Credit Card

Apply For The Upgrade Card: Low Credit Score Approval, Contactless Payments and More!

Would you like to apply for the Upgrade Card? Then follow our guide and get this card fast to start earning 1.5% cash back on purchases.

Advertisement

The Credit Card-Personal Loan Combo That Offers Flexible Payment Options, High Rewards, and No Annual Fees

In this article you are going to learn how to apply for the Upgrade Card. The Upgrade Card offers several benefits for consumers in need of financing.

With the flexibility of a credit card and the predictability of a personal loan, you can use the card to make purchases and convert them into installment loans with fixed interest rates.

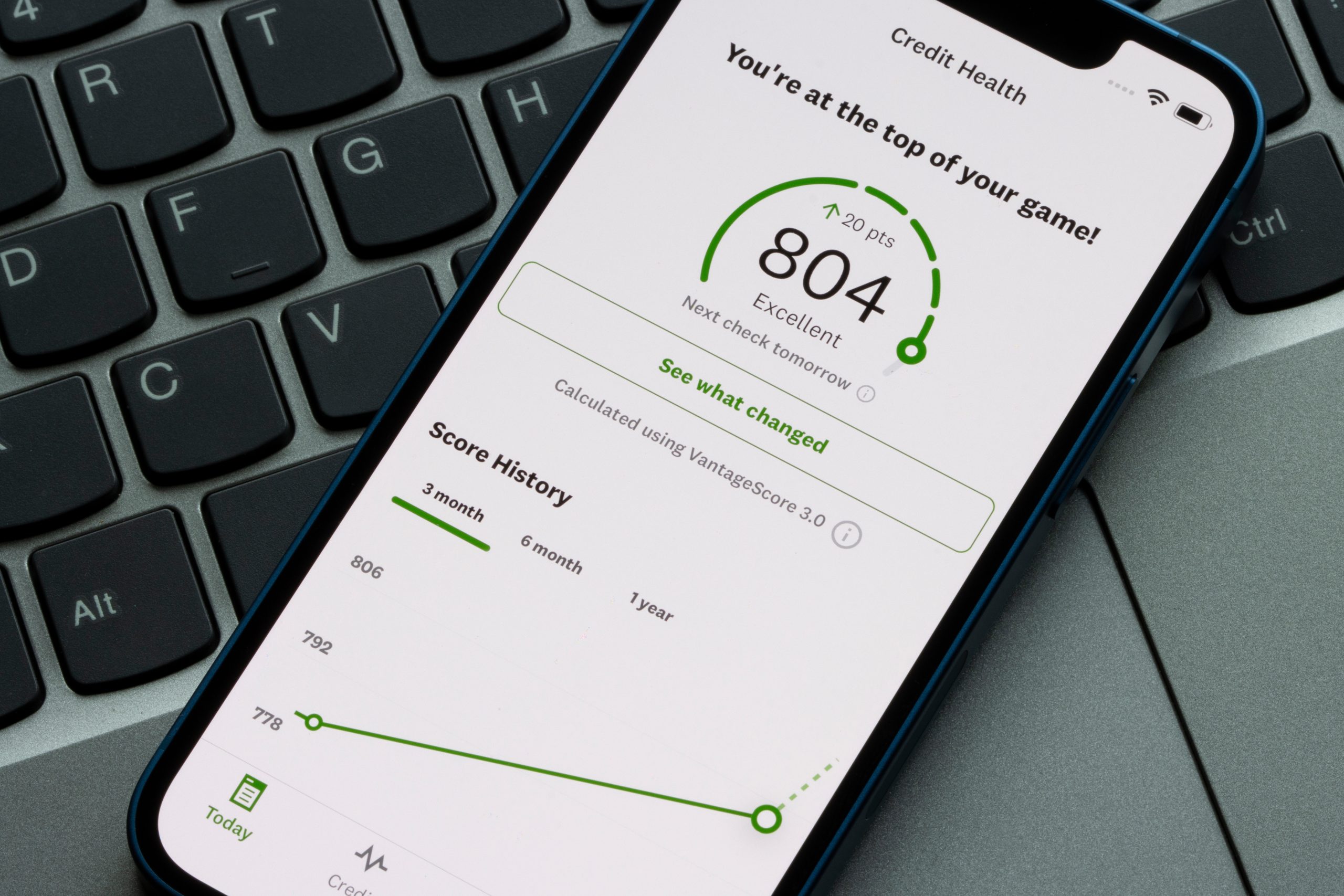

The card also has no annual fee or foreign transaction fee, and reports to all three major credit bureaus, helping you build your credit score.

Plus, with 1.5% unlimited cash back on all purchases, the Upgrade Card rewards you for using it.

Ready to apply for the Upgrade Card? Follow our application guide to apply in just a few minutes and start enjoying its many benefits.

Online application process

You can apply for the Upgrade Card by visiting their website. On the site, locate the section labeled “Cash Rewards” and click on it.

This will redirect you to a page where you can explore the numerous advantages and perks associated with the card. Carefully evaluate the information there to ensure it meets your needs.

If you decide to proceed with the application, click the “start now” button to access the application page.

Fill in your basic information, including your complete name, residential address, date of birth, income details, and Social Security Number.

Create a password and enter your email address to establish an account. Before submitting your application, ensure that you have reviewed and agreed to the essential documents.

Your application will undergo a thorough review by the bank so they can reach a decision regarding its acceptance or rejection.

The approval process typically takes only a few moments, but in certain circumstances, it may take longer.

Assuming your application gets approved, your Upgrade Card will arrive in your mail within a few days. However, you must activate it before using it.

