Rebuild your credit with the Destiny Mastercard® featuring pre-qualification, monthly reporting, and zero liability protection!

Destiny Mastercard®: Pre-Qualify and Rebuild Your Credit with Monthly Reporting and Zero Liability Protection.

Advertisement

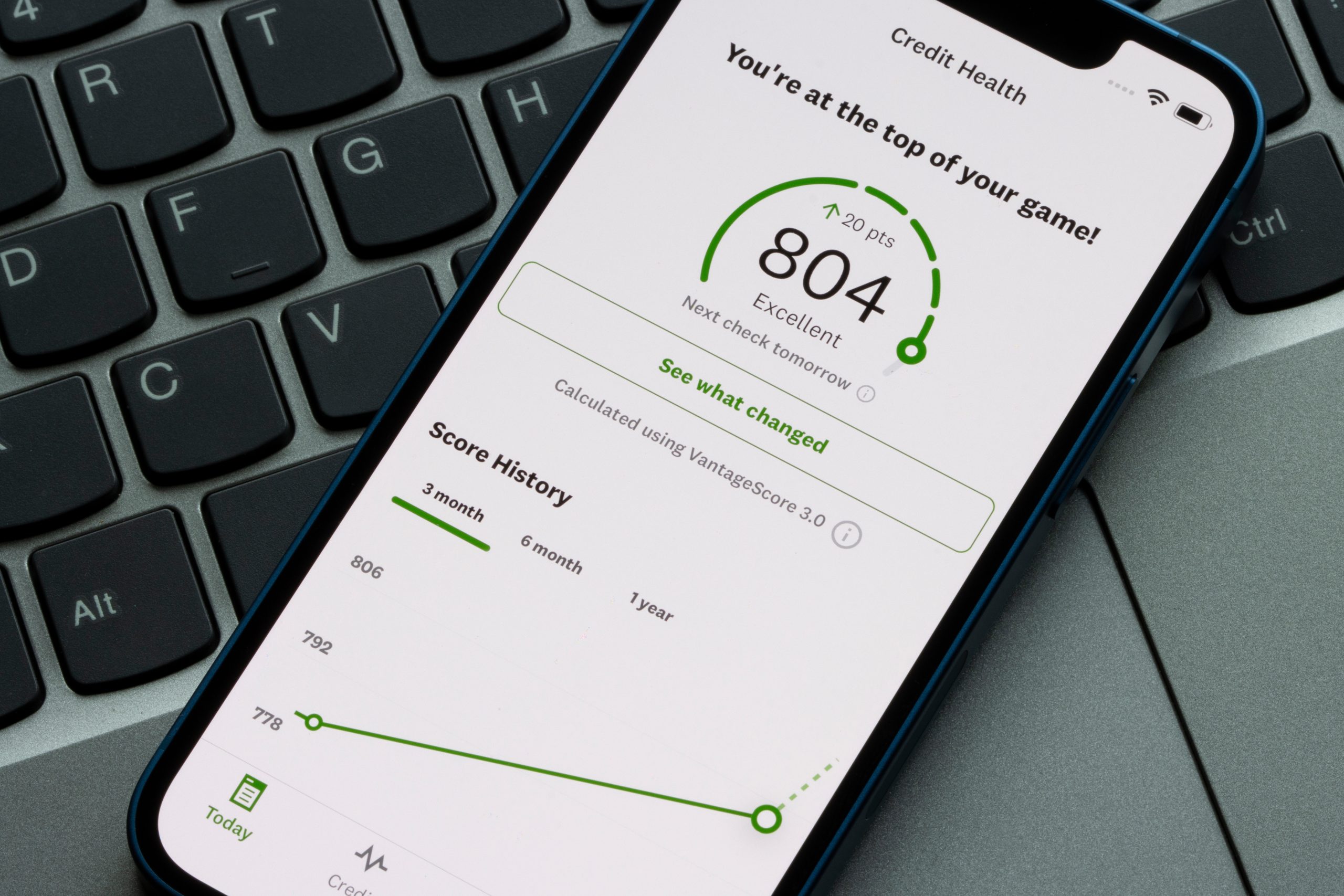

The Destiny Mastercard® is an unsecured credit card ideal for those with bad credit looking to rebuild their score. The card features pre-qualification without impacting your credit score, monthly reporting to all three major credit bureaus, and zero liability protection. Additionally, $0 fraud liability and easy online account access make it a great option for those looking to take control of their credit.

