Personalized Solutions for Every Journey: How Upstart Loans Cater to Unique Needs

Upstart Loans, No Minimum Credit Score Required!

Advertisement

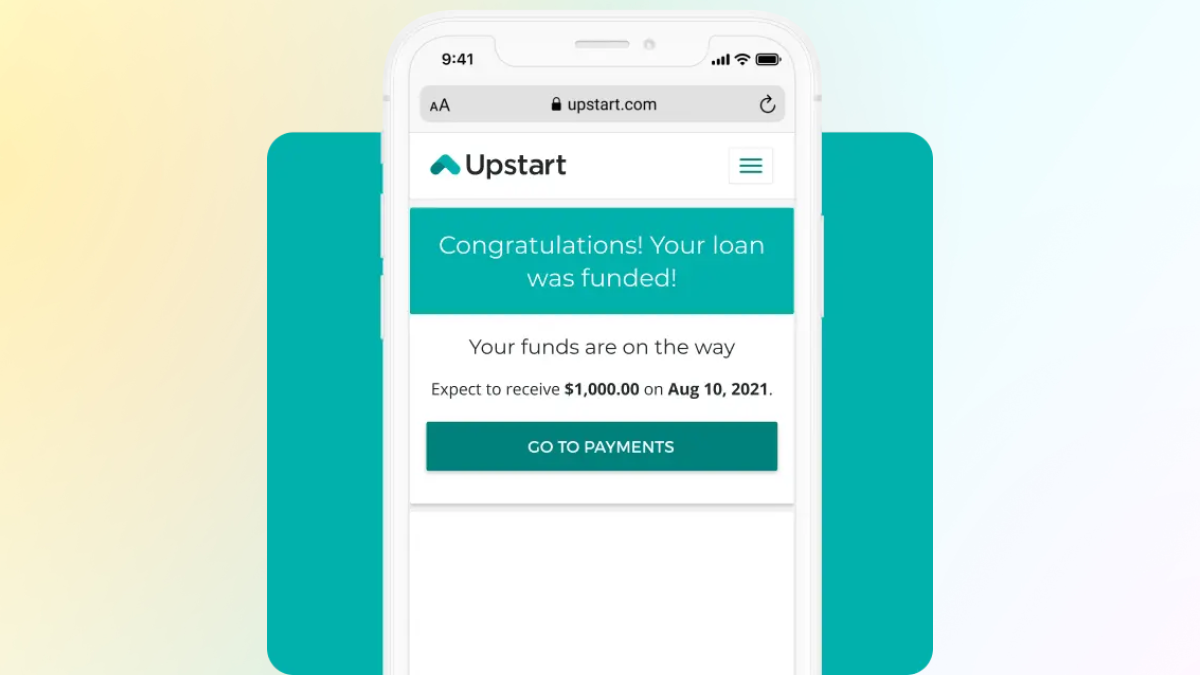

Applying for a personal loan with Upstart offers advantages that will make it easier to overcome financial emergencies and achieve your dreams. It provides an inclusive and borrower-friendly approach to accessing funds and achieving your financial goals. You deserve the chance to access a credit line and provide a better future for you and your family.

Applying for a personal loan with Upstart offers advantages that will make it easier to overcome financial emergencies and achieve your dreams. It provides an inclusive and borrower-friendly approach to accessing funds and achieving your financial goals. You deserve the chance to access a credit line and provide a better future for you and your family.

You will remain in the same website

If you think getting a loan is a burden, check Upstart's friendly approach toward credit evaluation. You’ll have many benefits in applying for this loan:

Personal loans differ from other types of loans in that they are generally unsecured, meaning they don’t require collateral such as a house or car. Unlike a mortgage or auto loan that is specific to a particular purpose, personal loans provide flexibility in how the funds are used. Additionally, personal loans typically have fixed interest rates and fixed monthly payments over a specific term, making them predictable and easier to budget for.

Yes, Upstart does charge an origination fee for its personal loans. The origination fee is a one-time fee deducted from the loan amount before it is disbursed to the borrower. The origination fee typically ranges from 0% to 10% of the loan amount, and the specific fee percentage is determined based on factors such as the borrower’s creditworthiness, loan amount, and loan term.

Yes, Upstart Personal Loans offer borrowers the opportunity to borrow larger loan amounts of up to $8,000 or more. The loan amounts available through Upstart typically range from $1,000 to $50,000, providing flexibility to meet various borrowing needs. The specific loan amount you may be eligible for will depend on factors such as your creditworthiness, income, and other relevant financial information.

Yes, Upstart is considered a reliable lender in the personal loan industry. Upstart is a reputable online lending platform that has been in operation since 2012 and has facilitated numerous loans for borrowers. The company is backed by reputable investors and has received positive reviews from borrowers.

Don’t worry about your credit score if you aim for Upstart Personal Loans. To learn more about eligibility requirements and online application, read the following content.

Upstart Loan: up to $50,000 quickly

This lender can be your partner on the path to financial success! Read on and discover what Upstart Loan offers and its application process!

Would you like a second option? We got it! Check our Best Egg personal loans review to see if you like its features and benefits.

We’ve made an application guide to help you understand how it works. Click on the following link and navigate Financeiro Consulte’s interesting blog post.

Best Egg Loans: How does it work?

In need of a loan? Look no further than Best Egg Loans and discover how it works, including their competitive rates, and easy application.

Trending Topics

United Health Care review: Medicare and Medicaid!

United Health Care review - Unveil the comprehensive review of UnitedHealthcare: Explore coverage, costs, and benefits!

Keep Reading

FIT® Platinum Mastercard® review: Get a $400 line of credit!

Are you looking to boost your credit score to excellence? Check out this FIT® Platinum Mastercard® review and learn how you can do it!

Keep Reading

Apply for the Wells Fargo Active Cash® Card

Learn how you can easily apply for a new Wells Fargo Active Cash® Card and enjoy all the benefits it has to offer. Get started today!

Keep ReadingYou may also like

Evolve Home Loans Review: Smart Choices, Strong Foundations!

Discover the future of mortgage lending with Evolve Home Loans. Tailored solutions that make buying your dream home a reality!

Keep Reading

Apply for the Mission Money™ Visa® Debit Card

Discover how easy and secure it is to apply for a Mission Money™ Visa® Debit card and read more about its special benefits!

Keep Reading

Upgrade Card review: No annual fee, foreign transaction fee; reports to credit bureaus

Want to earn 1.5% cash back on all purchases? Then this card might just be for you. Check our Upgrade Card review.

Keep Reading