Loans (US)

GoVa Loans Review: A Comprehensive Analysis of the Mortgage Lending Service!

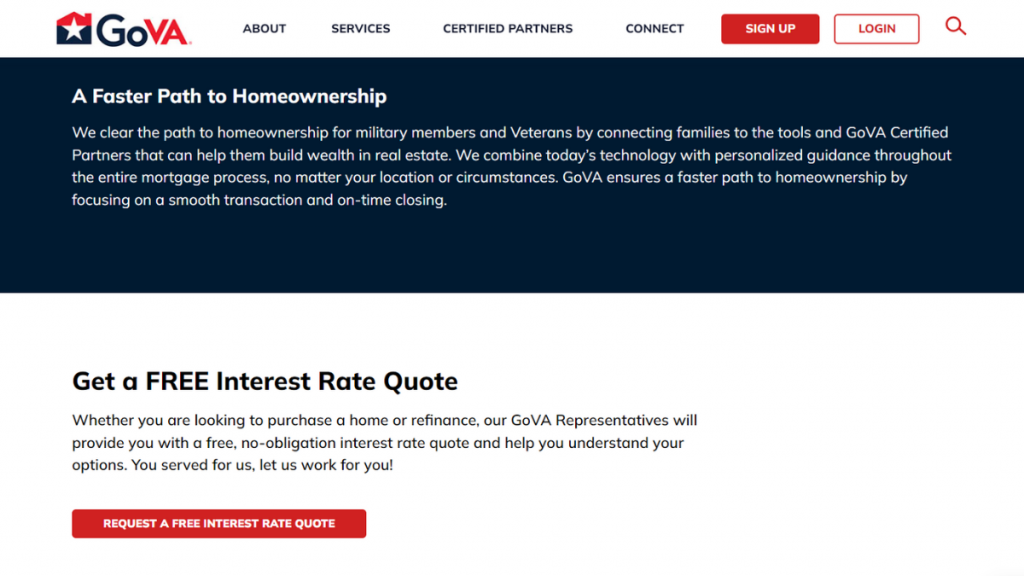

Veterans, embrace the freedom of homeownership with GoVa Loans! From VA Loan limits to the various types of eligible properties. See how GoVa Loans offers a helping hand to veterans!

Advertisement

Navigating the path to homeownership is a dream cherished by many. For veterans and eligible service members, GoVa Loans stands as a beacon of hope, offering a unique route to this cherished goal.

The GoVa Loan program, officially known as the VA Loan Program, is a testament to the nation’s gratitude and commitment to those who have served in the military.

With features like zero down payment and lenient credit requirements, GoVa Loans open the doors to homeownership for many who might otherwise struggle to secure traditional mortgages.

- APR: Personalized rates according to your financial conditions;

- Loan amount: N/A;

- Loan purpose: They can be used for primary residences and, in some cases, investment properties;

- Income needed: While there isn’t a specific income requirement for GoVa Loans, borrowers need a stable source of income to demonstrate their ability to repay the loan;

- Origination fee: Not disclosed;

- Late fee: N/A

- Terms: GoVa Loans typically offer flexible loan terms, with popular options being 15 years and 30 years;

- Early payoff penalty: Borrowers are generally free to pay off their loans ahead of schedule without incurring additional charges.

GoVa Loans: a complete overview

In summary, GoVa Loans are a powerful financial tool designed to make homeownership more attainable for veterans and eligible service members.

The U.S. Department of Veterans Affairs guarantees a portion of the loan, reducing the risk for lenders. This guarantee serves as a safety net for lenders, encouraging them to offer favorable terms.

But, to get a GoVa Loan, you need to work with a lender that is approved by the VA to participate in the program. Besides, to qualify you must meet certain eligibility criteria related to military service.

Moreover, GoVa Loans can be used to purchase a home, refinance an existing mortgage, or even make improvements to a home. The loan program is versatile and can serve various homeownership needs.

GoVa Loans offer flexibility in terms, typically available in options like 15 years and 30 years. So, borrowers can choose the term that aligns with their budget, impacting monthly payments and the overall cost of the loan.

Reasons you might find it a good choice

One of the most significant advantages of GoVa Loans is their zero down payment requirement. This financial flexibility can be a game-changer, especially for first-time homebuyers.

Plus, they’re designed to accommodate a wide range of individuals, including veterans, active-duty service members, members of the National Guard and Reserves, and eligible surviving spouses.

GoVa Loans often come with more lenient credit standards, making it easier for applicants with diverse credit histories to qualify. See some more benefits below:

- Competitive interest rates;

- No Private Mortgage Insurance (PMI);

- No prepayment penalties;

- Assistance with closing costs.

Why you might consider other options

GoVa Loans have specific property requirements, including safety and structural standards, and not all properties may meet these requirements. Plus, they require a home appraisal to determine the property’s value.

While a home inspection is highly recommended for a thorough evaluation of the property’s condition, it’s not covered by the VA. Some other cons of GoVa Loans include:

- Funding fee to support the loan program;

- The application process can be more complex;

- Loan limits set by FHFA can vary by location and change annually;

- Not for investment properties.

