Loans (US)

LendKey Student Loans review: No application fee!

Explore our in-depth analysis of LendKey Student Loans: the pros, cons, and everything in between. Find out if this lending platform aligns with your financial goals and aspirations for educational funding!

Advertisement

LendKey Student Loans review: No prepayment fees!

The landscape of student loans can often feel like traversing uncharted waters, where each decision shapes your educational journey. So, you can read our LendKey Student Loans review!

So, in this review, we delve into the realm of LendKey Student Loans, a platform heralded for its unique approach to financing higher education.

- APR: 8.11% fixed APR (refinancing); 4.39% fixed APR or 6.09% variable APR (with AutoPay for Private Student Loans);

- Loan Amount: $5,000 to $250,000;

- Loan Purpose: Student refinancing and private student loans;

- Credit Needed: At least a good score;

- Origination fee: There is no origination fee;

- Late Fee: There can be late fees if you don’t make your payments on time;

- Terms: 5 to 20 years, depending on your loan type and terms;

- Prepayment penalty: There are no early payoff fees.

LendKey Student Loans: A Complete Overview

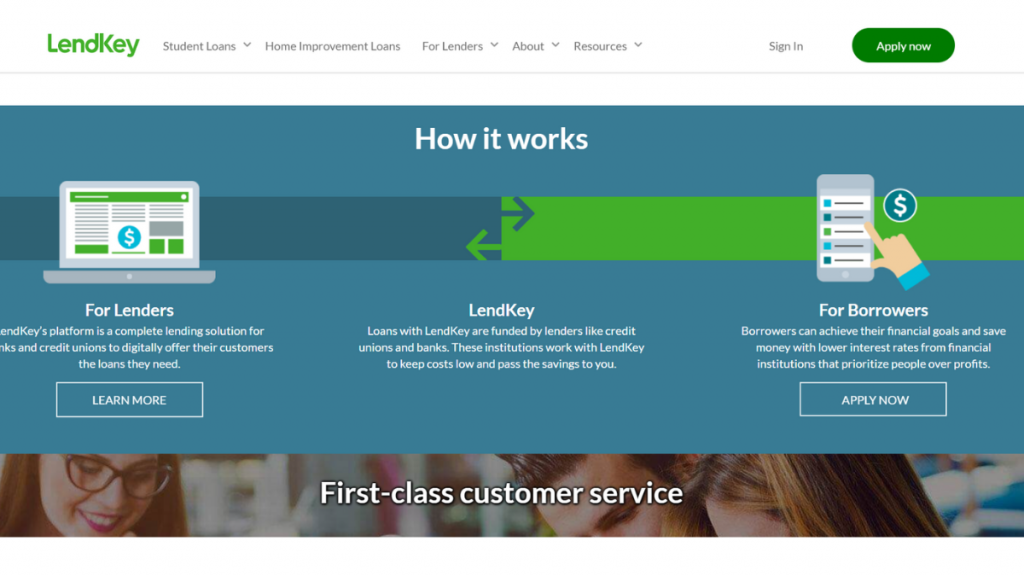

What sets LendKey apart is its commitment to serving both students and the institutions funding the loans, fostering a symbiotic relationship that benefits both parties.

Also, with an emphasis on simplicity and transparency, LendKey aims to simplify the loan process for students while offering personalized support and guidance.

Moreover, LendKey prioritizes customer satisfaction, offering a user-friendly interface and responsive customer service to address any concerns or queries.

In addition, by championing accessibility and affordability, LendKey stands as a commendable option for students seeking financial assistance to pursue their educational aspirations.

Reasons you may want it

There are many reasons you may want to get this loan. Moreover, you can find incredible perks. So, read about the main ones below!

Longer loan terms

LendKey distinguishes itself from a number of other lenders by offering a unique 18-month forbearance option for loan maturities of 15 and 20 years.

Also, because forbearance lasts for a long time, debtors have a large safety net that enables them to cease paying payments or lower them temporarily.

Moreover, this might be quite helpful in situations where unforeseen events or financial troubles arise.

