Debit Cards

Chime Visa® Debit Card review: Redefining Banking with Simplicity and Savings

Discover the perks of early direct deposit and no minimum opening deposits. Dive into the details in our Chime Visa® Debit Card review!

Advertisement

Unlocking the Future of Finance: Exploring the Chime Visa® Debit Card

In the world of modern banking, finding a financial companion that aligns with your lifestyle and priorities can be a game-changer. So, you can read our Chime Visa® Debit Card review!

This card is a disruptive force in the traditional banking sphere. In this comprehensive review, we’ll delve into the key features that set Chime apart!

- Credit Score: No credit score requirements;

- Fees: There are no monthly service fees for this card. You’ll need to pay a $2.50 fee per out-of-network withdrawal;

- Welcome bonus: There is no welcome bonus;

- Rewards: There is no rewards program.

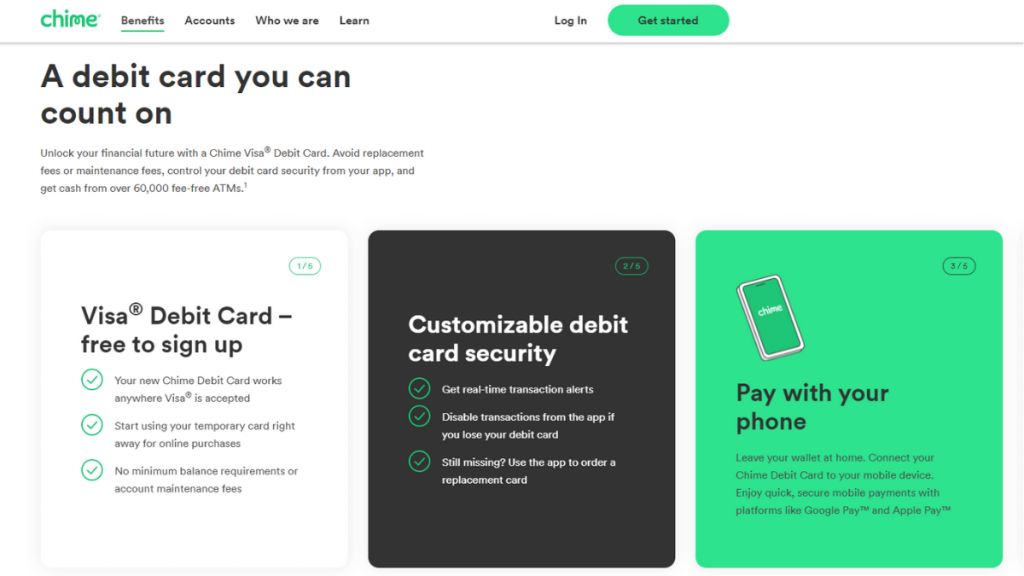

Chime Visa® Debit Card: A Complete Overview

From its extensive, fee-free ATM network to its commitment to a fee-less experience, it promises a breath of fresh air for those tired of navigating the complexities of conventional banking.

Chime is not just a debit card; it’s a financial ally designed to simplify your banking experience.

Also, with no overdraft fees, early direct deposit options, no minimum opening deposits, and a promise of zero monthly fees, Chime aims to redefine the way you interact with your finances.

Moreover, whether you’re a seasoned financial guru or just starting your journey to financial wellness, this card can offer revolutionary features!

In addition, the Chime Visa® Debit Card is a game-changer in modern banking. No branches mean no waiting in lines or scheduling appointments; it’s all about digital convenience.

So, with no overdraft fees, Chime puts an end to unexpected financial headaches.

Reasons you may want it

There are many reasons for you to want to use this great debit card. So, read some of the main ones below!

Free ATM Network

With Chime, users can withdraw cash without incurring additional fees, thanks to its expansive network of ATMs across the country.

Also, this feature ensures that users can access their money whenever and wherever they need it.

