Loans (US)

Happy Money Personal Loans: learn how it works

Happy Money Personal Loans make acquiring the funds you need a breeze. Discover simplified borrowing processes and competitive rates that put financial empowerment within your reach.

Advertisement

Get the funding you need in no time with Happy Money!

If you need some extra cash to achieve your goals, you’re in the right place! In this blog post, we’ll tell you how Happy Money Personal Loans works and how to apply for it. So keep reading!

- APR: the interest rate will vary according to each lender but will range between 10.50% and 29.99%.

- Loan Amount: From $5,000 to $40,000

- Loan Purpose: consolidate credit card debt and personal loans for various purposes.

- Credit Needed: Good credit score, preferably above 640

- Origination fee: Each lender will charge a different amount, but you must indeed pay an Origination Fee of up to 5%

- Late Fee: Happy Money partners do not charge late fees

- Terms: You’ll have from 2 to 5 years to repay your loan, depending on your loan offer

- Early Payoff Penalty: Does not apply any

Happy Money Personal Loans: a complete overview

Happy Money Personal Loans offer a refreshing and joyful approach to borrowing money.

With their customer-centric philosophy, they prioritize not only providing financial assistance but also ensuring a positive and uplifting experience for their borrowers.

Happy Money Personal Loans aim to transform the borrowing journey into a source of happiness and empowerment.

Reasons why you might find it a good choice

There are several reasons why Happy Money Personal Loans can be a great choice:

- Customer-Centric Approach: Happy Money prioritizes the happiness and well-being of its customers. They go beyond providing loans by aiming to create a positive and uplifting experience throughout the borrowing journey.

- Competitive Rates: Happy Money Personal Loans offer competitive interest rates, ensuring that you can access the funds you need at a reasonable cost. This allows you to manage your finances more effectively and potentially save money in the long run.

- Flexible Loan Options: Happy Money provides flexible loan options to suit various needs and financial situations. Whether you require a small loan for a short-term expense or a larger loan for a significant investment, they offer personalized solutions tailored to your specific requirements.

- Streamlined Application Process: Applying for a Happy Money Personal Loan is a hassle-free process. Their online application makes it convenient and straightforward to submit your information, and you can often receive a quick decision. This saves you time and allows you to get the funds you need promptly.

How to apply for the Upgrade Card?

Learn how to apply for the Upgrade Card with our quick application guide and start earning 1.5% cash back on purchases.

Why you might consider other options

While Happy Money Personal Loans offer many advantages, there are a few areas where they may fall short:

- Loan Limits: Happy Money Personal Loans may have limits on the maximum loan amount they offer. If you require a larger loan, their loan limits may not accommodate your needs, and you might have to explore other lenders that can provide higher loan amounts.

- Does not allow you to co-sign with someone else: Unfortunately, Happy Money does not accept co-signed loans, so you can’t complement your creditworthiness.

- Charges an Origination Fee: Happy Money Personal Loans charge an origination fee, which is a one-time fee that covers administrative costs associated with processing your loan. The amount of the origination fee varies depending on the loan amount and interest rate you choose.

- Lack of Physical Branches: Happy Money primarily operates as an online lender, which means they may not have physical branches or in-person banking services. This might be a drawback if you prefer face-to-face interactions

Learn how to apply online for Happy Money Personal Loans

Applying for a personal loan will get easier with Happy Money. With an online application process, you can apply for a personal loan within minutes.

Eligibility criteria

To apply for a Happy Money personal loan, you need to meet a few requirements. You must be a U.S. citizen with a valid Social Security number, at least 18 years old, and have a valid checking account.

It’s important to note that Happy Money does not serve residents of Massachusetts or Nevada. While meeting these requirements doesn’t guarantee approval, you’ll have a higher chance of getting approved if you have a credit score above 640.

Happy Money online application: how it works?

