Credit Card

Unveiling the MyPoint Credit Union Visa Card: A Comprehensive Review

Explore the MyPoint Credit Union Visa Card in our in-depth review – from high credit limits to travel perks, discover if this card suits your financial goals!

Advertisement

Is the MyPoint Credit Union Visa Card Right for You? Find Out in Our Detailed Review

Looking for a credit card that truly caters to your financial needs? Look no further than this MyPoint Credit Union Visa review!

Moreover, in this review, we’ll dive deep into the features, benefits, and potential drawbacks of this credit card to help you make an informed decision.

Also, whether you’re a seasoned cardholder or a first-time credit user, the MyPoint Credit Union Visa Card has something to offer, and we’re here to guide you through it all.

MyPoint Credit Union Visa Card: A Complete Overview

With a wide range of perks and a reputation for customer-centric service, this card has been making waves in the financial world.

Also, from its competitive interest rates to its exciting rewards program, we’ll help you out!

Plus, we’ll break down everything you need to know to determine if the MyPoint Credit Union Visa Card is the right fit for your wallet.

So, let’s get started on this credit card journey and discover the advantages and any potential drawbacks you might encounter along the way.

Reasons you may want it

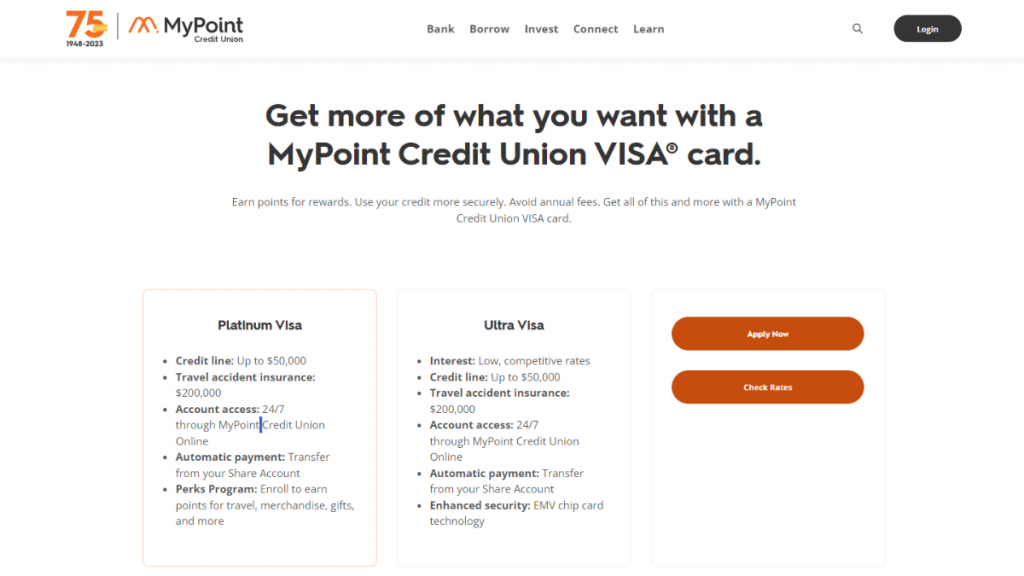

The MyPoint Credit Union Visa Card offers an impressive credit line of up to $50,000, giving cardholders significant purchasing power and flexibility.

This high credit limit can be especially advantageous for those who need access to substantial funds for various purposes.

With such a generous credit line, this card can accommodate a wide range of spending requirements, making it a versatile choice for individuals looking for financial freedom.

Additionally, the MyPoint Credit Union Visa Card provides travel accident insurance, offering cardholders added peace of mind during their journeys.

Also, this insurance can be a valuable asset for those who frequently travel, as it offers financial protection in the event of unexpected accidents while on a trip.

This feature ensures that cardholders can focus on their travel experiences with confidence, knowing they have a safety net in place.

Moreover, it’s just one of the many ways this card goes beyond standard credit offerings to cater to the needs of its users.

Furthermore, the MyPoint Credit Union Visa Card allows cardholders to make easy transfers from their Share Account with automatic payment.

Another enticing benefit of this card is the ability to earn points that can be redeemed for various rewards, including travel opportunities.