Pre-qualify without a hard credit check

LendKey’s student loans have numerous noteworthy benefits, one of which is the ability to verify eligibility and expected rates without requiring a formal credit investigation.

Also, this feature is essential since it lets applicants consider their alternatives without worrying about damaging their credit.

Many loan options

LendKey provides borrowers with a range of options beyond conventional loan options to suit their individual needs.

Moreover, LendKey offers a variety of loan solutions to accommodate various financial circumstances.

This includes examining non-traditional student loan possibilities and refinancing existing loans to obtain better terms potentially.

So, this adaptability demonstrates LendKey’s dedication to providing distinctive solutions that satisfy the particular needs and preferences of its clients.

No application or origination fees

One way that LendKey sets itself apart is that it doesn’t charge origination or application costs.

Also, since there are no up-front fees, students who apply for loans have less financial strain, preserving an honest and fair borrowing process.

Moreover, LendKey promotes pricing along with its goal of providing straightforward, student-friendly financial solutions by doing away with unnecessary costs.

Why maybe you wouldn’t choose it

Even though this lender offers incredible perks to its borrowers, there are also some downsides. Therefore, read the main cons below.

No international student options

The dearth of alternatives available to overseas students using LendKey’s student loans is an additional problem.

Also, using LendKey to get financial help for their admission to American institutions may provide difficulties for prospective overseas students.

No biweekly payments

Biweekly autopay installments are not offered by LendKey, which some borrowers might find helpful in organizing their repayment plans.

There are no postponements for payments

One disadvantage of LendKey’s student loans is that there aren’t many alternatives for payment delays for borrowers who want to return to school or join the military.

You can’t apply for this loan in every state

There are several restrictions on the LendKey student loan alternatives.

So, notably, citizens of Maine, Nevada, North Dakota, Rhode Island, or West Virginia are not eligible to use their loan services.

Apply for LendKey Student Loans

You can easily apply for a loan through this incredible lender at any time you need.

So read below for more information on how to complete the application process to get a loan from this lender.

Online application process

Also, you can do it all online and through the official website. So you’ll be able to provide the personal information required and documents they require.

Then, you’ll be able to complete your application and wait for a quick response.

Is there an app for applying?

You’ll be able to apply for this loan through the official website online. However, you can use the mobile app to manage all your loan features and much more!

Another great option: National Debt Relief Loans

If you have debt for any reason, you can go to debt relief with National Debt Relief Loans.

You’ll be able to consolidate multiple debts into a single loan. This way, you’ll be able to pay less fees and interest.

Therefore, you can read our blog post below to learn more about this lender and see if it’s the best option for your needs. Also, find out how to apply for it!

National Debt Relief Loans review

Discover the power of National Debt Relief Loans in our comprehensive review. Uncover how these loans consolidate debts and more!

About the author / Victória Lourenço

Trending Topics

Top 10 best apps for calorie counting to supercharge your health journey!

Are you looking for easier ways to keep track of your diet? If so, you can read on to learn about the best apps for calorie counting!

Keep Reading

Mission Money™ Visa® Debit Card review

Looking for a great debit card that fits your budget? Read our Mission Money™ Visa® Debit Card review and learn all you need to know.

Keep Reading

Maximize Your Efficiency: Best Apps for Productivity

Discover the ultimate productivity arsenal! Explore the best apps for productivity, apps for task management, time tracking, and more!

Keep ReadingYou may also like

Financeiro Consulte recommendation – Sanlam Personal Loans

Simplify your borrowing experience with Sanlam Personal Loans: Accessible, transparent, and customer-centric solutions.

Keep Reading

Upgrade Triple Cash Rewards Card review: 3% Cash Back on Home, Auto, and Health Purchases

Check out this Upgrade Triple Cash Rewards Card review and learn about this card's 3% cash back on home, auto, and health purchases.

Keep Reading

The Best Apps for Personal Training: Boost Your Fitness Lifestyle!

Enhance your fitness routine with the best apps for personal training. From tracking progress to meal planning, find the perfect app for you!

Keep Reading