Credit Card

Assent Platinum Secured card review: Build Your Credit and Save Money

This card will help you improve your credit and save money on interest. Check out our Assent Platinum Secured card review.

Advertisement

Get Low Fees, Flexible Deposit Options, and a Low Purchase APR

Welcome to our Assent Platinum Secured card review. If you’re looking to rebuild your credit, this card offers low fees, flexible deposit options, and a low purchase APR.

How to apply for the Assent Platinum Secured

Learn how to get a card that will help you improve your credit with a little help from our Assent Platinum Secured card application guide.

- Credit Score: (300-580).

- APR: 0% introductory APR for six months, after that, Prime Rate plus Margin of 9.74%.

- Annual Fee: $49.

- Fees: $10 or 3% cash advance fee (whichever is greater), 3% foreign transaction fee, up to $40 late payment fee, $29 return payment fee.

- Welcome bonus: N/A.

- Rewards: N/A.

This credit card is best for those seeking to rebuild their credit with low fees, flexible deposit options, and a low purchase APR. Keep reading and discover all of its features to decide whether it is for you.

Assent Platinum Secured card: a complete overview

If you’re in the market for a secured credit card to help rebuild your credit, the Assent Platinum Secured MasterCard might be an option to consider.

This card has an introductory 0% APR for six months, although carrying a balance on a secured card is not a good idea.

Also, the purchase APR is relatively low at 12.99% variable, but again, we do not recommend carrying a balance.

The annual fee of $49 may be a deterrent for some, but the flexible security deposit is a nice feature.

Further, the minimum deposit is $200, and you can increase it up to $2000 if you need it. Also, the security deposit is refundable when you close your account, as long as you don’t owe a balance.

Although the card has some fees, they are not excessive if you compare them to other secured credit cards.

For example, the cash advance fee is $10 or 3%, whichever is greater, and there is a foreign transaction fee of 3%. Late payment fees can go up to $40, and there is a return payment fee of $29.

The Assent Platinum Secured MasterCard reports to all three major credit bureaus. So with diligent use and timely payments, you can eventually improve your credit score.

You can also access your account 24/7 to get information about your balance and payments.

However, it may take up to three weeks to receive your card after approval, and there is a $19.95 fee for expedited processing.

So this card is a decent option for those looking for a secured credit card with minimal fees and a flexible security deposit. However, it is not available in some states.

Reasons you may want it

Firstly, Assent Platinum Secured card reports to all three major credit bureaus, allowing you to rebuild your credit with responsible use.

Secondly, the card has a relatively low purchase APR of 12.99% variable, which can be helpful in managing interest charges.

Additionally, the flexible security deposit starting at $200 and refundable when you close your account is a handy feature.

Also, the card has minimal fees compared to other secured credit cards. Plus, there’s also a 0% introductory APR for six months, useful for larger purchases while avoiding interest charges.

Why maybe you wouldn’t choose it

The card has an annual fee of $49, which may be a drawback for some consumers. Additionally, the card is not available in certain states, including Wisconsin, New York, Arkansas, and Iowa.

The $19.95 fee for expedited processing is another cost to consider. While the 0% introductory APR for six months may be tempting, carrying a balance on a secured card is not recommended.

Lastly, the card has a late payment fee of up to $40, so it’s important to make payments on time to avoid additional costs.

Inside the application process for Assent Platinum Secured card

If our review of the Assent Platinum Secured card has piqued your interest, why not apply today?

Our application guide makes it simple and straightforward. Click the link below to learn more.

How to apply for the Assent Platinum Secured

Learn how to get a card that will help you improve your credit with a little help from our Assent Platinum Secured card application guide.

About the author / Danilo Pereira

Trending Topics

Marketplace on Facebook: How to get it and start using it!

Learn how to start buying and selling online while unraveling the secrets of this virtual marketplace on Facebook!

Keep Reading

Discover the Best Apps When Traveling for a Seamless Journey

If you love to travel, you can find the best apps to use when traveling! Read on to download these essential apps before your next adventure!

Keep Reading

Apply for the US Bank Altitude® Go Visa Signature® Card

Apply for the US Bank Altitude® Go Visa Signature® Card: it may be a great option for you. Read on to learn how to get yours!

Keep ReadingYou may also like

Freedom Gold Card review

Get the inside scoop on the pros and cons of the Freedom Gold Card with our comprehensive review. Find out if it's right for you!

Keep Reading

UniCreditCard Flexia Classic – Il tuo partner finanziario flessibile

UNICREDITCARD FLEXIA CLASSIC è la carta di credito ideale per le tue esigenze finanziarie. Approfitta di tutti i vantaggi!

Keep Reading

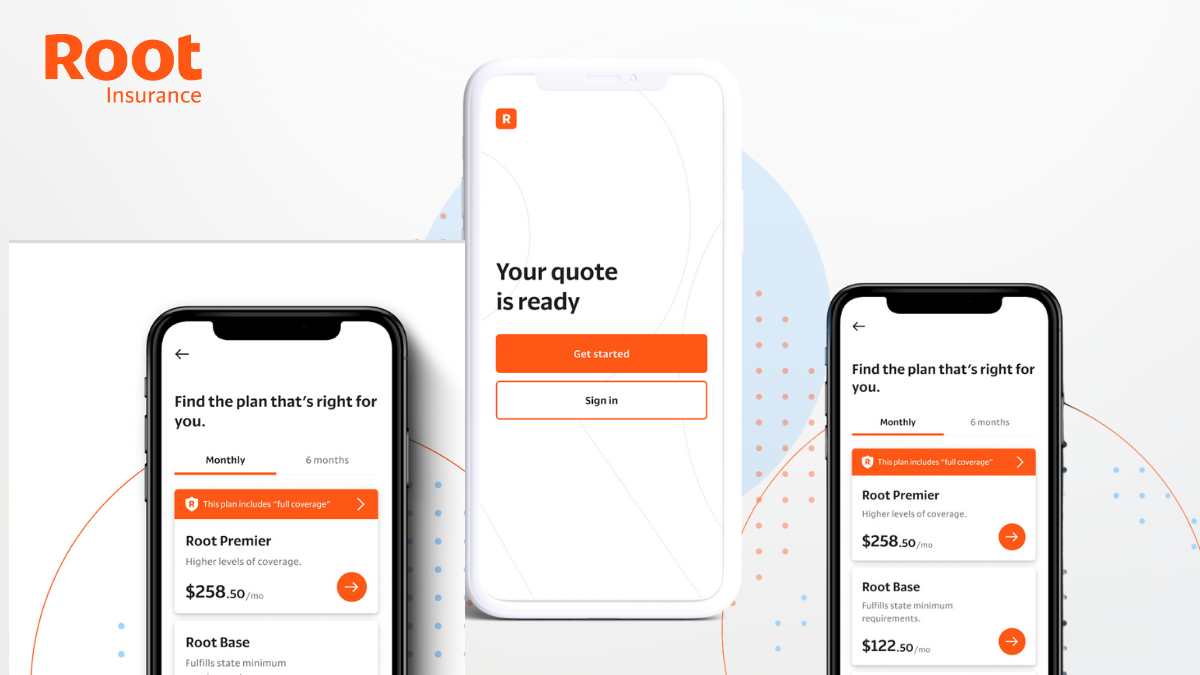

Root Car Insurance: Drive Smart, Save Big

Uncover the innovative approach of Root Car Insurance as we dive into its transparent pricing model and mobile app convenience.

Keep Reading