Credit Card

Citi Custom Cash℠ Card Review

Having a credit card with a valuable rewards program can help you save a good amount of money. Read this review and see if the Citi Custom Cash Card is the right rewards credit card for you.

Advertisement

Citi Custom Cash℠ Card: The perfect credit card to maximize your rewards

Have you ever had trouble applying for a credit card? With the Citi Custom Cash℠ Card review, applying is quick and easy. In just a few minutes, you can apply and be approved instantly.

Check out this article to see how simple it is to apply for your card and enjoy its unique benefits.

How to apply for the Citi Custom Cash℠ Card?

Discover how to earn cash back on all purchases with the Citi Custom Cash℠ Card – the secret to maximizing your rewards the smart way.

- Credit Score: Good/Excellent

- APR : 0% on transfers and purchases for 15 months, then 18.74%-28.74%.

- Annual Fee: $0

- Fees: Foreign transaction fee 3%.

- Welcome bonus: In the first 6 months of account opening, get $200 after spending $1,500

- Rewards: 5% Cashback up to $500 spent.

The Citi Custom Cash℠ Card is a unique credit card with many outstanding benefits. This card offers users an easy and convenient way to earn cash rewards on every purchase they make.

With so many credit card options available on the market, it is difficult to choose which one will meet your needs. However, the Citi Custom Cash℠ Card stands out for its unique features and unmatched advantages.

Citi Custom Cash Card: a complete Overview

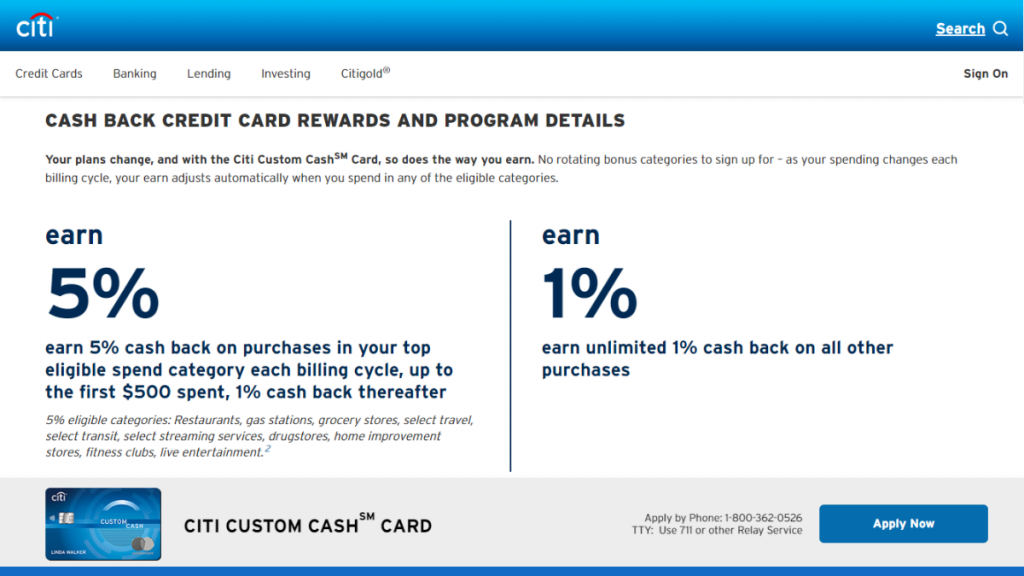

One of the main advantages of the Citi Custom Cash℠ Card is its rewards structure.

With this card, users can earn 5% cash back rewards on their chosen purchase categories, which means that you can earn cash back rewards on virtually everything you buy.

In addition, the card offers 1% cash rewards on all other purchases, making it one of the best rewards credit cards on the market.

Another great advantage of the Citi Custom Cash℠ Card is the ease of reward redemption. Users can redeem their cash rewards at any time, with no minimum redemption limit, meaning that users can get their money back on their own terms.

In addition, the card offers the option to transfer cash rewards to other bank accounts or to another person’s credit card, making the rewards redemption experience even more flexible.

The Citi Custom Cash℠ Card review also offers other exceptional benefits such as fraud protection, protection against identity theft, protection against unauthorized charges, and other benefits.

Significant benefits and disadvantages you may find

After you have seen the amazing benefits of this card, we will show you the pros and cons of using the Citi Custom Cash℠ Card. Check them out below:

Reasons you may want this card

- Cashback in customizable categories

- No annual fee

- Generous APR introduction

- Fraud protection

- Access to the Citi Entertainment platform

Why maybe you wouldn’t choose this card

- High fees and interest

- Reward limits

- High credit requirements

- Rewards redemption restrictions

Inside the application process for the Citi Custom Cash Card

Like what you see on the Citi Custom Cash Card? Apply now with our step-by-step application guide and start enjoying its exclusive benefits.

Don’t waste any more time and apply for the Citi Custom Cash Card now to start enjoying its exclusive benefits.

Apply now and become a holder of this innovative and flexible credit card that can help you achieve your financial goals.

How to apply for the Citi Custom Cash℠ Card?

Discover how to earn cash back on all purchases with the Citi Custom Cash℠ Card – the secret to maximizing your rewards the smart way.

About the author / Marcos

Trending Topics

LendingClub Personal Loans: how does it work?

Learn everything you need to know about how LendingClub Personal Loans works and make an informed decision about it for your future.

Keep Reading

Bet Anytime, Anywhere: Download the 10bet mobile app today!

Find out how to download the 10bet mobile app and gain instant access to an extensive selection of sports betting markets.

Keep Reading

Apply for the Unique Platinum Card

Learn how to apply for the Unique Platinum Card and get the confidence you need to build a strong score and a brighter financial future!

Keep ReadingYou may also like

Capitec Global One Review: Is It the Best Banking Option in South Africa?

Discover the Capitec Global One Card in this review. Your key to financial freedom with a R500,000 credit limit and cash back rewards.

Keep Reading

CashNetUSA review: Get an immediate decision!

Discover the pros and cons of CashNetUSA loans in our comprehensive review. From lightning-fast approvals to potential drawbacks!

Keep Reading

Happy Money Personal Loans: learn how it works

Explore the features of Happy Money Personal Loans and find out how it works and why they're a trusted option to get financial support.

Keep Reading