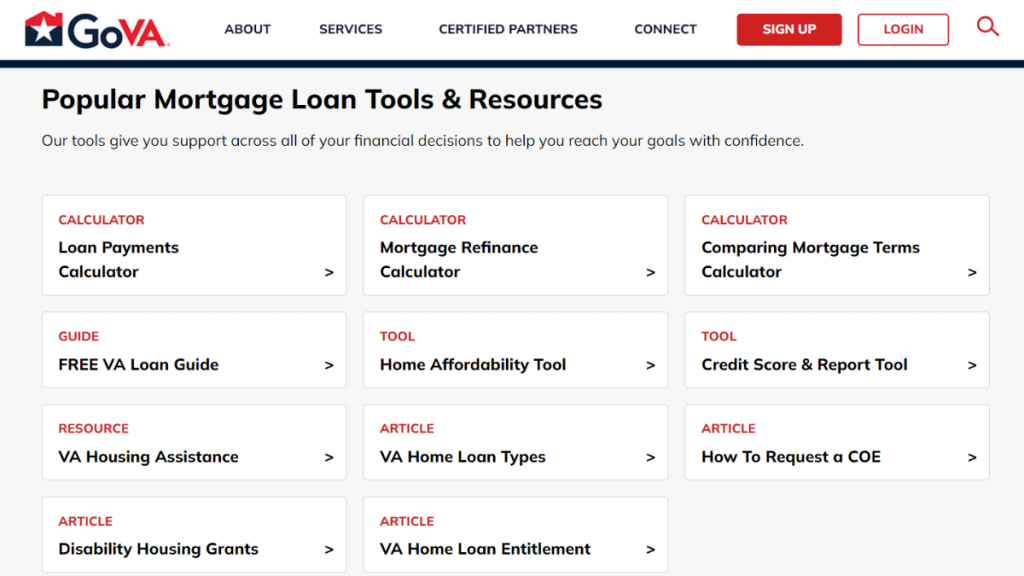

Let’s talk about the application process for GoVa Loans

Though the process of applying to GoVa Loans may seem daunting at first, with the right knowledge and guidance, it becomes a manageable and rewarding experience!

Don’t worry! We’ll walk you through the steps and provide valuable insights on how to apply for GoVa Loans. Just keep reading to find out all the details below!

Learn how to apply online

Whether you’re a first-time homebuyer or looking to upgrade to a new home, understanding the application process is the first and most crucial step toward achieving your homeownership goals.

- Eligibility and documents: Firstly, ensure you meet the eligibility criteria for GoVa Loans. Then, collect the necessary documents. This includes your Certificate of Eligibility (COE), proof of income, credit reports, and more.

- Find a GoVa-approved lender: Explore the list of lenders approved by the VA to participate in the GoVa Loan program.

- Get pre-approved: Your chosen lender will review your financial information and provide a pre-approval letter, specifying the loan amount you qualify for.

- Complete the online application: Most GoVa Loan lenders offer online application platforms on their websites. They streamline the process and save you time.

- Underwriting and approval: Finally, the lender’s underwriting team will assess your application to ensure it aligns with GoVa Loan program requirements. Upon approval, you’ll receive a loan commitment.

- Home appraisal and inspection: To secure your investment, the lender will typically require a home appraisal to determine the property’s value and ensure it meets the VA’s minimum property requirements.

- Closing: The final phase is the closing process, where you’ll sign the necessary documents and handle any closing costs!

While GoVa Loans offers veterans and eligible service members an excellent path to homeownership with many benefits, we understand that financial needs come in all shapes and sizes.

That’s where Sanlam Personal Loans step in. If you’re looking for financial flexibility to fulfill personal dreams, consolidate debt, or handle expenses, Sanlam Personal Loans provide a versatile alternative.

Curious to see how it works? To learn more about Sanlam Personal Loans and how they can cater to your financial goals, just click below. Your financial aspirations are just one click away from becoming a reality.

Sanlam Personal Loans application

Say yes to financial possibilities with the Sanlam Personal Loans application: Empowering you to live life on your terms.

About the author / Vinicius Barbosa

Trending Topics

The best credit cards with 0% APR: save your money for better things!

Using a credit card can be expensive if you carry a balance. But not with one of the best credit cards with 0% APR!

Keep Reading

Upgrade Triple Cash Rewards Card review: 3% Cash Back on Home, Auto, and Health Purchases

Check out this Upgrade Triple Cash Rewards Card review and learn about this card's 3% cash back on home, auto, and health purchases.

Keep Reading

Fashion on a Budget? Discover Mr Price Money Account!

Experience convenient online shopping and unbeatable value at Mr Price Money in South Africa. Shop with confidence!

Keep ReadingYou may also like

Apply for the Amazon Prime Rewards

Maximize your rewards: learn how to apply for the Amazon Prime Rewards credit card to earn up to 5% cashback on Amazon purchases!

Keep Reading

Apply for the Upgrade Triple Cash Rewards Card: Cash Back on Home, Auto, and Health Purchases

This post tells you how to apply for the Upgrade Triple Cash Rewards Card. You will see how you can get this card in just a few minutes.

Keep Reading

Sable Secured card review: Upgrade to a Traditional Credit Card in Just Four Months

Want to get 2% cash back on purchases at major streaming services and more? So check out this Sable Secured card review.

Keep Reading