Credit Card

Navy Federal Visa Signature® Flagship Rewards review: earn points

Unlock premium rewards with Navy Federal's Visa Signature® Flagship card: travel points, cashback, no foreign fees. Is it for you? Read on to learn more!

Advertisement

Navy Federal Visa Signature® Flagship Rewards: Up to 3x points on travel!

Looking to navigate the world of credit cards with perks tailored to your lifestyle? The Navy Federal Visa Signature® Flagship Rewards review might just be the compass you need.

In this comprehensive review, we’ll dive into the depths of this premier card, exploring its features, benefits, and how it stacks up against other offerings in the market. So, read on!

- Credit Score: Good to excellent (at least 700 points);

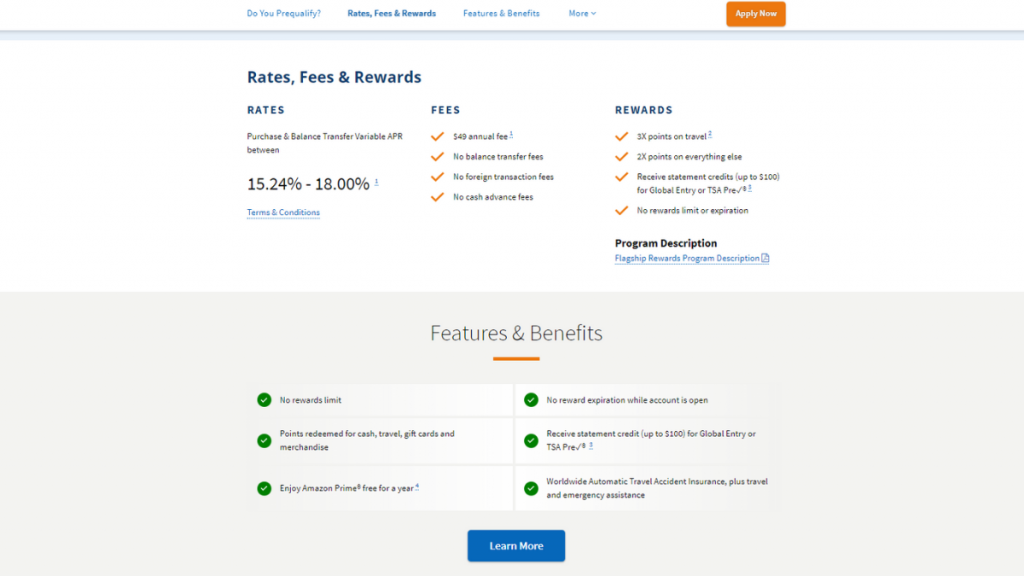

- APR: 15.24% to 18% variable APR;

- Annual Fee: Intro $0 annual fee for the first year as a new cardholder. After that, there will be the regular $49;

- Fees: You won’t pay balance transfer, foreign transaction or cash advance fees;

- Welcome bonus: You can earn 30,000 bonus points when spending $3,000 within 90 days of opening your account;

- Rewards: You can earn 3x points on travel purchases and 2x points on any other eligible purchase (there are no rewards limits or expiration).

Navy Federal Visa Signature® Flagship Rewards: A Complete Overview

From its generous rewards program to its array of travel perks and competitive rates, this card has garnered attention among savvy consumers.

So, if you seek value and flexibility in your credit card choices, this can be a great card for your financial needs!

Also, whether you’re a seasoned traveler, a frequent shopper, or someone looking to maximize everyday spending, join us as we uncover the facets of this credit card gem.

With a myriad of credit cards saturating the market, finding the right fit can feel akin to searching for treasure.

The Navy Federal Visa Signature® Flagship Rewards card boasts an array of enticing features that set it apart from the rest.

Beyond its attractive sign-up bonus, this card shines with its flexible rewards structure, offering points that can be redeemed for travel, cash back, or merchandise.

Reasons you may want it

There are many reasons to use this card and enjoy its perks. Read below for the main ones!

$0 annual fee for the first year

As a new cardholder, you won’t need to pay the annual fee during your first year with the card.

This feature allows users to experience the card’s benefits and rewards without the immediate financial commitment of an annual fee.

