alternative options based on your specific needs and circumstances.

How to apply for the Upgrade Card?

Learn how to apply for the Upgrade Card with our quick application guide and start earning 1.5% cash back on purchases.

- Strict Eligibility Criteria: SoFi Personal Loans have specific eligibility requirements, including a good credit history, stable income, and a strong financial profile. If you don’t meet their criteria, you may need to explore alternative lenders with more lenient requirements.

- No co-sign allowed: Unlike some other lenders, SoFi Personal Loans do not allow co-signed applications. They assess applicants based on individual creditworthiness, focusing on credit history and income.

Let’s talk about the application process for SoFi Personal Loans

Applying for a personal loan is not as hard as you think. You just need a little patience and follow these instructions to learn how to apply for SoFi Personal Loans:

Learn how to apply online

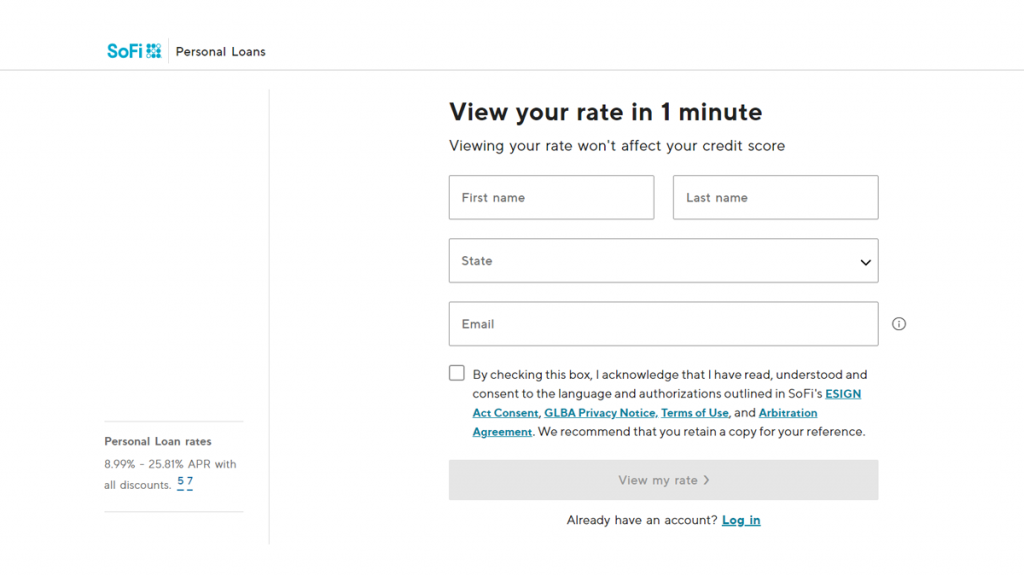

SoFi respects your valuable time. So, the application is quick, and you can check your rates in one minute with no harm to your credit score.

To get started, visit the official SoFi website and create an account by providing your basic information.

Once you’re logged in, select the type of loan you need and specify the loan amount and desired term.

Next, complete the application form by accurately filling in details about your employment, income, and financial background.

Check your rates and choose your offer

After reviewing your application, SoFi will provide a decision within a reasonable timeframe. If approved, carefully review the loan offer, including the interest rate, repayment terms, and any associated fees.

If you’re satisfied with the terms, accept the offer electronically. Once you’ve accepted the offer, the funds will be deposited into your designated bank account, typically within a few business days.

Is there an app available for applying?

Yes, SoFi offers a mobile app that allows you to apply for loans conveniently from your smartphone or tablet.

The SoFi app is available for download on both iOS and Android devices. With the app, you can easily navigate through the loan application process, submit your information, and track the progress of your application.

Another great option: Happy Money loans

It is always a good idea to look for more than one lender when it comes to applying for personal loans. So let’s give you another option.

Happy Money Loans has been awarded for its outstanding customer service and focus on solving the client’s needs.

With a straightforward online application process, you will get the funds you need to fulfill your dreams. Check the full review below to learn more about this lender.

Happy Money Personal Loans: learn how it works

Learn everything there is to know about the Happy Money Personal Loans and how you can easily apply for one!

Trending Topics

Streamlining Finances: PayPal Prepaid Mastercard Review

Discover the pros and cons of the PayPal Prepaid Mastercard® in our in-depth review. Uncover the benefits and limitations of this card!

Keep Reading

The Platinum Card® from American Express: Unmatched benefits for high-end lifestyle

Want to know how to get global credit for luxury? Then check out this The Platinum Card® from American Express review.

Keep Reading

The best ways to make money online!

Discover a world of opportunities with our blog post on the best ways to make money online! From freelancing to affiliate marketing!

Keep ReadingYou may also like

Watch NFL Games Online with these Apps!

Watch your favorite NFL teams go head-to-head online with these mobile apps. Stream games anytime, anywhere.

Keep Reading

Apply online for the First Latitude Platinum Mastercard® Secured Credit Card: learn how!

In this First Latitude Platinum Mastercard® Secured Credit Card application guide, you will learn how to apply for this card fast!

Keep Reading

Score Big with the Best iOS Apps to Watch Sports Online!

Dive into the realm of sports streaming apps for iOS and check out the best iOS apps to watch sports online!

Keep Reading