We recommend you the OpenSky® Plus Secured Visa® Credit Card!

OpenSky® Plus Secured Visa® Credit Card, build your credit score and get rewards!

Advertisement

The OpenSky® Plus Secured Visa® Credit Card is like a trusty sidekick on your financial journey. It’s designed to help you build or rebuild your credit, whether you’re just starting out or bouncing back from some credit bumps. What’s great about this card is that it doesn’t require a credit check during the application process, which can be a game-changer for those who may have had difficulty getting approved for other credit cards.

The OpenSky® Plus Secured Visa® Credit Card is like a trusty sidekick on your financial journey. It’s designed to help you build or rebuild your credit, whether you’re just starting out or bouncing back from some credit bumps. What’s great about this card is that it doesn’t require a credit check during the application process, which can be a game-changer for those who may have had difficulty getting approved for other credit cards.

You will remain in the same website

Looking for a great card to build your credit score and get perks? If so, read below to see the main benefits of applying for the OpenSky® Plus Secured Visa® Credit Card!

One of the standout features of the OpenSky® Plus Secured Visa® Credit Card is its flexibility. You can choose your own credit limit, depending on your deposit amount, which means you’re in control of how much you want to spend and how you want to manage your credit. Plus, OpenSky reports your payment history to all three major credit bureaus, which is crucial for building credit.

Upsides and special benefits

- No annual fee: This is a great low-maintenance card option for anyone looking for one. Without having to pay an annual fee, you may benefit from all the features of a credit card.

- Accepts those who have low scores: For this card, consideration will be given to those with bad credit. Even if your credit is not the finest, you may still have a good chance of getting accepted.

- No credit check: Applying for this great card does not involve a credit check. OpenSky is dedicated to giving everyone an opportunity.

- Keep track of your score: One easy way to keep an eye on your credit is to view your FICO® Score through your OpenSky account.

Downsides and factors to consider

- High APR: If you have debt, this is not a good card for you. Its variable annual percentage rate is 29.99%, and this can cause you not be unable to pay the APR at some points and decrease your credit score.

- Deposit required: Before you may have a credit line with this card, you must pay a refundable deposit. People with bad credit or no credit history frequently use these cards to increase their credit score.

- Foreign transaction fee: This card costs a 3% commission each time you make a purchase outside of the United States, so avoid using it overseas.

For those without a bank account or with bad credit, the OpenSky® Secured Visa® Credit Card may be the ideal choice because it doesn’t require either. When used properly, the card can aid in establishing credit because it informs the three main credit agencies of account activity.

Your OpenSky Credit Card is accepted anywhere Visa is accepted. Furthermore, you may take advantage of exclusive Visa savings by visiting www.visa.com/discounts. Moreover, you’ll be able to use this card to make your daily purchases and get perks and rewards while you build or rebuild your credit score easily!

You have a lot more control over your monthly spending with the OpenSky Secured Visa, since you may spend up to $3,000—much more than with many other secured cards. Moreover, your account balance determines your credit limit. Therefore, your credit limit can vary with this card, and you’ll only be able to know about it after you apply to get this card!

If you love the features of the OpenSky® Plus Secured Visa® Credit Card and want to apply for it, we can help! So, check out our blog post below to learn more about this card and find out how the application process works!

OpenSky® Plus Secured Visa® Card Review

Discover the OpenSky® Plus Secured Visa® Credit Card: Your guide to better credit and financial freedom. Read our in-depth review now!

Are you not so sure about getting the OpenSky card? If that’s the case, you can try applying for the First Latitude Platinum Mastercard® Secured Credit Card! Also, with this card, you’ll be able to get up to 1% cash back and improve your credit score!

Therefore, check out our blog post below to learn more about this card and find out all about how the application process works for this card!

Apply For The First Latitude Platinum Mastercard®!

In this First Latitude Platinum Mastercard® Secured Credit Card application guide you will learn how to get this card fast.