The Destiny Mastercard® is an unsecured credit card ideal for those with bad credit looking to rebuild their score. The card features pre-qualification without impacting your credit score, monthly reporting to all three major credit bureaus, and zero liability protection. Additionally, $0 fraud liability and easy online account access make it a great option for those looking to take control of their credit.

You will remain in the same website

With so many benefits and perks, it's no wonder the Destiny Mastercard® has become one of the most popular ways to get a better credit score. Meet some of these benefits next!

To apply for the Destiny Mastercard®, you can visit their website and fill out an online application. The application process is straightforward and can be completed in just a few minutes. Before submitting your application, make sure to review the terms and conditions carefully to understand the fees and interest rates associated with the card. Once you have submitted your application, you should receive a response within a few minutes regarding your eligibility. If you are approved, you can expect to receive your credit card in the mail within a few business days. If you have any questions or concerns during the application process, you can contact Destiny Customer Services for assistance.

The credit limit for the Destiny Mastercard® is initially set at $300. However, this limit can be increased over time with responsible use of the card and timely payments. It is important to note that the card has an annual fee of $59-$99, and that the interest rate for the card is 24.90% APR. As such, it is recommended that cardholders use the card responsibly and make timely payments in order to avoid accruing interest and fees. Additionally, the Destiny Mastercard® offers pre-qualification without impacting your credit score, allowing you to see if you are eligible for the card before applying and potentially risking further damage to your credit score.

Pre-qualifying for the Destiny Mastercard® is a smart decision for a few reasons. First and foremost, pre-qualification allows you to determine whether you are eligible for the card without impacting your credit score. This is because pre-qualification typically involves a “soft” credit check, which does not leave a mark on your credit report. This can be beneficial for those who are concerned about further damaging their credit score, or who want to avoid the risk of applying for a credit card and being rejected. Additionally, pre-qualification for the Destiny Mastercard® allows you to get a sense of the credit limit you may be approved for, as well as the terms and conditions of the card. This can help you make an informed decision about whether the card is right for you, and can help you plan for how you will use the card once you are approved.

Interested in the Destiny Mastercard®? Our application guide will walk you through the process and help you get it in no time. Click the link below to get started!

How to Apply For The Destiny Mastercard®?

Learn how to apply for the Destiny Mastercard® with no security deposit, and pre-qualification available. Here's how!

Are you on the lookout for a credit card that gives you some cash back? You should totally check out the Upgrade Triple Cash Rewards Card!

It hooks you up with a sweet 3% cash back deal on things like home, auto, and health purchases, and 1% cash back on everything else.

This card is perfect for folks who make lots of purchases in those categories, and the best part is that there’s no annual fee!

Want to know more? Click the link below and we’ll spill all the details!

How to get your Upgrade Triple Cash Rewards Card

In this Upgrade Triple Cash Rewards Card application guide you will see how you can get this card in just a few minutes.

Trending Topics

Unicredit Banca Prestito – La soluzione finanziaria su misura per te

Unicredit Banca Prestito è la soluzione finanziaria ideale per realizzare i tuoi progetti. Approfitta di piani di rimborso flessibili!

Keep Reading

What Are the 3 Credit Bureaus? How Do They Work?

What are the 3 credit bureaus? You can learn all about your score in our blog post and see how you can improve it!

Keep Reading

Best Egg Loans: How does it work?

In need of a loan? Look no further than Best Egg Loans and discover how it works, including their competitive rates, and easy application.

Keep ReadingYou may also like

Chase Bank Review: a large menu of financial products

Get a $200 bonus on your Total Checking account when you sign up to the chase bank review. See how to apply now here.

Keep Reading

Rise Credit Review: 5-Day Risk-Free!

Considering RISE Credit Loans? Discover the ins and outs in our review. Learn about flexible loan options, credit score perks, and more!

Keep Reading

UniCreditCard Flexia Classic – Il tuo partner finanziario flessibile

UNICREDITCARD FLEXIA CLASSIC è la carta di credito ideale per le tue esigenze finanziarie. Approfitta di tutti i vantaggi!

Keep Reading