Debit Cards

Walmart Money Card review: Cashback & Fees Decoded

Is the Walmart Money Card worth it? Dive into our review for insights into its rewards, fees, and convenience. Make informed financial decisions today!

Advertisement

Unveiling Walmart MoneyCard: Rewards & Costs

Looking for a reliable and convenient way to manage your finances? The Walmart MoneyCard review might just be the solution you’ve been seeking.

In this comprehensive review, we’ll delve into the ins and outs of this prepaid debit card, exploring its features, benefits, and potential drawbacks to help you out!

- Credit Score: No credit check required;

- APR: None;

- Monthly fee: None;

- Fees: There are some bank fees;

- Welcome bonus: None;

- Rewards: Up to 3% cash back on eligible purchases.

Walmart Money Card: A Complete Overview

Our job here in this post is to help you make an informed decision about whether it suits your financial needs. So, we’ll talk about the features of the Walmart Money card to help you!

Moreover, as one of the leading prepaid debit cards in the market, the Walmart MoneyCard offers a plethora of features designed to simplify your financial life.

From cashback rewards to direct deposit options and the ability to shop online or in-store, this card boasts versatility and accessibility.

Join us as we take a closer look at what sets the Walmart MoneyCard apart and whether it lives up to its reputation as a convenient financial tool!

Reasons you may want it

This card can have many incredible features. Below are the main ones for you to enjoy as a cardholder!

Cash back rewards

With 3% cash back for purchases on Walmart.com, 2% at Walmart gas stations, and 1% at Walmart stores, this card provides a substantial incentive for regular Walmart shoppers.

Also, this perk can significantly add value to everyday spending, turning routine purchases into opportunities for savings and rewards.

Free withdrawals

This card offers free access to over 5,000 Walmart locations with free withdrawals worldwide!

Moreover, this feature ensures convenient and fee-free access to funds, eliminating the hassle of searching for ATMs and incurring additional charges for withdrawals.

Reloading process

Users can conveniently reload their cards for free at Walmart stores using the MoneyCard app, avoiding extra fees that might accompany other reload methods.

Direct deposit for free

Users can receive their payroll or government benefits up to 2 or 4 days early, providing financial flexibility and quicker access to funds compared to traditional deposit methods.

So, you’ll be able to get access to free direct deposit!

Easy to manage

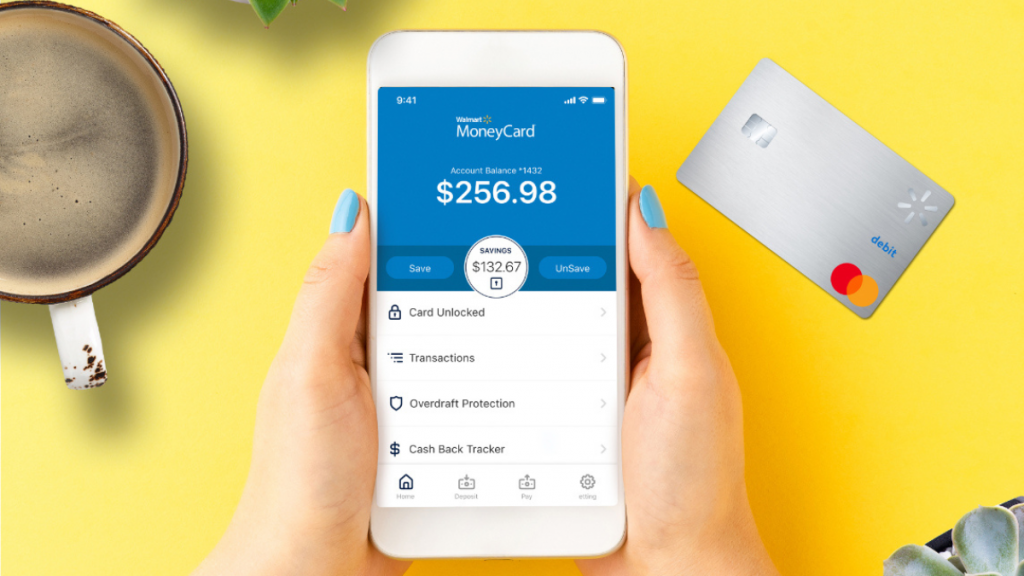

This card’s app and features allow you to easily manage your finances with free online bill pay services.

This feature enables users to conveniently manage and pay bills online, adding to the card’s convenience and utility as an everyday financial tool.

Why maybe you wouldn’t choose it

Even though this card offers incredible perks, it also has some downsides. So, keep reading below to learn about this card’s downsides!

Load to waive the monthly fee

To waive the monthly fee, a relatively steep load of $1,000 is required on the card.

This means users must ensure a consistent load to avoid incurring monthly fees, making it more suitable for those who regularly maintain higher balances or use the card for substantial transactions.