Trending Topics

Walmart Money Card review: Cashback & Fees Decoded

Discover the perks and costs of the Walmart Money Card in our review. From cashback rewards to fees, make an informed choice!

Keep Reading

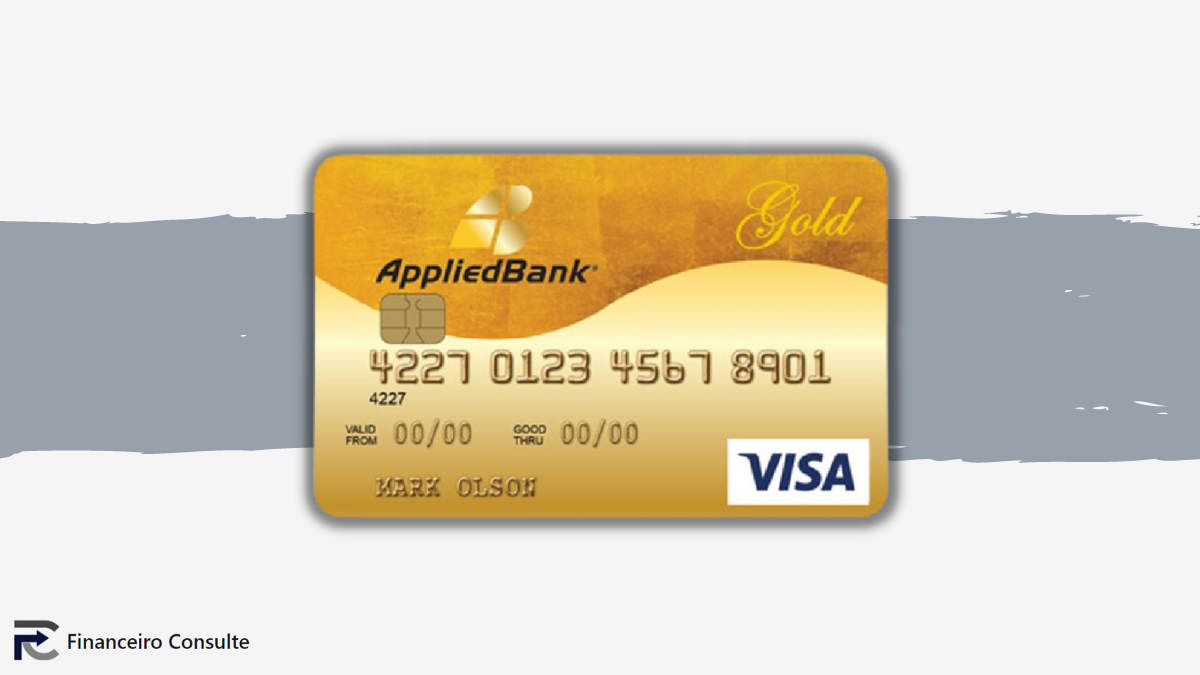

Apply for the Applied Bank® Gold Preferred® Secured Visa®

Get security and financial power even without credit history with Applied Bank® Gold Preferred® Secured Visa® apply.

Keep Reading

Easy Guide to Amex Membership Rewards: points worth and eligible cards

Unlock a world of possibilities with AMEX Membership Rewards points. Learn how to earn, redeem, and maximize the value of your rewards!

Keep ReadingYou may also like

Discover the Best Apps When Traveling for a Seamless Journey

If you love to travel, you can find the best apps to use when traveling! Read on to download these essential apps before your next adventure!

Keep Reading

Apply for the Reflex® Platinum Mastercard®: wide acceptance to help you build credit

Get this card in just a few minutes and start building credit with a little help from our Reflex® Platinum Mastercard® guide to apply for it.

Keep Reading

How to apply For The Destiny Mastercard®

Learn how to apply for the Destiny Mastercard® with no security deposit and pre-qualification available. Here's how!

Keep Reading