Credit Card

U.S. Bank Cash+™ Visa Signature® Card Review

If you're looking for outstanding cash back rewards, this credit card is worth considering. Check this U.S. Bank Cash+™ Visa Signature® Card review.

Advertisement

Discover why the Cash+™ Visa Signature® Card is the smart choice for maximizing your cash rewards

Do you want to take full control of your spending and still earn rewards? Read the U.S. Bank Cash+™ Visa Signature® Card review and know how it could be the perfect credit card for you!

Apply for the U.S. Bank Cash+™ Visa Signature® Car

Want to earn cash back on your everyday purchases? In the U.S. Bank Cash+™ Visa Signature® Card apply way you will see the perfect solution.

If you apply for this card, you’ll find out how easy it can be to manage your finances and enjoy the unique benefits of this card. Learn more in this article.

Be sure to take advantage of all the exclusive benefits of this credit card.

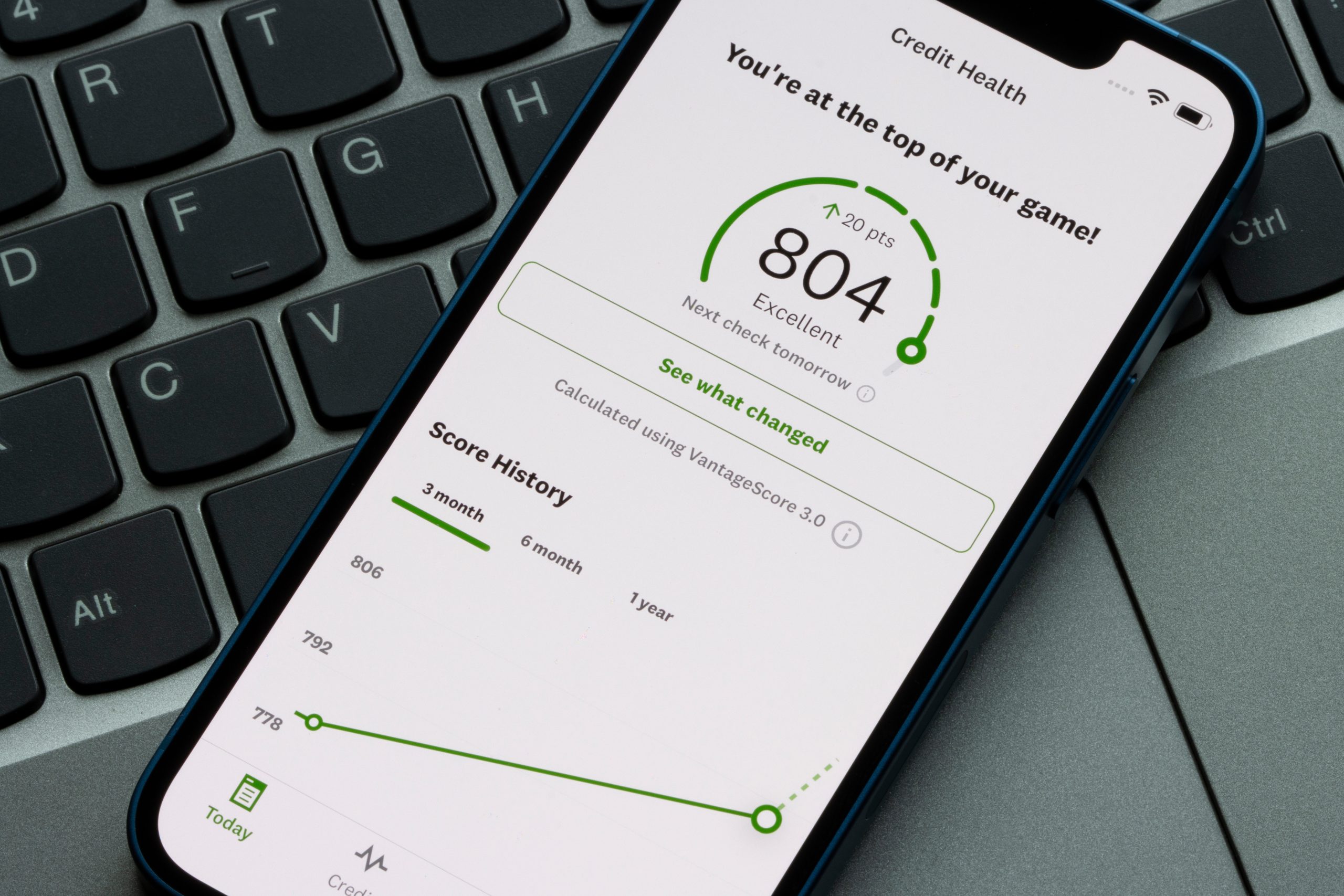

- Credit Score: The Cash+™ Visa Signature® Card requires a good credit history to be approved. Typically, this means a credit score above 670.

