Credit Card

Sam’s Club Credit Plus Member Mastercard review: No annual fee

This card helps you save on fuel and rewards you with cash back. Find out more in this Sam’s Club Credit Plus Member Mastercard review.

Advertisement

Big Savings with This Wholesale Sam´s Club Credit Plus Member Mastercard!

In this Sam’s Club Credit Plus Member Mastercard review, we’ll take a closer look at this card., It features big rewards on gas, dining, and in-store purchases, plus a $30 welcome bonus.

How to apply for Sam’s Club Credit Plus Mastercard

Ready to start earning cash back and saving on fuel? Then follow our Sam’s Club Credit Plus Member Mastercard application guide.

- Credit Score: Good to Excellent (690-850)

- APR: Ongoing APR is 20.15%-28.15%, variable

- Annual Fee: $0

- Fees: No foreign transaction fee

- Welcome Bonus: Get a $30 statement credit when you open a new account and make $30 in Sam’s Club purchases within 30 days.

- Rewards: 5% cash back (on up to $6,000 spent per year, then 1%) at EV charging stations and eligible gas stations worldwide, including stations at Sam’s Club. 3% back on dining and takeout, 3% cash back on eligible Sam’s Club purchases for Plus members. Club members earn 1% cash back. 1% cash back on other purchases.

The Sam’s Club Credit Plus Member Mastercard is best for frequent Sam’s Club shoppers who want big rewards on gas, dining, and in-store purchases.

Keep reading to learn all you need to know about this card.

Sam’s Club Credit Plus Member Mastercard: a complete overview

The Sam’s Club Credit Plus Member Mastercard review reveals that this card is an excellent option for Sam’s Club “Plus” members.

If you frequently buy gas, dine out, and shop at Sam’s Club, this card’s for you.

The card offers some of the highest rewards rates available on fuel purchases and a solid rate on dining.

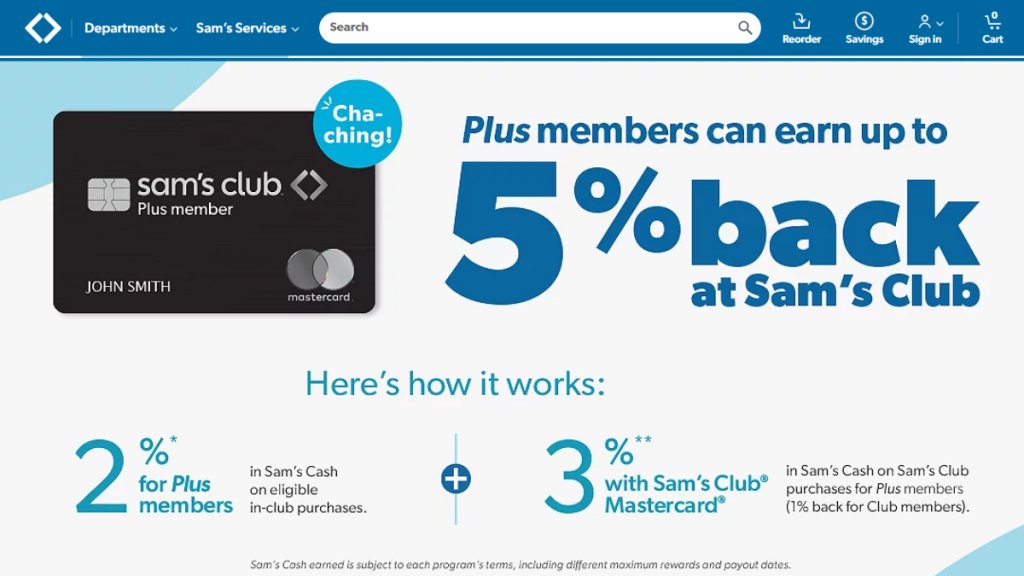

Cardholders earn up to 5% back on eligible Sam’s Club shopping, but only for “Plus” members. However, the card is less appealing for lower-tier Sam’s Club members.

“Club”-level members won’t earn any bonus rewards for using it at the store, making other cash-back cards a better option for them.

The card has no annual fee and offers a new cardholder bonus. However, its rewards can be difficult to understand and come with several rules and caps, making it challenging to use.

To get the card, you must be a Sam’s Club member. This comes with a yearly fee of either $45 for a baseline “Club” membership or $100 for a “Plus” membership.

The card doubles as your membership card and you can use it at Sam’s Club and Walmart® nationwide.

The card’s total rewards are capped at $5,000 per calendar year, and rewards are redeemable for cash, statement balance, or Sam’s Club purchases.

While the Sam’s Club Credit Plus Member Mastercard offers a 5% cash-back rate on up to $6,000 in gas and EV charging expenses per year, this rate is subject to a cap. This makes it difficult to maximize rewards.

For “Plus” members, the card itself earns 3% back on qualifying Sam’s Club purchases. However, the additional 2% back via your membership is only on qualifying in-store purchases, not at samsclub.com.

So now let’s have a look at the pros and cons of this card.

Reasons you may want it

The Sam’s Club Credit Plus Member Mastercard could be a great option for you if you frequently buy gas, dine out, and shop at Sam’s Club.

With its high rewards rate on fuel purchases and dining, you could earn up to $105 annually just from dining out. Plus, if you’re a Sam’s Club “Plus” member, you could earn up to 5% back on eligible Sam’s Club shopping, and the card has no annual fee.

Additionally, the card doubles as your membership card and offers a $30 statement credit as a new cardholder bonus offer.

Why maybe you wouldn’t choose it

The Sam’s Club Credit Plus Member Mastercard may not be the best fit for you if you’re a heavy spender or find complicated rewards structures confusing.

Additionally, the card requires good to excellent credit, which could make it harder to qualify if you have a lower credit score. Furthermore, you must be a Sam’s Club member to get the card, which comes with a yearly fee of either $45 or $100, depending on your membership level.

Lastly, if you have a baseline “Club” membership, the card earns only 1% back on eligible Sam’s Club shopping, which is less appealing compared to other cash-back cards.

Inside the application process for Sam’s Club Credit Plus Member Mastercard

If you’re impressed by what you’ve learned from this Sam’s Club Credit Plus Member Mastercard review, why not apply for the card in just a few minutes?

Our application guide can help you navigate the process, so click the link below to get started.

How to apply for Sam’s Club Credit Plus Mastercard

Ready to start earning cash back and saving on fuel? Then follow our Sam’s Club Credit Plus Member Mastercard application guide.

About the author / Danilo Pereira

Trending Topics

Unique Platinum Card review

Check our Unique Platinum Card review to learn how you can have easy access to a $1,000 merchandise credit line without a credit check!

Keep Reading

Mission Money™ Visa® Debit Card review

Looking for a great debit card that fits your budget? Read our Mission Money™ Visa® Debit Card review and learn all you need to know.

Keep Reading

Top 10 best apps for calorie counting to supercharge your health journey!

Are you looking for easier ways to keep track of your diet? If so, you can read on to learn about the best apps for calorie counting!

Keep ReadingYou may also like

Unlocking Financial Potential: OpenSky® Plus Secured Visa® Card Review

Discover the OpenSky® Plus Secured Visa® Credit Card: Your guide to better credit and financial freedom. Read our in-depth review now!

Keep Reading

Score Big with the Best iOS Apps to Watch Sports Online!

Dive into the realm of sports streaming apps for iOS and check out the best iOS apps to watch sports online!

Keep Reading

Rise Credit Review: 5-Day Risk-Free!

Considering RISE Credit Loans? Discover the ins and outs in our review. Learn about flexible loan options, credit score perks, and more!

Keep Reading