So, this card can be an attractive choice for those exploring its offerings for the first time.

Amazon Prime benefits

New cardholders can enjoy the benefits of Amazon Prime, from expedited shipping to streaming services, at no extra cost, further enhancing the card’s appeal and utility beyond its rewards program.

No cash advance fees

The waive of the cash advance fee alleviates the financial burden typically associated with cash advances.

This way, the card offers more flexibility in managing finances or dealing with unforeseen circumstances without incurring additional costs.

Relatively low APR

The APR can be considered relatively low when compared to other similar card options.

This aspect benefits not only those who might occasionally carry a balance but also contributes to the card’s overall appeal and cost-effectiveness.

This is the case, particularly for individuals seeking a credit card with both rewarding perks and a reasonable interest rate.

Good rewards

You can earn up to 3x points for travel purchases and up to 2x points for other eligible purchases.

So, this generous rewards program caters to both avid travelers and everyday spenders, allowing for substantial point accumulation across various spending categories.

Moreover, whether booking flights, hotels, or dining out, this tiered rewards system ensures that every dollar spent translates into valuable points, enhancing the card’s overall value proposition.

Why maybe you wouldn’t choose it

Even though this card offers incredible perks to its cardholders, there are some downsides to it. Read below to learn the main negative points about this card!

High requirements for approval

As a premium rewards card, it tends to target individuals with a good to excellent credit history.

While the specific credit score requirement isn’t publicly disclosed, a higher credit score is generally indicative of a strong credit profile.

Navy Federal membership

You’ll need to have the Navy Federal Membership to apply for this card. So, if you’re not a member, you won’t be able to apply for this card!

However, gaining membership is more accessible than commonly perceived.

Annual fee

While the first year’s annual fee might be waived for new cardholders, subsequent years will involve this cost.

However, the card’s benefits, rewards program, and perks might outweigh the annual fee for individuals who frequently capitalize on its features.

Apply for the Navy Federal Visa Signature® Flagship Rewards

If you meet the necessary requirements, you can easily apply for this card. Read below to learn more about how the application process works!

Online application process

To apply online for this card, you’ll need to go to the official website and provide the information to get the Navy Federal membership.

So, you can only apply for this card if you have a Navy Federal membership. Therefore, you’ll be able to complete the card application after you follow the steps online to apply.

Is there an app for applying?

You’ll be able to use the Navy Federal Credit Union mobile app to manage your finances with Navy Federal and your card’s features.

However, you’ll need to apply through the official website to get your membership and complete the card application.

Another great option: MyPoint Credit Union Visa Card

If you’re looking for other card options, you can try applying for the MyPoint Credit Union Visa Card!

Also, with this card, you’ll be able to get a high credit limit, travel perks, and much more!

MyPoint Credit Union Visa Card review

Do you need a MyPoint Credit Union Visa Card review? Read on to learn about rates, fees, and rewards before making your decision!

About the author / Victória Lourenço

Trending Topics

Apps and Strategies for Financial Freedom: Ultimate Guide to Build Wealth

Discover game-changing apps and savvy strategies in our guide to financial freedom. From budgeting tools to investment platforms!

Keep Reading

Apply For The Platinum Card® from American Express: Travel Credits, and No Foreign Transaction Fees!

Follow this guide to apply for The Platinum Card® from American Express and start enjoying VIP travel perks and much more.

Keep Reading

Capital One Quicksilver Cash Rewards Credit Card review

In this Capital One Quicksilver Cash Rewards Credit Card review you will learn about this card's cashback rewards!

Keep ReadingYou may also like

FIT® Platinum Mastercard® review: Get a $400 line of credit!

Are you looking to boost your credit score to excellence? Check out this FIT® Platinum Mastercard® review and learn how you can do it!

Keep Reading

Group One Platinum Card: See the best perks!

Unlock the power of the Group One Platinum Card! Dive into our review and discover this exclusive card - no APR or complications!

Keep Reading

Cash App: Step Into a New Era in Your Finances!

Experience the convenience of Cash App by understanding its key features, and learn how to download and set up your account.

Keep Reading