To activate the card, contact the number on the back of the card and follow the instructions. The issuer will require you to provide personal information to authenticate your identity.

Once the activation process is complete, your card will be ready for use. That’s all there is to it – this is how you apply for the Upgrade Card. Congratulations!

Another great option: Destiny Mastercard®

Looking for another recommendation? It is always good to compare offers before making a financial decision. So check out the Destiny Mastercard®.

The Destiny Mastercard® is a credit card that assists individuals who have poor or imperfect credit scores in rebuilding their credit.

It is an unsecured card, meaning no security deposit is required. With an initial credit limit of $300, it is an excellent option for those looking to establish a credit history or improve their credit score.

Feel like learning more about this card? Then click the link below to access our complete review and find out everything you need to know about it.

How to Apply For The Destiny Mastercard®?

Learn how to apply for the Destiny Mastercard® with no security deposit, and pre-qualification available. Here's how!

About the author / Danilo Pereira

Trending Topics

How to apply For The Destiny Mastercard®

Learn how to apply for the Destiny Mastercard® with no security deposit and pre-qualification available. Here's how!

Keep Reading

U.S. Bank Cash+™ Visa Signature® Card Review

Do you want to take full control of your spending and still earn rewards? Then read this U.S. Bank Cash+™ Visa Signature® Card review!

Keep Reading

What Are the 3 Credit Bureaus? How Do They Work?

What are the 3 credit bureaus? You can learn all about your score in our blog post and see how you can improve it!

Keep ReadingYou may also like

Chime Visa® Debit Card review: Redefining Banking with Simplicity and Savings

Discover the banking revolution with the Chime Visa® Debit Card review! No branches, no problem—experience digital convenience at its finest.

Keep Reading

Navigating Your Finances: A Review of the Brink’s Prepaid Mastercard®

Discover the pros and cons of Brink's Prepaid Mastercard® in our in-depth review. Is it the right financial tool for you? Find out now!

Keep Reading

CreditFresh review: Flexible Loans!

Discover the ins and outs of CreditFresh Loans in our review. From flexible withdrawal options to potential drawbacks - up to $5,000!

Keep Reading