Loans (US)

True American Loan review: Up to $35,000!

Discover the pros and cons of True American Loan - from its swift funding and credit inclusivity to its limitations in credit score acceptance and state availability. Get an insightful review to aid your decision-making process!

Advertisement

True American Loan review: Next business day funding!

Unlocking financial potential and meeting unforeseen expenses often necessitate a reliable lending partner. So, you can read our True American Loan review!

Also, in the crowded landscape of financial services, True American Loan emerges as a beacon for individuals seeking swift access to funds!

- APR: From 5.99% to 35.99% variable APR;

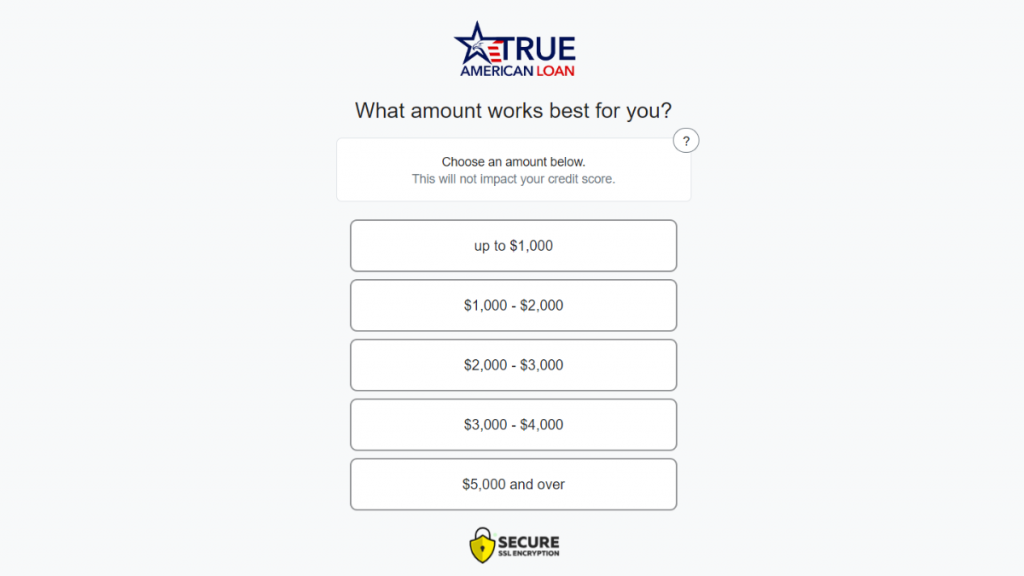

- Loan Amount: From $1,000 to $5,000 and over;

- Loan Purpose: Home improvements, car repairs, rental deposits, vacations, medical bills, unexpected expenses, and other personal reasons;

- Credit Needed: You’ll need at least a 540 minimum credit score to have more chances to qualify;

- Origination fee: There are no origination fees;

- Late Fee: There can be fees if you don’t make your loan repayments on time;

- Terms: 61-day minimum repayment and 72-month maximum repayment period;

- Early Payoff Penalty: N/A.

True American Loan: A Complete Overview

The platform’s consideration of diverse credit types further emphasizes inclusivity, allowing a wider range of individuals to apply for personal loans online, irrespective of their credit histories.

Also, this approach fosters financial empowerment and provides opportunities for individuals to improve their financial situations.

Reasons you may want it

You may want to apply for this loan for many reasons. So, you can read the main ones below!

Wire transfers available

True American Loan streamlines the cash flow process by offering wire transfers for loans through an easy-to-use form.

Moreover, this simplified method spares borrowers the frustrations and hassles of laborious paperwork and intricate procedures that are commonly connected with loan applications.

No minimum credit score requirements

True American Loan sets itself apart by accepting all forms of credit.

Also, opportunities are offered by this inclusive policy to those who may have previously suffered from financial difficulties.

Next business day funding

The quick processing time of True American Loans guarantees that approved cash can be sent into the borrower’s account.

This can be done as early as the following business day, making it one of the company’s top features.

