Apps

Fashion on a Budget? Discover Mr Price Money Account!

From fashion to home goods, Mr Price Money offers it all - explore its diverse range of benefits today with our comprehensive review.

Advertisement

Shopping for fashion and home essentials can be both exciting and daunting. But with Mr Price Money, the process becomes a breeze.

In this review, we’ll explore the ins and outs of this product, the renowned e-commerce platform in South Africa.

Get ready to discover an array of stylish clothing, footwear, accessories, and home decor items, all at affordable prices.

What is Mr Price Money, and how does it works?

Are you in search of a hassle-free way to shop for your favorite fashion and home essentials? Well, look no further!

It’s an incredible financial service provided by the renowned South African retail company, Mr Price Group. You can easily apply for credit and unlock a world of convenient shopping options.

By simply filling out an application online or in-store, you can get approved for a credit limit tailored to your needs.

Once approved, you’ll have the freedom to shop to your heart’s content at any of the fantastic Mr Price Group stores, like Mr Price, Miladys, and Sheet Street.

Plus, you’ll have the flexibility to repay the borrowed amount at your own pace – whether it’s through manageable installments or paying it off within a specific period.

Moreover, managing your account is a breeze too, as you’ll have online access to track your purchases, outstanding balances, and transaction history.

Is Mr Price Money worth it? An overview of its features

When considering whether Mr Price Money is worth it, it’s important to take an overview of its features into account.

This account offers several benefits that make it a compelling option for shoppers in South Africa.

First and foremost, it provides a convenient and accessible way to shop for fashion and home essentials.

With a simple application process, you can easily apply for credit and gain access to a credit limit tailored to your needs.

This allows you to shop at various Mr Price Group stores, offering a wide range of products to choose from.

Advantageous features of this account

This product offers flexible repayment options, allowing you to choose between manageable installments or paying off the borrowed amount within a specific period.

This gives you the freedom to budget and manage your finances effectively. With online account access, managing your account is a breeze.

You can easily track your purchases, outstanding balances, and transaction history, providing transparency and control over your spending.

MyLoan Review

Discover the convenience of MyLoan Co in our review. Learn about its cost-effectiveness – find the perfect loan for your needs!

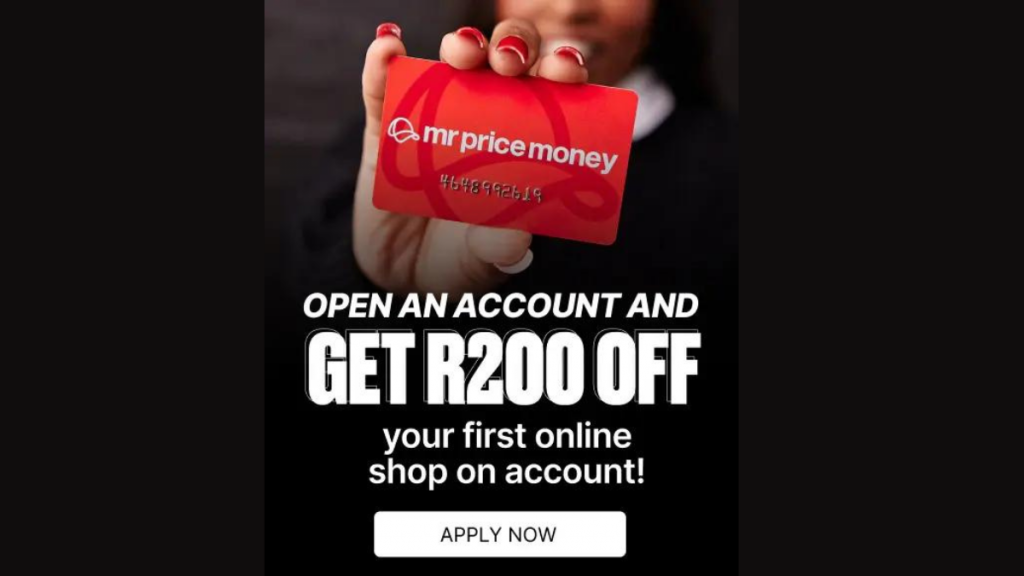

Should you open a Mr Price Money account?

