Credit Card

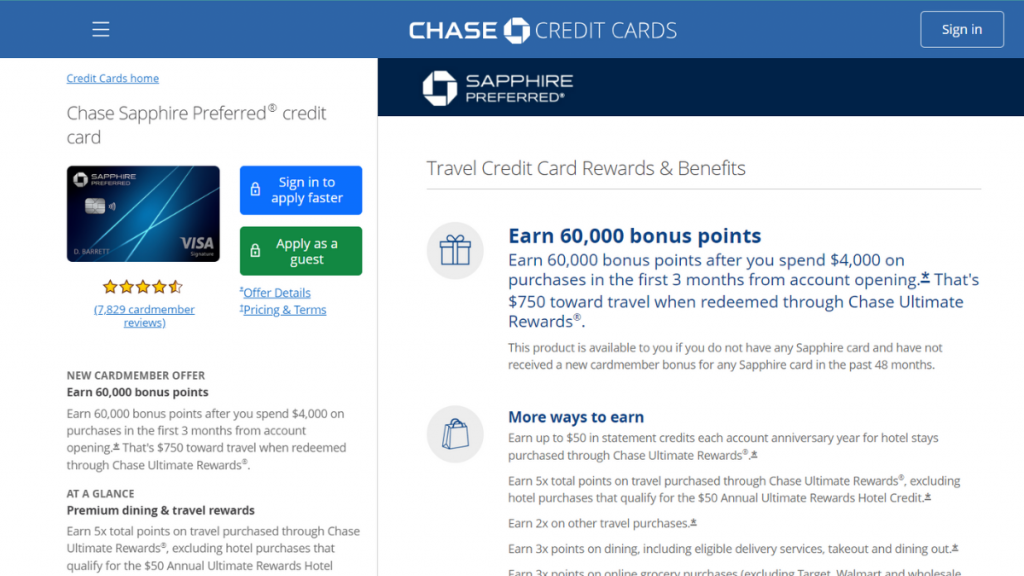

60K bonus points: Chase Sapphire Preferred Card

Where luxury, adventure, and rewards converge: Introducing the Chase Sapphire Preferred Card - Earn on every purchase! Discover below!

Advertisement

The Chase Sapphire Preferred card is more than just plastic; it’s a powerful tool to unlock incredible savings and unmatched perks.

If you’ve dreamed of stretching your vacation budget, indulging in luxurious hotel stays, or even flying business class without breaking the bank – this credit card is your golden ticket!

Travel Smarter, Not Harder: How Chase Sapphire Preferred Works Its Charm

The Chase Sapphire Preferred is a travel lover’s dream come true. Every dollar you spend on travel and dining rewards you with bonus points.

The card welcomes you with a generous sign-up bonus, setting the tone for exciting travels ahead. And here’s the icing on the cake – no foreign transaction fees.

Say hello to stress-free international trips and wave goodbye to unnecessary charges.

Moreover, rest easy with travel insurance coverage, providing you with the reassurance you need during your escapades.

With the flexibility to transfer points to various loyalty programs, you can personalize your adventures and make your travel dreams a reality.

Chase Sapphire Preferred features: is it worth the hype?

The Chase Sapphire Preferred is a superstar among travel cards. Moreover, the annual fee is relatively low when compared to similar credit cards in its category.

However, is it the perfect and flawless travel card? Let’s review the pros and cons you might step into when you put the Chase Sapphire Preferred into your wallet:

Pros

- Generous Sign-Up Bonus: The Chase Sapphire Preferred card offers a substantial sign-up bonus, providing a strong start to your rewards journey;

- Rewarding Points Structure: Earn bonus points on every dollar spent on travel and dining, making it easy to accumulate rewards for your adventures;

- Travel Insurance Coverage: Travel with confidence, as the card provides essential travel insurance coverage, including trip cancellation/interruption, baggage delay, and rental car insurance;

- No Foreign Transaction Fees: Make purchases abroad without incurring extra charges for foreign transactions, a great perk for international travelers;

- Exclusive Travel Benefits: Access a range of premium travel benefits, such as airport lounge access, travel concierge services, and special hotel and car rental privileges;

- Points Transfer to Travel Partners: Transfer points at a 1:1 ratio to various airline and hotel loyalty programs, giving you more options for using your rewards.

