Rewards

Easy Guide to Amex Membership Rewards: points worth and eligible cards

Discover the inner workings of AMEX Membership Rewards points and make the best out of your purchases! Read on to learn more!

Advertisement

Unlocking the Ultimate Guide to AMEX Membership Rewards Points!

In a world where credit card rewards have become a cornerstone of modern financial strategies, American Express Membership Rewards stand out as a shining example of versatility and value.

Moreover, If you’re intrigued by the concept of turning your everyday spending into tangible benefits, you’re in for a treat.

Therefore, this blog post is your key to unlocking the intricate workings of AMEX Membership Rewards points and harnessing them to their full potential. So, read on to learn more!

What are AMEX membership rewards?

The flexible point currency used in the American Express Membership Rewards® credit card rewards program is Membership Rewards points.

Moreover, with many American Express credit cards, you receive points for every dollar you spend.

Also, sometimes you receive them at a predetermined rate and sometimes based on the kind of shop you make.

In addition, you may also earn Membership Rewards points by getting friends to apply for American Express cards and buying online through the Rakuten shopping site.

Moreover, you can earn MP by taking advantage of particular spending incentives.

Then, you may exchange these points for gift cards, getaways, cash back, and other benefits.

How to earn AMEX membership rewards points?

To enroll in the program, you must have one of the American Express cards to earn Membership Rewards. Such as the Gold, Platinum, and signature Green ones.

Moreover, there are alternatives. So, you can get credit card welcome bonuses and regular spending.

Also, there are a number of alternative ways to earn Membership Rewards.

In addition, American Express offers a variety of personal and business cards that earn Membership Rewards.

However, you should know that various cards provide different rewards and earning rates.

Therefore, you can get your American Express Rewards login to your account and manage your MP rewards points online through the app or the official website!

How much are Amex membership rewards points worth?

Rewards points from American Express Membership Rewards for travel, for example, are effectively cash equivalents for flexible travel.

Therefore, before acquiring or using them, it’s crucial to grasp their respective value.

Moreover, AmEx points are presently worth between one cent when used to book travel directly and two cents when transferred to partners.

Also, this information is shown according to multiple online assessments and studies.

In addition, in this instance, simplicity and convenience are the main advantages.

Therefore, you don’t need to spend hours learning how to use your points, finding the availability of rare prizes, or finding the best transfer partners.

When do membership rewards points post?

Your Membership Rewards points are first regarded as pending.

Also, if your minimum payment is made by the Payment Due Date, these points will be added to your Points Balance and made available for use.

However, you should know that the payment due date is usually between 24 and 72 hours after the payment has been applied to your Card account.

Do you still get Amex points if you pay early?

The timing of your payment has no bearing on the number of airline miles or hotel points you will accumulate. Also, you will still receive all of the rewards you earned.

However, it depends on your spending whether you pay off the whole balance prior to the statement closing or only the necessary minimum payment on the due date.

Which AMEX cards earn membership rewards?

Many different credit cards can make you earn Membership rewards.

For example, The Platinum Card® from American Express, the American Express® Gold Card, the American Express® Green Card, and the Amex EveryDay® Preferred Credit Card.

However, you should know that most of the Gold, Platinum, and signature Green cards allow you to earn MP rewards from Amex.

Are the AMEX membership rewards worth it?

Even though the AMEX membership offers incredible perks, there can be some downsides to it.

Therefore, you can read our pros and cons below to learn more about this program and see if it’s the best choice!

Pros

The versatility of Amex Membership Rewards is one of its main advantages.

Moreover, out of all the main transferable point currencies, Amex has the most and the most productive transfer partners.

Also another benefit is how simple it is to accumulate Membership Rewards points.

In addition, Amex offers a variety of credit cards, each of which has a unique method for accumulating Membership Rewards points.

Therefore, you can open many American Express cards to receive bonus points on the majority of your everyday purchases.

So, you will accumulate points more rapidly and get closer to your next significant redemption by doing this.