Up to $35,000 in loan amounts

One of the main advantages of True American Loan is that it makes it possible for borrowers to effortlessly and quickly get up to $35,000 in cash.

Moreover, consumers may now fulfill a variety of financial needs, such as debt relief, home upgrades, unplanned medical expenses, and other pressing requirements.

Why maybe you wouldn’t choose it

Even though this lender offers incredible loan options and perks, there are also some downsides as with any other lender. Therefore, read our cons list below to learn more:

Higher rates

The application process is quick, easy, and pleasant, but its simplicity might have drawbacks.

Also, while straightforward application processes are generally preferable, they may also be a sign of looser acceptance criteria, which might mean higher rates or less favorable terms for borrowers.

For this convenience, those who qualify for the loan could have to pay more.

Not available in every state

Not all states provide True American Loans; those who live in states like NY, CT, VT, WV, AK, and GA are not eligible to apply.

Also, residents in these states who may have otherwise been interested in using True American Loan’s loan services may get frustrated by this geographic limitation.

Only for U.S. citizens

Another restriction is that True American Loan is only available to citizens of the United States.

So, no non-US citizens may apply for this loan, not even those with work permits or other legal status.

Checking account required

The requirement that candidates for True American Loans have a bank account is another drawback.

Moreover, even though a lot of people regularly maintain a checking account, it might be challenging for those who only use other banking services or who don’t have one yet to fulfill this criteria.

Not all credit scores are accepted

Even with all of True American Loan’s benefits, you should be mindful of any possible drawbacks, such as the upper limit on acceptable credit ratings.

Apply for True American Loan

You can apply for a loan with this lender easily online. However, you’ll need to know about the requirements before you apply.

So, to apply, you’ll need to be at least 18 years old and be a U.S. citizen or permanent resident. Also, you’ll need to be employed or have a current regular income.

Moreover, you’ll also need to already have a current bank account to receive your funds with direct deposit.

Online application process

To apply online, you’ll need to go to the official website and read the loan information. Also, you’ll be able to find the requirements information and much more.

Then, you’ll be able to start the application process by providing the personal information required.

After that, you’ll be able to complete the application process online and wait for a quick response to get your loan funds or not.

Is there an app for applying?

There is not much information about a mobile app available to manage your finances and your loan through True American Loan.

Therefore, you’ll need to complete the application process online through the official website.

Another great option: Upstart Loans

If you’re not so sure about getting a loan through True American Loan, you can check the Upstart Loans!

Also, with this lender, you’ll be able to get up to $50,000 in loan amounts, depending on your finances at the moment of the application.

So, you can learn even more about this lender and how to apply for it in our blog post below. So, read on!

Upstart Loan: up to $50,000 quickly

This lender can be your partner on the path to financial success! Read on and discover what Upstart Loan offers and its application process!

About the author / Victória Lourenço

Trending Topics

The Best Credit Cards for Luxury Travel: Pamper Yourself with Exclusive Benefits!

Embark on a journey of luxury and convenience with these credit cards, your passport to the best travel experiences!

Keep Reading

How to apply for the Assent Platinum Secured card: Regular Credit Reports!

Learn how to apply for a card to help you improve your credit with a little help from our Assent Platinum Secured card application guide.

Keep Reading

Apply For The Platinum Card® from American Express: Travel Credits, and No Foreign Transaction Fees!

Follow this guide to apply for The Platinum Card® from American Express and start enjoying VIP travel perks and much more.

Keep ReadingYou may also like

Apply for the Capital One Quicksilver Cash Rewards Credit Card

Check out this Capital One Quicksilver Cash Rewards Credit Card application guide and learn how to apply online for this card fast!

Keep Reading

First Access Visa® Credit Card review

Get the full scoop on the First Access Visa® credit card with this comprehensive review. Find out about benefits, fees, and resources!

Keep Reading

Fashion on a Budget? Discover Mr Price Money Account!

Experience convenient online shopping and unbeatable value at Mr Price Money in South Africa. Shop with confidence!

Keep Reading