Bank fees

It’s important to note that while the card offers free cash withdrawals at Walmart locations, there’s a $2.50 fee for withdrawals made through bank tellers or non-Walmart ATMs.

When it comes to reloading funds onto the card, there are associated fees to consider.

Apply for the Walmart Money Card

You can learn below how to easily apply for this incredible Walmart card!

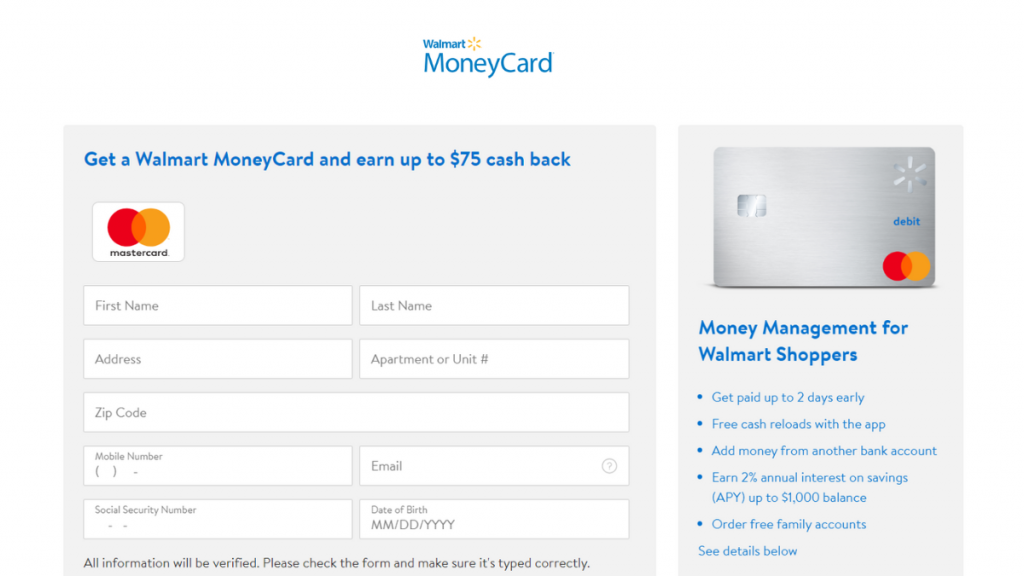

Online application process

You’ll be able to easily apply online for this incredible card. But you’ll need to know a few information before you start applying.

You’ll need to go to the official website and provide the personal information required.

Then, you’ll be able to get a response and start the process of activating your mobile app and using your card!

Is there an app for applying?

You can use the Walmart Money Card mobile app at any time! Moreover, you’ll be able to use the app 24/7 to get control of your money anywhere you are at any time!

Also, you’ll be able to use the app to check all your money features, such as balance and much more!

However, you’ll need to go to the official website and complete your card application online.

Therefore, after you complete your card application and are accepted, you’ll be able to activate your mobile app to start using the features!

Another great option: Extra Debit Card

Do you love the features of the Walmart Money Card but want to find a different option? If so, we can help! So, you can get the Extra Debit Card!

Also, this card can offer many incredible perks to its cardholders! For example, you’ll be able to use this card as a debit card and still improve your credit score!

Therefore, you’ll be able to use this card to improve your score if you make all your payments on time and use it responsibly!

Moreover, with this card, you’ll be able to earn cash back on all your eligible purchases with the card!

Also, it will be up to 1% in cashback! Therefore, you can learn much more about this debit card in our blog post below!

Plus, you’ll be able to learn all about how to apply for this card! So, read on!

How to apply for the Extra Debit Card online!

Looking for a debit card that can help build your credit? See the Extra Debit Card apply way may be the right option for you! Read on.

About the author / Victória Lourenço

Trending Topics

Apply for the Applied Bank® Gold Preferred® Secured Visa®

Get security and financial power even without credit history with Applied Bank® Gold Preferred® Secured Visa® apply.

Keep Reading

Applied Bank® Gold Preferred® Secured Visa® review

Want a card that doesn't require a credit score? See Applied Bank® Gold Preferred® Secured Visa® review in this article.

Keep Reading

Enhance your Pictures With the Best Apps to Edit Your Photo Like a Pro!

From basic adjustments to advanced filters and effects, these photo editing apps are your key to unlocking endless possibilities!

Keep ReadingYou may also like

The best credit cards with 0% APR: save your money for better things!

Using a credit card can be expensive if you carry a balance. But not with one of the best credit cards with 0% APR!

Keep Reading

How to apply for the OpenSky® Secured Visa® Credit Card

Get this credit card easily and start improving your credit. Here's how to apply for the OpenSky® Secured Visa® Credit Card.

Keep Reading

Unique Platinum Card review

Check our Unique Platinum Card review to learn how you can have easy access to a $1,000 merchandise credit line without a credit check!

Keep Reading