It’s important to exercise responsible credit use and consider your financial situation before applying.

While it offers convenient shopping opportunities, it’s crucial to assess your ability to make repayments and avoid accumulating excessive debt.

Ultimately, whether this account is worth, it depends on your individual circumstances and shopping preferences.

If you value convenience and flexible repayment options and enjoy shopping at Mr Price Group stores, it can be a worthwhile choice.

Just remember to carefully evaluate your financial capacity and weigh the benefits against your personal needs before making a decision.

Eligibility Requirements: What are Mr Price Money criteria to accept your application

Mr Price Money has certain criteria that need to be met in order for your application to be accepted.

While specific requirements may vary, here are some general eligibility criteria to give you an idea:

- Age: Applicants need to be at least 18 years old to be considered for this account;

- South African Citizenship or Permanent Residence: You’ll be required to provide proof of South African citizenship or permanent residence;

- Identification: A valid South African ID document or a valid passport will be necessary for the application process;

- Employment and Income: Depending on the credit assessment, it may consider factors such as employment status, income level, and stability. Regular income from employment or a stable source is often preferred;

- Creditworthiness: Mr Price Money will evaluate your creditworthiness, which may include checking your credit history and score to assess your ability to manage credit and make repayments;

- Spousal permission: If you’re married in a community of property or customary law, your spouse must give you permission to open this account

It’s important to note that meeting the basic eligibility criteria does not guarantee approval, as the decision ultimately rests with Mr Price Money based on their assessment of your application.

Mr Price Money application: Learn how to open your account

Opening your account is easy and straightforward. Here’s a simplified step-by-step guide:

- Visit the official website;

- Click on “Open an Account” button;

- Fill out the application form with your personal and employment details to see if you’re eligible;

- Review the information for accuracy and submit the application;

- Await approval after the credit assessment process;

- Once approved, you’ll receive a notification with your credit limit;

- Start shopping at Mr Price Group stores using your approved account.

Remember to use your account responsibly and make timely repayments to maintain good credit.

Still, looking for a credit line? Try Sanlam Personal Loans

Are you in need of a credit line to help you through a financial situation? Look no further than Sanlam Personal Loans!

With Sanlam Personal Loans, you have access to a range of flexible borrowing options that can suit your specific needs.

Whether you’re looking to consolidate debt, fund a major purchase, or cover unexpected expenses, Sanlam offers competitive interest rates and repayment terms tailored to your budget.

To learn more about the features and benefits of Sanlam Personal Loans, we highly recommend checking out our in-depth review.

Don’t let financial stress hold you back – discover the convenience and reliability of Sanlam Personal Loans today!

Sanlam Personal Loans application

Whether financing a major life event or consolidating your debts for better financial management, Sanlam's range of loan solutions caters to your unique circumstances.

Trending Topics

How to get the best audiobooks for free to listen!

Don't break the bank to satisfy your audiobook cravings. Learn how to access a world of audiobooks that are free to listen to!

Keep Reading

Apply for the Capital One Walmart Rewards® Mastercard®

Check out this Capital One Walmart Rewards® Mastercard® application guide to learn how to apply for this card in just a few minutes

Keep Reading

Apply for the Upgrade Triple Cash Rewards Card: Cash Back on Home, Auto, and Health Purchases

This post tells you how to apply for the Upgrade Triple Cash Rewards Card. You will see how you can get this card in just a few minutes.

Keep ReadingYou may also like

CashNetUSA review: Get an immediate decision!

Discover the pros and cons of CashNetUSA loans in our comprehensive review. From lightning-fast approvals to potential drawbacks!

Keep Reading

Capital One Platinum Credit Card review

Establish your credit with ease using the Capital One Platinum Credit Card. Enjoy no annual fees, fraud coverage, and much more!

Keep Reading

Apply for the US Bank Altitude® Go Visa Signature® Card

Apply for the US Bank Altitude® Go Visa Signature® Card: it may be a great option for you. Read on to learn how to get yours!

Keep Reading