Credit Card

Apply For The Chase Freedom Flex℠: No annual fee and cashback rewards for everyday purchases

Start enjoying flexible redemption options for cashback rewards with a little help from our Chase Freedom Flex℠ application guide.

Advertisement

Chase Freedom Flex℠: Simple Online Application, Fast Approval, and Versatile Rewards Program

This card offers cashback rewards of up to 5% in rotating categories plus 1% on all other purchases. Just follow our guide and apply for the Chase Freedom Flex℠.

The card also comes with benefits such as purchase protection, extended warranty, and travel insurance. It also offers contactless payment and mobile wallet options.

Cardholders of the Chase Freedom Flex℠ can enjoy exclusive perks like discounts, access to events, and complimentary services through the Chase Offers program.

Ready to apply for the Chase Freedom Flex℠? Follow our step-by-step Chase Freedom Flex℠ application guide and complete your application easily and quickly online.

Online application process

Time to dive into the Chase Freedom Flex℠ application. So let’s get it done right now! You can complete the application process quickly and easily through their online portal. Just follow our guidelines, and we will get you there.

To begin, visit the main page of the Chase website and select the “Credit Cards” option. From there, navigate to the “Explore Credit Cards” tab.

Once on the credit card page, locate the card you’re interested in and click the “Learn more” button. You have the option to apply as a guest or sign in to expedite the process.

If you choose to apply as a guest, you will be taken to a form where you must input your personal details such as your full name, date of birth, Social Security Number, and mother’s maiden name.

After filling in your personal information, provide your address, email address, and phone number.

You will be asked to give your electronic signature to authorize the release of your social security number verification.

Next, select your type of residence, employment status, and gross annual income. You can also choose to have them send your billing to you digitally and add an authorized user.

Finally, read through the pricing and terms document and agree to the conditions by checking the box. After that you are ready to submit your Chase Freedom Flex℠ application.

After submitting your application, you can relax while waiting for the issuer’s response, which typically takes only a few minutes.

If you get approved, you will receive your new card in a few business days at the address you provided during the application process. Congratulations!

Another great option: Capital One Quicksilver Cash Rewards Credit Card

If you would like to check out another rewards credit card to compare, have a look at the Capital One Quicksilver Cash Rewards Credit Card.

Are you searching for an effortless cashback card? Then the Capital One Quicksilver Cash Rewards Credit Card is a fantastic choice.

With no categories to recall or spending limits, it earns 1.5% cashback on every purchase. Moreover, it offers a generous sign-up bonus and an interest-free APR promotion.

How does that sound to you? If you feel like learning more about this credit card, just click the link below to access our complete review.

Apply for the Capital One Quicksilver Cash Rewards

Check out this Capital One Quicksilver Cash Rewards Credit Card application guide and learn how to get this card fast!

About the author / Danilo Pereira

Trending Topics

Mission Money™ Visa® Debit Card review

Looking for a great debit card that fits your budget? Read our Mission Money™ Visa® Debit Card review and learn all you need to know.

Keep Reading

Apply for the Unique Platinum Card

Learn how to apply for the Unique Platinum Card and get the confidence you need to build a strong score and a brighter financial future!

Keep Reading

Enhance your Pictures With the Best Apps to Edit Your Photo Like a Pro!

From basic adjustments to advanced filters and effects, these photo editing apps are your key to unlocking endless possibilities!

Keep ReadingYou may also like

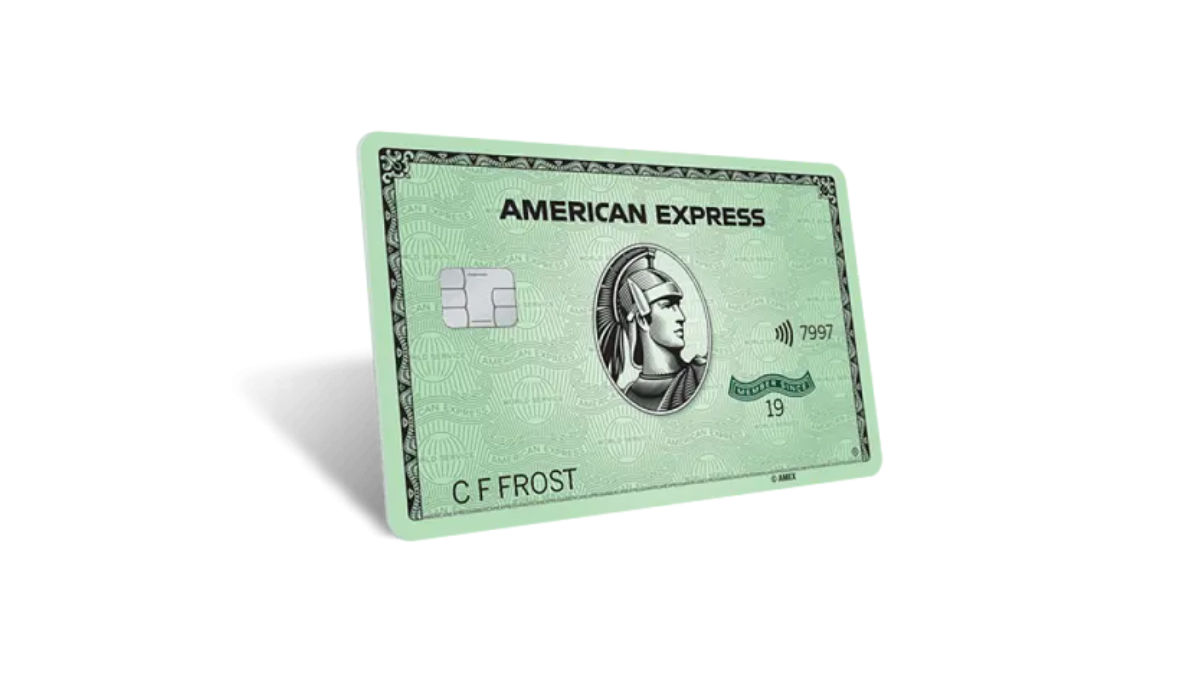

Get the best travel perks with the Amex Green Card!

Is the Amex Green Card right for you? Our review breaks down its travel benefits - earn up to 3 points on purchases and 40K bonus points!

Keep Reading

How to apply For The Destiny Mastercard®

Learn how to apply for the Destiny Mastercard® with no security deposit and pre-qualification available. Here's how!

Keep Reading

First Progress Platinum Prestige Secured review: no credit score

First Progress Platinum Prestige Secured review: This card reports to all credit bureaus, and no credit history is needed. Learn its perks!

Keep Reading