Reviews

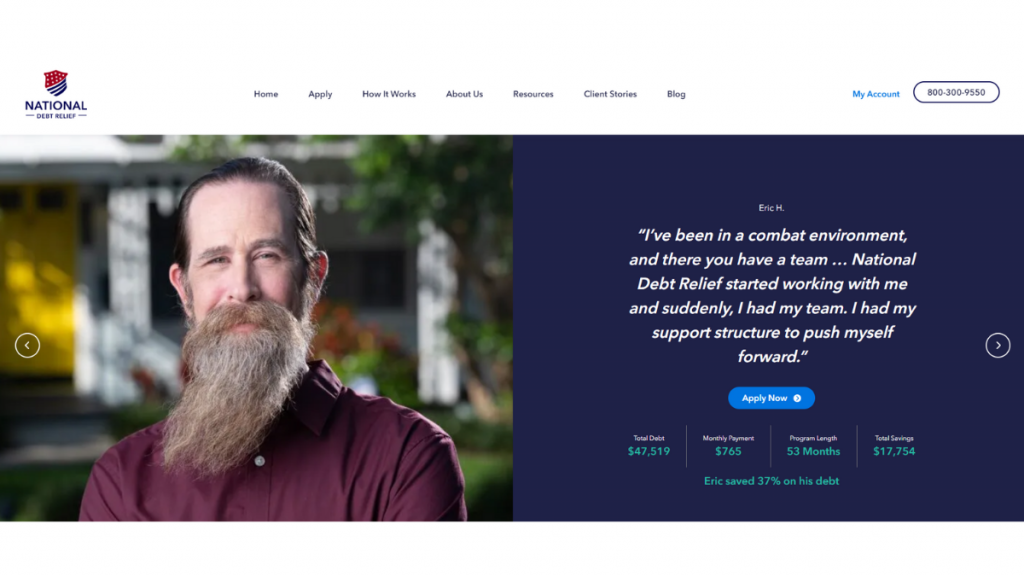

National Debt Relief Loans review: Easy debt relief!

Explore our detailed National Debt Relief Loans review and learn how this strategic solution redefines debt management.

Advertisement

National Debt Relief Loans review: Good terms!

Navigating through the tumultuous waters of financial struggles can feel overwhelming, but solutions like the National Debt Relief Loans review aim to offer a beacon of hope and stability.

National Debt Relief has emerged as a leading figure in the realm of debt relief solutions, offering a suite of services geared towards aiding individuals in overcoming their financial challenges.

- APR: It depends on your loan type and financial situation;

- Loan Amount: It depends on your debt type;

- Loan Purpose: Debt consolidation loans;

- Credit Needed: Regular scores;

- Origination fee: N/A;

- Late Fee: There can be late fees if you don’t make your payments on time;

- Terms: From 24 to 48 months, depending on where you live;

- Prepayment penalty: There can be a prepayment penalty.

National Debt Relief Loans: A Complete Overview

These loans work by consolidating multiple debts into a single, more manageable loan, potentially offering borrowers reduced interest rates and extended repayment terms.

Also, by consolidating debts, borrowers can streamline their financial obligations, simplifying multiple payments into one and potentially lowering monthly payments.

Moreover, this approach not only provides financial convenience but also offers a more structured and organized way to tackle outstanding debts.

This empowers individuals to regain control over their finances.

Reasons you may want it

There are many reasons to choose this as your favorite lender option. So, we’ll show you the main ones below!

Save money on interest

This strategy not only reduces the overall interest paid but also accelerates the journey toward debt freedom.

Also, with a more manageable interest rate, a larger portion of each payment goes toward the principal amount owed, facilitating a faster escape from the burden of debt.

Consolidate debt

By consolidating debts and adhering to a structured repayment plan, borrowers can experience relief from relentless calls and aggressive collection actions.

Moreover, this allows individuals to focus on their financial recovery without the added anxiety and pressure of dealing with constant creditor demands.

Avoid bankruptcy

By providing a structured repayment plan and consolidation of debts, these loans offer a chance to regain control over finances.