Why maybe you wouldn’t choose it

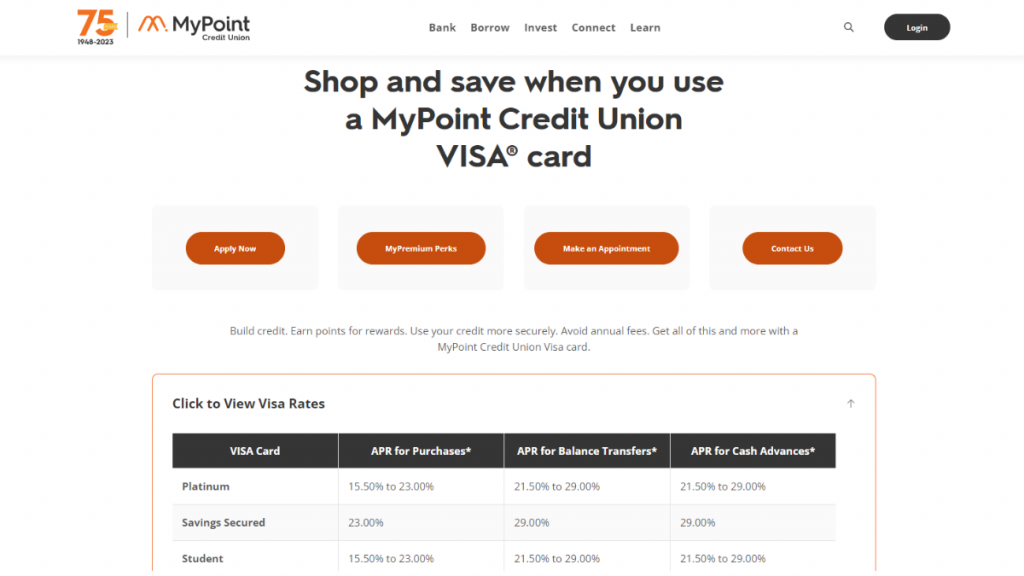

When considering the MyPoint Credit Union Visa Card, it’s important to note that there isn’t abundant information about its rates.

Also, you’ll only be able to see them after beginning the application process. This limited transparency can be a potential drawback for those who like researching and comparing card options.

Furthermore, potential applicants should be aware that a good credit score may be a requirement for qualification with the MyPoint Credit Union Visa Card.

Moreover, a good credit score is typically considered above 700, reflecting a history of responsible credit management and timely payments.

Therefore, before applying, you must check your credit score and understand where you stand regarding creditworthiness.

Apply for the MyPoint Credit Union Visa Card

You can easily apply for this incredible credit union card. Moreover, you’ll be able to find it can be easy to apply online and manage your card’s features through the mobile app.

Therefore, you can keep reading below to learn all about how the application process works for this incredible card!

Online application process

Applying for the MyPoint Credit Union Visa Card is a straightforward process. First, visit the MyPoint Credit Union’s official website to access the online application.

Then, you can fill out the required information, including personal details, financial information, and contact information.

Moreover, provides accurate and up-to-date information to facilitate the approval process.

Once your application is complete, you may submit it electronically.

Then, once your application has been reviewed, the credit union will notify you if you meet their standards.

So, after you are accepted, you will receive your new MyPoint Credit Union Visa Card in the mail, which you may use for regular transactions.

Is there an app for applying?

You can use the MyPoint Credit Union mobile app to manage all your card’s features and your account.

Therefore, you can use this app to check your finances and keep track of your card’s usage!

Another great option: Revvi Card

If you’re looking for a different credit card option for your financial needs, we can help!

Moreover, you can try applying for the Revvi Card! Also, with this card, you’ll be able to qualify even with a bad credit score.

Also, this card can help you make your everyday purchases and get cashback for it! Plus, you’ll be able to improve your credit score.

However, you’ll need to use this card responsibly and make timely payments! This way, you’ll be able to build your score quickly!

Therefore, if you love this card’s features, you can learn how to apply for it in our blog post below! So, read on!

Learn how to apply for the Revvi Card!

Are you ready to boost your score to excellence? Then learn how you can apply for the Revvi Card with our easy step-by-step guide.

About the author / Victória Lourenço

Trending Topics

Apply For The First Digital Mastercard®: Build Your Credit with Ease

Read through this First Digital Mastercard® application guide to learn how to apply and get this card to start building credit fast!

Keep Reading

How to apply for the Assent Platinum Secured card: Regular Credit Reports!

Learn how to apply for a card to help you improve your credit with a little help from our Assent Platinum Secured card application guide.

Keep Reading

Group One Platinum Card: See the best perks!

Unlock the power of the Group One Platinum Card! Dive into our review and discover this exclusive card - no APR or complications!

Keep ReadingYou may also like

Capital One Quicksilver Cash Rewards Credit Card review

In this Capital One Quicksilver Cash Rewards Credit Card review you will learn about this card's cashback rewards!

Keep Reading

Evolve Home Loans Review: Smart Choices, Strong Foundations!

Discover the future of mortgage lending with Evolve Home Loans. Tailored solutions that make buying your dream home a reality!

Keep Reading

Achieve Early Retirement with Financial Independence Advisors and a Calculator

Ready to take control of your financial future? Learn how financial independence advisors can pave the way for an early retirement.

Keep Reading