- APR: The annual interest rate (APR) for purchases and balance transfers on the Cash+™ Visa Signature® Card is 19.49% to 24.49% variable, depending on your credit history and other financial information.

- Annual Fee: The Cash+™ Visa Signature® Card does not charge an annual fee.

- Fees: The Cash+™ Visa Signature® Card has a 3% foreign transaction fee on all purchases made outside the United States.

- Welcome Bonus: Currently, the Cash+™ Visa Signature® Card offers a $200 welcome bonus after you spend $1000 on purchases in the first 120 days after account opening.

- Rewards: The Cash+™ Visa Signature® Card allows you to earn cash back rewards in various categories, such as restaurants, gas stations, and department stores. You can choose your rewards categories each quarter and earn 5% cashback on up to $2,000 in combined purchases in those categories. You can also earn 2% cashback on a permanent category of choice and 1% cashback on all other purchases.

The card offers additional features, such as fraud protection, travel assistance, and extended warranties, that provide a safer, more secure experience.

U.S. Bank Cash+™ Visa Signature® Card review: a complete Overview

The U.S. Bank Cash+™ Visa Signature® Card review is a credit card that offers its holders a number of exclusive benefits, as you’ll see in this full review.

With the U.S. Bank Cash+™ Visa Signature® Card, you can have the chance to earn generous rewards that fit your lifestyle without worrying about limitations or restrictions.

One of the key advantages in the U.S. Bank Cash+™ Visa Signature® Card review is the flexibility of its rewards.

With this card, you can choose your favorite spending categories, such as restaurants, grocery stores, department stores, and more, and receive 5% cash back rewards each quarter.

Moreover, you can also select an additional spending category and receive 2% cash back reward. And even if you spend in other categories, you will still receive 1% cash back reward.

Another advantage is the fraud protection that the Cash+™ Visa Signature® Card offers.

If there is suspicious activity on your account, the card’s security team will contact you immediately to confirm that the transactions are legitimate.

In addition, the card also offers protection against unauthorized charges, so you can feel secure while using your card.

Significant benefits and disadvantages you may find

Now that you know more about the features of the U.S. Bank Cash+™ Visa Signature® Card review, let’s explore its benefits and possible limitations.

Check out the list below with the advantages and disadvantages of this credit card to make the best possible decision.

Reasons you may want it

- The Cash+™ Visa Signature® Card offers a wide variety of reward categories, allowing cardholders to customize their earnings according to their shopping habits.

- The card offers a generous cashback rate of up to 5% on up to two categories selected by the cardholder, plus 2% cashback on a selected supermarket category.

- There is an attractive sign-up bonus for new cardholders, who can receive a cash bonus after spending a certain amount within the first three months of account opening.

- The Cash+™ Visa Signature® Card comes with valuable protections and benefits, such as cell phone theft or accidental damage protection, travel insurance, and rental car insurance.

- The card has no annual fee, which means cardholders can enjoy the benefits of the card without having to pay an extra fee every year.

- 0% intro APR for 15 months

Why maybe you wouldn’t choose it

- Minimum spending requirements to earn additional rewards

- Limited access to advantages and benefits exclusive to Visa Signature® compared to other Visa Signature® cards

- The requirement of excellent credit to qualify for the card

Inside the application process for the Cash+™ Visa Signature® Card

Like what you’ve seen in this U.S. Bank Cash+™ Visa Signature® Card review? Apply now with our step-by-step application guide and start enjoying the exclusive benefits of this credit card.

Apply for the U.S. Bank Cash+™ Visa Signature® Car

Want to earn cash back on your everyday purchases? In the U.S. Bank Cash+™ Visa Signature® Card apply way you will see the perfect solution.

About the author / Marcos

Trending Topics

Apply for the Applied Bank® Gold Preferred® Secured Visa®

Get security and financial power even without credit history with Applied Bank® Gold Preferred® Secured Visa® apply.

Keep Reading

True American Loan review: Up to $35,000!

In-depth True American Loan review: Explore its fast processing, credit flexibility, and geographic limitations!

Keep Reading

Sable Secured card review: Upgrade to a Traditional Credit Card in Just Four Months

Want to get 2% cash back on purchases at major streaming services and more? So check out this Sable Secured card review.

Keep ReadingYou may also like

Cash App: Step Into a New Era in Your Finances!

Experience the convenience of Cash App by understanding its key features, and learn how to download and set up your account.

Keep Reading

Extra Debit Card Review: the perfect card to start your credit journey

Do you want a practical and safe option to make your purchases without having to worry about interest rates? Read the Extra Debit Card review

Keep Reading

What Are the 3 Credit Bureaus? How Do They Work?

What are the 3 credit bureaus? You can learn all about your score in our blog post and see how you can improve it!

Keep Reading