So, this makes the Chime Visa® Debit Card an attractive choice for those who prioritize flexibility and ease of access in their banking experience.

There are no overdraft fees

Chime understands the financial strain that overdraft fees can place on individuals, and as a result, they have eliminated this burden for their users.

Moreover, with Chime, customers can make transactions with confidence, knowing that they won’t incur hefty fees for accidental overdrawing of their accounts.

So, this no-overdraft-fee policy aligns with Chime’s mission to provide a more accessible and stress-free banking experience for its users.

Direct deposit

Users can enjoy the convenience of receiving their paychecks up to two days earlier than traditional banking systems would allow.

Moreover, this feature is particularly advantageous for those who rely on timely access to their funds for essential expenses.

So, by prioritizing early direct deposit, Chime empowers its users with increased financial flexibility and the ability to manage their money more effectively.

No minimum deposit for account opening

This feature makes Chime accessible to a broader demographic, including those who may not have significant initial funds to deposit.

Also, the absence of a minimum opening deposit requirement aligns with Chime’s goal of breaking down barriers to entry in traditional banking.

There are no monthly fees

Chime sets itself apart in the competitive landscape by eliminating monthly fees for its users.

Also, this means that account holders won’t be burdened with recurring charges simply for maintaining their accounts.

Moreover, the absence of monthly fees contributes to a more transparent and cost-effective banking experience.

This allows users to maximize the value of their money without the worry of hidden charges.

Why maybe you wouldn’t choose it

On the other hand, this card can have many downsides to its features. So, read below to learn about them!

No branches

While the absence of branches contributes to the card’s accessibility, individuals who value in-person assistance for complex transactions or financial guidance may find this limitation to be a drawback.

Fees on cash deposits

Users who rely on cash transactions or need to deposit physical currency may find themselves facing fees that traditional banks might not impose.

Moreover, this limitation might impact users who deal primarily in cash.

Apply for the Chime Visa® Debit Card

You can easily find a way to apply for this card. Moreover, you’ll need to open a Chime account before you apply for this debit card.

Also, you can read below our topics to learn more about how the application process works!

Online application process

To apply online, you’ll need to go to the official Chime website. Then, you’ll need to provide your personal email to open an account.

After this, if you’re approved to get your account, you’ll be able to start using your Chime card in no time!

Is there an app for applying?

You’ll only be able to open your Chime account and apply for your card through the official website.

However, you’ll be able to use the app to manage all your financial needs!

Another great option: Extra Debit Card

If you’re looking for another great debit card, you can consider the Extra Debit Card! With this card, you’ll be able to build your credit score and get cashback!

So, read our blog post below to learn more and see how to apply for it!

How to apply for the Extra Debit Card online!

Looking for a debit card that can help build your credit? See the Extra Debit Card apply way may be the right option for you! Read on.

About the author / Victória Lourenço

Trending Topics

Apply for the Petal® 1 Visa® Credit Card

Get access to rewards with the Petal® 1 Visa® Credit Card. Find out how to easily apply and learn more about this unique credit offering.

Keep Reading

CashNetUSA review: Get an immediate decision!

Discover the pros and cons of CashNetUSA loans in our comprehensive review. From lightning-fast approvals to potential drawbacks!

Keep Reading

Wells Fargo Active Cash® Card review

Discover why the Wells Fargo Active Cash® card is worth considering for your next credit card. Learn about fees, rewards, and more!

Keep ReadingYou may also like

Reflex® Platinum Mastercard® review: a credit-builder card

Get this credit card with no credit history and improve y credit score. Check out our Reflex® Platinum Mastercard® review.

Keep Reading

Apply for the Unique Platinum Card

Learn how to apply for the Unique Platinum Card and get the confidence you need to build a strong score and a brighter financial future!

Keep Reading

LendKey Student Loans review: No application fee!

Discover the ins and outs of LendKey Student Loans in our review. Uncover the advantages, drawbacks, and unique features!

Keep Reading