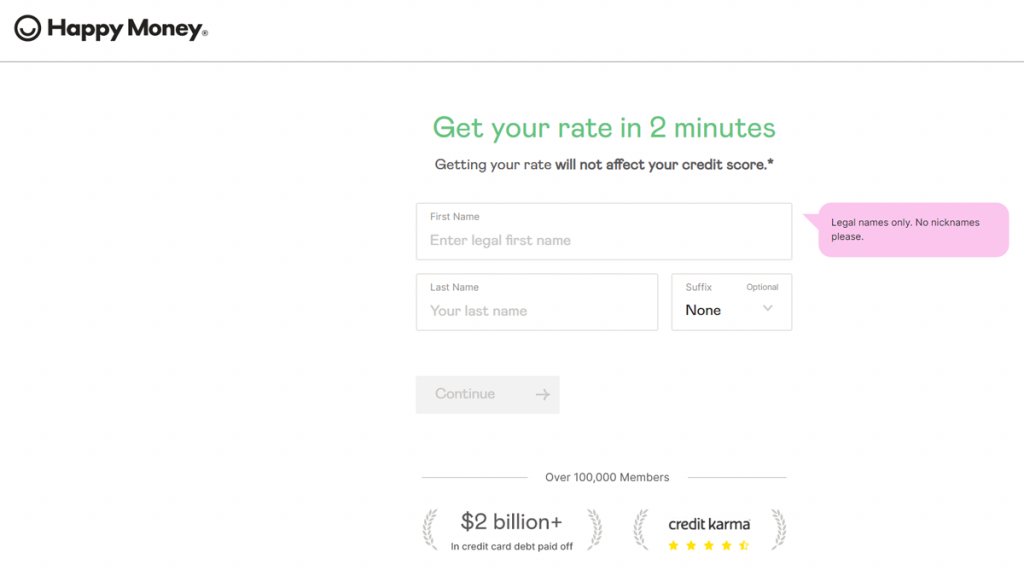

Happy Money offers a rate-checking feature that won’t impact your credit score.

Simply visit their website and click on “check my rate” to access a short form where you’ll provide basic information about yourself, such as your full name, birthdate, address, contact details, income, and employment.

Based on this information, you’ll receive an offer. If you’re pleased with the numbers, you can proceed with the application process to explore official offers from partner lenders.

Happy Money will guide you through the necessary documentation, and once approved, you’ll receive your loan amount promptly to use as needed.

Is there an app available for applying?

Happy Money offers a convenient app for managing your balance and loan payments. However, to apply for a personal loan, you will need to visit their website.

Another great option: Upgrade Cash Rewards credit card

Most credit cards can not replace the use of a personal loan because they have lower credit limits and variable APR, which makes it harder to manage – and also more expensive.

But then it comes the Upgrade Cash Rewards credit card to change the rules. This versatile credit card has a credit limit that goes up to $25,000 and works like a personal loan too.

To see how it is possible and how you can get this revolving credit line to make large purchases and take a cash advance, read the following post.

How to apply for the Upgrade Cash Rewards?

Follow our guide to apply for the Upgrade Cash Rewards. Get this card and start earning cash back at a high rate, plus a $200 welcome bonus.

Trending Topics

GoVa Loans Review: A Comprehensive Analysis of the Mortgage Lending Service!

Home financing redefined! Find out how GoVa Loans can make buying a home a stress-free experience in this comprehensive post!

Keep Reading

PNC Bank Personal Loans review: Up to $25,000!

Don't miss our PNC Bank's Personal Loans review! Borrow up to $25,000 quickly and secure the money you need! Read on!

Keep Reading

How to apply For The Destiny Mastercard®

Learn how to apply for the Destiny Mastercard® with no security deposit and pre-qualification available. Here's how!

Keep ReadingYou may also like

Apply for the Capital One Quicksilver Cash Rewards Credit Card

Check out this Capital One Quicksilver Cash Rewards Credit Card application guide and learn how to apply online for this card fast!

Keep Reading

Top 10 best apps for calorie counting to supercharge your health journey!

Are you looking for easier ways to keep track of your diet? If so, you can read on to learn about the best apps for calorie counting!

Keep Reading

Sam’s Club Credit Plus Member Mastercard review: No annual fee

Read this Sam’s Club Credit Plus Member Mastercard review to find out how this card helps you save on fuel and much more

Keep Reading