Credit Card

Vast Platinum Card: Find the best store perks with 0% intro APR

Explore the key to save money and use your card online to shop and get perks! Read our post to learn all about the Vast Platinum Card - $0 annual fee!

Advertisement

Introducing the Vast Platinum Card – Your Ticket to Exclusive Benefits!

Are you tired of sifting through endless credit card offers, searching for the perfect one that suits your needs? Look no further! The Vast Platinum Card is here to simplify your financial life!

Moreover, the Vast Platinum Card isn’t just another piece of plastic in your wallet; it’s a key to many perks and advantages.

Therefore, you can keep reading this review to learn all about this store card and how to apply for it!

- Credit Score: You can apply even with a bad score;

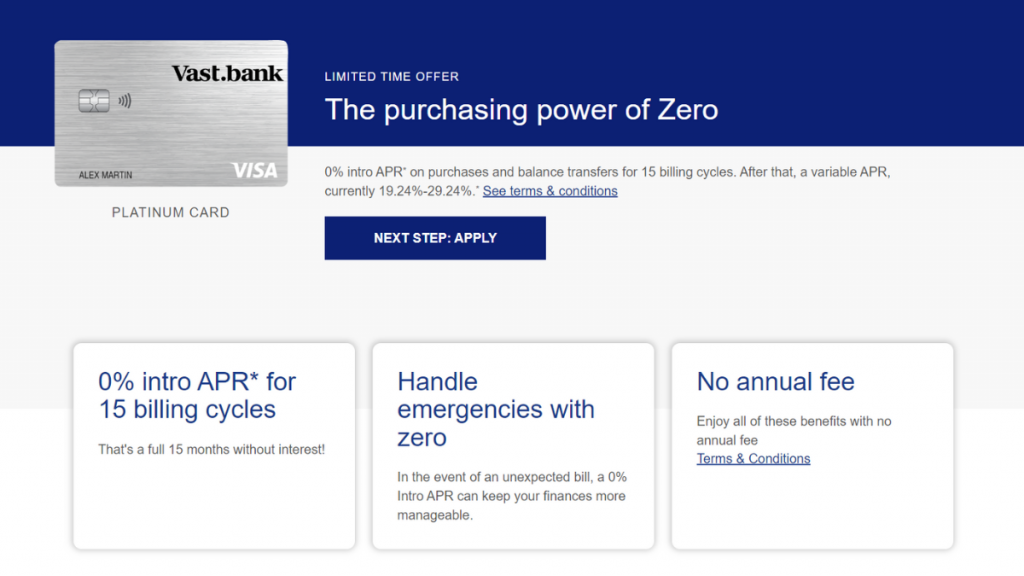

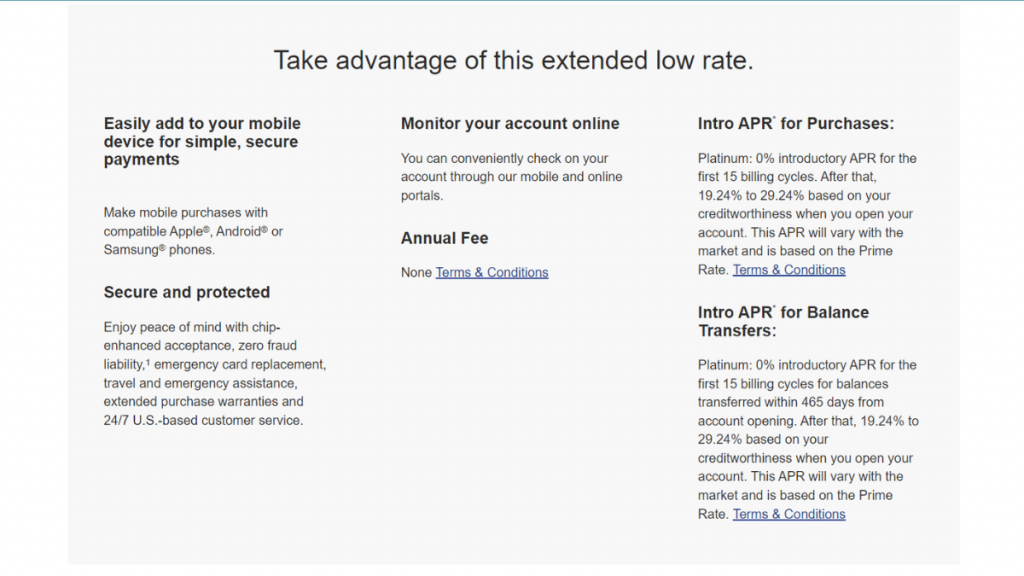

- APR: Intro APR for your first 15 billing cycles on purchases and balance transfers. After that, there can be a variable APR ranging from 19.24% to 29.24%;