Cons

- Annual Fee: The Chase Sapphire Preferred card comes with an annual fee, which might be a consideration for some cardholders;

- High Credit Score Requirement: To qualify for the card, you generally need a good to excellent credit score, which might limit access for some individuals;

- No Introductory 0% APR Offer: Unlike some other credit cards, the Chase Sapphire Preferred card does not offer a 0% APR introductory period on purchases or balance transfers;

- Not Ideal for Cash Back: If you prefer cash-back rewards, this Chase card might not be the best fit, as its primary strength lies in travel rewards.

Apply online to put your hands on the Chase Sapphire Preferred Credit Card

Ready to seize the opportunity? Applying for the Chase Sapphire Preferred card is a breeze with its user-friendly online application process. Follow these simple steps to get started:

- Gather Your Information: Before diving in, have your personal details and financial information ready. This includes your Social Security number, annual income, and employment details;

- Visit Chase’s Website: Head to the Chase website and navigate to the Chase Sapphire Preferred card page;

- Click “Apply Now”: Find the prominent “Apply Now” button and give it a click to begin the application process;

- Fill in the Form: Follow the on-screen instructions and provide the requested information accurately and honestly;

- Review and Submit: Double-check your application for any errors or omissions. Once you’re confident, hit that submit button;

- Wait for Approval: Now, it’s time to exercise patience. Chase will review your application and let you know their decision;

- Activate Your Card: Once approved, you’ll receive your shiny new card in the mail. Activate it following the provided instructions, and you’re all set to embark on a world of travel rewards!

With the Chase Sapphire Preferred card in your wallet, the world is your oyster. Embrace the magic of travel and unlock extraordinary experiences like never before!

Eligibility Requirements

Requirements to get this credit card include a good to excellent credit score, which is generally considered to be around 690 or higher.

In addition to creditworthiness, applicants should have a stable source of income and a responsible credit history.

It’s important to note that meeting the eligibility criteria doesn’t guarantee approval, as credit card issuers consider various factors during the application process.

Chase Sapphire Preferred vs. Capital One Venture Rewards

When comparing the Chase Sapphire Preferred Credit Card and the Capital One Venture Rewards Card, both offer enticing travel rewards, but each has its own unique perks.

The Chase Sapphire Preferred card stands out with its generous sign-up bonus and bonus points on travel and dining, while the Capital One Venture Rewards Card impresses with a flat-rate rewards system for all purchases.

The Chase card allows point transfers to various travel partners, offering flexibility in redemption, whereas the Capital One Venture Rewards Card simplifies rewards with straightforward earning and redeeming options.

Additionally, the Chase card provides comprehensive travel insurance coverage, while the Capital One Venture Rewards Card boasts no foreign transaction fees, making it advantageous for international travelers.

If you need more info to make an informed decision, you can read our Capital One Venture Rewards full review on the following link. Travel more with the right credit card.

Capital One Venture Rewards Review: Earn 75K miles

The Capital One Venture Rewards is an affordable credit card with powerfull travel rewards. If that's something you wish you had, read this review!

Trending Topics

SoFi Personal Loans: Learn how it works in this full review!

Discover the ins and outs of SoFi Personal Loans and how it works. You’ll get access to the funds you need to achieve your goals.

Keep Reading

Credit Card Security: How to Protect Yourself from Fraud and Identity Theft!

Explore credit card security measures, from safeguarding your financial data to recognizing and avoiding common credit card scams!

Keep Reading

Visa Kreditkarte von DKB: Sicher und vielseitig weltweit!

Die Visa-Kreditkarte von DKB ist Ihr vertrauenswürdiger Begleiter für sichere Zahlungen, Online-Shopping und bequeme Bargeldabhebungen!

Keep ReadingYou may also like

Happy Money Personal Loans: learn how it works

Explore the features of Happy Money Personal Loans and find out how it works and why they're a trusted option to get financial support.

Keep Reading

Apply For The Upgrade Card: Low Credit Score Approval, Contactless Payments and More!

Learn how to apply for the Upgrade Card with our quick application guide and start earning 1.5% cash back on purchases.

Keep Reading

How to apply for the Sam’s Club Credit Plus Member Mastercard: Get 5% Cash Back

Ready to start earning cash back and saving on fuel? Then learn how to apply for Sam’s Club Credit Plus Member Mastercard in this easy guide.

Keep Reading