And you can do all of this without resorting to the severe implications and lasting impact of bankruptcy.

Lower monthly payments

By consolidating multiple debts into a single loan with a lower interest rate and extended repayment terms, borrowers might find their monthly payments significantly reduced.

Also, this decrease in monthly payments can ease the financial burden and improve cash flow, allowing individuals to manage their expenses better.

Simple application

They offer a free consultation to provide guidance and clarity about the loan program, ensuring that individuals have the information they need to make decisions about their finances.

Moreover, this commitment to simplicity and support streamlines the process for those seeking relief from their debt obligations.

Why maybe you wouldn’t choose it

Even though this lender offers incredible lending perks, it also has some downsides. So, read below for the main ones.

Some debts are inedible

Debts with certain creditors who do not participate in debt settlement programs might also be ineligible.

Therefore, it’s crucial for individuals seeking assistance to understand the types of debts that can be enrolled in National Debt Relief programs.

Also, you can seek clarification on which debts are eligible for their services.

Paid services

Usually, the business charges a percentage of the enrolled debt or a fraction of the savings made possible by the settlement procedure as payment for its services.

Credit score impact

This decline is a common consequence, as debt settlement or consolidation often involves negotiations with creditors and a restructuring of payment terms.

Some creditors may not accept

While some creditors might be less eager to do so, others might be more prepared to bargain and settle outstanding obligations.

So, in these situations, National Debt Relief keeps looking at different approaches and plans to help customers efficiently manage their debt.

Apply for National Debt Relief Loans

You can easily learn how to apply for a loan through this lender. Therefore, check out the topics below to learn more about the application process!

Online application process

When you apply for a debt consolidation loan, you have to give the whole amount of your outstanding invoices.

Also, when that loan is accepted, you combine all of those debts into one new loan.

Moreover, this might save you money and time by lowering the interest rate and monthly payments.

Therefore, if you can manage your debt more simply, you’ll be in a better position to pay it off more quickly.

Is there an app for applying?

You’ll be able to use your phone to check your loan needs. However, you’ll need to apply online or by phone to get your loans with this lender.

Another great option: SoFi Personal Loans

If you’re not so sure about which lender to borrow from, we can help! So, you can try applying for SoFi Personal Loans!

Therefore, you can read below to learn more about this lender and see if it’s the best choice for your finances!

- APR: 8.99% APR to 25.81% APR;

- Loan Amount: $5,000 to $100,000;

- Loan Purpose: SoFi offers loans to support all of your dreams, including consolidating debt and other personal reasons;

- Credit Needed: Good credit score;

- Origination fee: None;

- Late Fee: None;

- Terms: 2 to 7 years;

- Prepayment penalty: None.

Therefore, if this lender offers better perks for your financial needs, you can read our blog post below to learn more!

SoFi Personal Loans

Learn all there is to know and how easy it is to apply for the SoFi Personal Loans!

About the author / Victória Lourenço

Trending Topics

Apply for the Mission Money™ Visa® Debit Card

Discover how easy and secure it is to apply for a Mission Money™ Visa® Debit card and read more about its special benefits!

Keep Reading

Apply for the SavorOne Cash Rewards Credit Card

Learn how to apply for the SavorOne Cash Rewards Credit Card today and take advantage of all the great benefits it has to offer!

Keep Reading

Assent Platinum Secured card review: Build Your Credit and Save Money

Start improving your credit with this excellent credit-buidler card. Read our Assent Platinum Secured card review and learn more.

Keep ReadingYou may also like

Discover the Best Apps to Learn Spanish and Master the Language

Looking for the best apps to learn Spanish? Discover our top recommendations for the best apps to learn Spanish!

Keep Reading

LendKey Student Loans review: No application fee!

Discover the ins and outs of LendKey Student Loans in our review. Uncover the advantages, drawbacks, and unique features!

Keep Reading

Boost Your Savings Game: Discover the Best Managing Finances Apps

Looking for ways to keep track of your spending? Discover the mechanics behind cutting-edge managing finances apps!

Keep Reading