Cons

The major disadvantage of Membership Rewards is that you cannot use your points to purchase paid flights without a corporate Gold, Platinum, or Centurion card.

Moreover, Amex’s transfer partners are not the easiest to understand and use. Therefore, you need to consider these points when wanting to start using Amex and getting the membership!

Do I need a high credit score to get Amex Membership rewards?

To get your Amex Membership rewards points, you’ll need to get a credit card through Amex. So, this can be the easiest and most worthwhile way to earn Membership Points.

However, despite other issuers offering cards for those with less-than-perfect credit, American Express does not provide any subprime or secured cards.

Therefore, you generally need to have at least good credit, which FICO commonly characterizes as a score of 670 or above, in order to be approved for an American Express card.

What is the most worth it to use Amex points on?

American Express Travel Partners accepts point transfers.

Also, transferring your Membership Rewards to one of Amex’s 21 transfer partners is the choice with the most upside potential.

Moreover, Amex points may be worth up to 2 cents each when transferred to airline partners.

Therefore, because it provides the highest return on investment, this is by far the greatest option to make the most of your points!

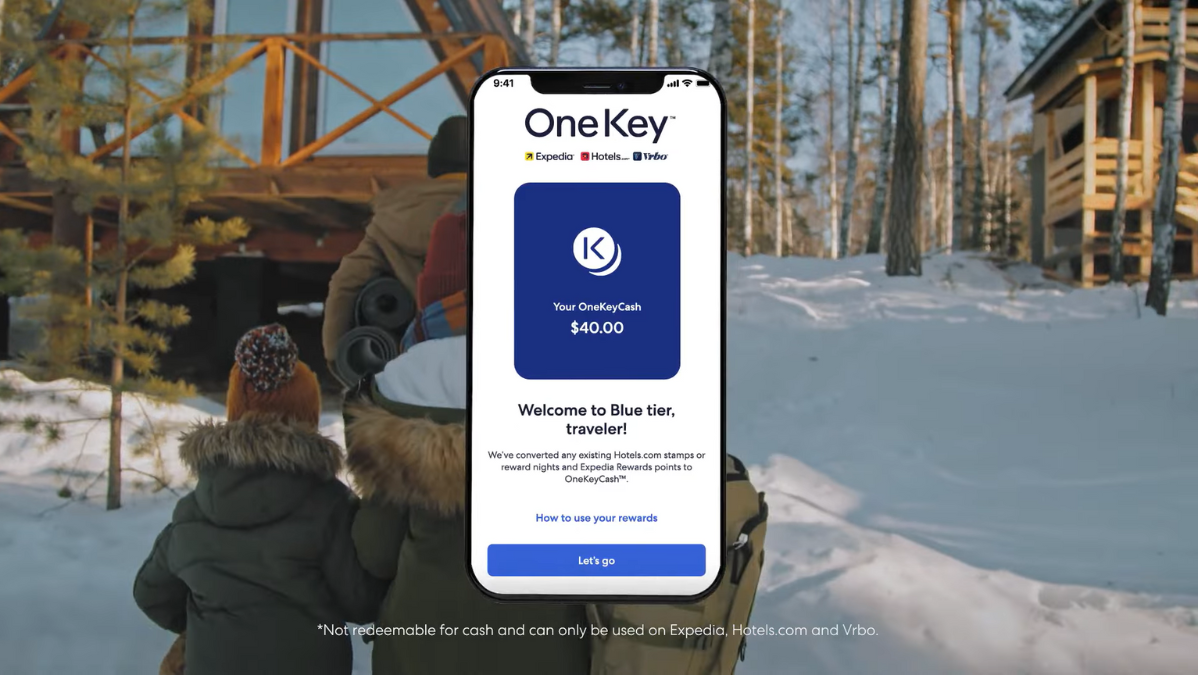

Do you want to discover more excellent reward programs? Then don’t miss our following article and find out more about the One Key Rewards Program!

One Key Rewards Program

Join the elite league of travelers and unlock exclusive benefits with One Key Rewards, the program that sets the new standard in travel rewards!