- Annual Fee: No annual fee, but there is a monthly fee;

- Welcome bonus: There is no welcome bonus for new cardholders besides the intro APR for purchases and balance transfers;

- Rewards: There is no rewards program besides the perks it offers;

- Terms apply.

Vast Platinum Card: A Complete Overview

In this blog post, we will dive deep into this remarkable store card’s features, advantages, and application process.

This way, you can make an informed decision about whether it’s the right choice for you.

Also, its straightforward application process and user-friendly interface make it a hassle-free addition to your financial toolkit.

Reasons you may want it

You may enjoy using this store card if you love to purchase at the My Unique Outlet from Vast online! Also, you’ll be able to get accepted for this card even with a low score or no score.

Moreover, you’ll be able to get amazing perks, such as 24/7 roadside assistance. Also, you’ll get a $1,000 merchandise credit limit to use as you want to shop online at the Outlet.

Why maybe you wouldn’t choose it

If you want a regular card with perks and other features, you may want a different card from the Vast Platinum Card.

Moreover, you’ll need a high membership fee to get the perks and roadside assistance the card promises.

In addition, you won’t be able to use this card in other places besides the My Unique Outlet online.

Apply for the Vast Platinum Card

You’ll be able to easily apply for this store card online through the official website. Therefore, you can read our tips on how the application process works!

Online application process

You’ll be able to go to the official website online and click on the card you want to apply for. Then, you’ll need to provide the personal information required during the application.

After that, you’ll need to wait for a quick response. Also, you won’t need to worry about your credit score to apply because there are no credit checks during the application process.

However, we recommend reading all the terms and conditions before applying for this card and starting to use it.

Is there an app for applying?

Unfortunately, you won’t be able to get a mobile app to manage your account and store your card.

However, you can contact the card company to solve any issues through their official communication channel anytime.

Another great option: Upgrade Card

If you’re looking for a different card besides a store card, try the Upgrade card! Moreover, with this card, you’ll enjoy incredible cash-back perks!

Also, this card offers up to 1.5% cash back on eligible purchases you make with your card! Plus, you won’t have to pay any annual or foreign transaction fees to get all of this!

Moreover, you’ll also be able to build or rebuild your credit score while using this card!

However, you’ll need to use this card responsibly and make timely payments to improve your credit.

Therefore, if you want to learn more about this great Upgrade card, we can help! So, read our post below to learn how this card’s application process works!

How to apply for the Upgrade Card?

Learn how to apply for the Upgrade Card with our quick application guide and start earning 1.5% cash back on purchases.

About the author / Victória Lourenço

Trending Topics

Enhance your Pictures With the Best Apps to Edit Your Photo Like a Pro!

From basic adjustments to advanced filters and effects, these photo editing apps are your key to unlocking endless possibilities!

Keep Reading

Revolut Visa Card: Die Zukunft des Bankwesens in Ihren Händen!

Von Budgetierungstools bis zur Unterstützung von Kryptowährungen - erfahren Sie, wie die Revolut Visa Karte Ihr Geldmanagement verbessert!

Keep Reading

Build the road to financial success with these Credit Building Credit Cards!

Building credit will get easier with one of the best credit cards designed for this purpose! Get the right tool for building this road.

Keep ReadingYou may also like

U.S. Bank Cash+™ Visa Signature® Card Review

Do you want to take full control of your spending and still earn rewards? Then read this U.S. Bank Cash+™ Visa Signature® Card review!

Keep Reading

Smart Loan Review: Empowering Borrowers with Intelligent Loan Decisions

Discover why Smart Loan stands out from the crowd with its commitment to transparency and customer-centric approach in this full review.

Keep Reading

Credit Card Security: How to Protect Yourself from Fraud and Identity Theft!

Explore credit card security measures, from safeguarding your financial data to recognizing and avoiding common credit card scams!

Keep Reading