About the author / Victória Lourenço

Trending Topics

FIT® Platinum Mastercard® review: Get a $400 line of credit!

Are you looking to boost your credit score to excellence? Check out this FIT® Platinum Mastercard® review and learn how you can do it!

Keep Reading

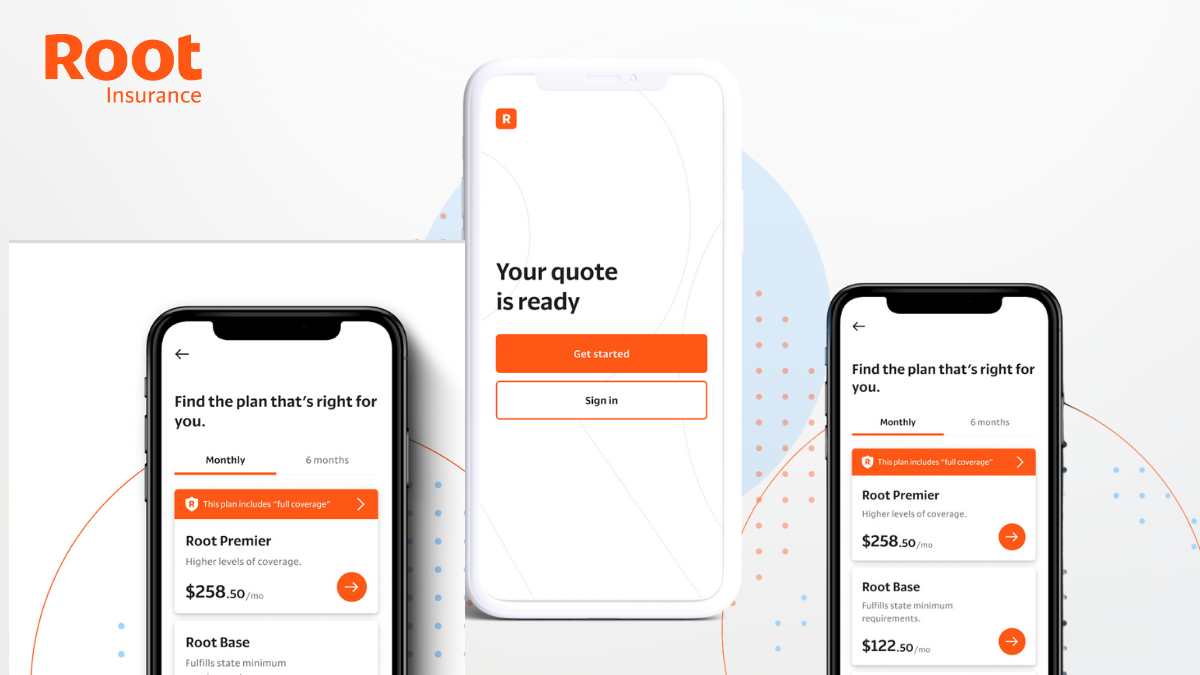

Root Car Insurance: Drive Smart, Save Big

Uncover the innovative approach of Root Car Insurance as we dive into its transparent pricing model and mobile app convenience.

Keep Reading

Chase Freedom Unlimited® review: Enjoy a lengthy 0% intro APR period

In this Chase Freedom Unlimited® review you are going to learn about this card's 1.5% cash back rewards and much more!

Keep ReadingYou may also like

Apply for the Applied Bank® Gold Preferred® Secured Visa®

Get security and financial power even without credit history with Applied Bank® Gold Preferred® Secured Visa® apply.

Keep Reading

Navy Federal Visa Signature® Flagship Rewards review: earn points

Explore the Navy Federal Visa Signature® Flagship Rewards review card: high rewards, low APR, Amazon Prime perks & accessible membership.

Keep Reading

Evolve Home Loans Review: Smart Choices, Strong Foundations!

Discover the future of mortgage lending with Evolve Home Loans. Tailored solutions that make buying your dream home a reality!

Keep Reading