Credit Cards

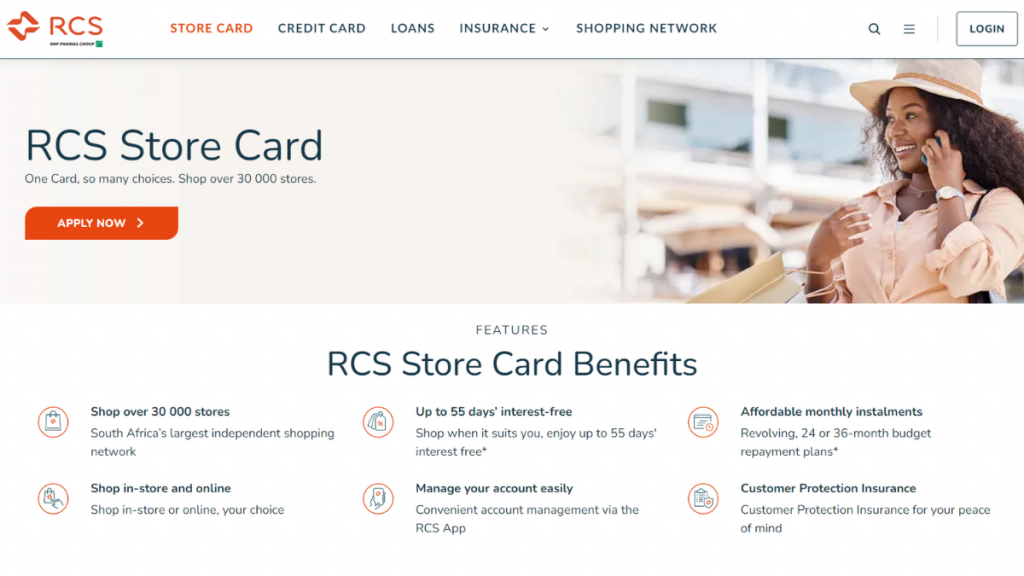

RCS Store Card Review: Unleash the Retail Paradise!

Empower your retail journey with the RCS Store Card. Unlock a world of convenience, secure shopping, and smart account management, all while enjoying up to 55 days without interest!

Advertisement

In this RCS Store Card review, we embark on a journey through the world of retail convenience. South Africa’s retail landscape is evolving, and this card is at the forefront of this transformation!

Moreover, the RCS Store Card offers shoppers an unmatched opportunity to explore a shopping network of over 30,000 stores. Explore features and the incredible retail freedom this card unlocks!

- Credit Score: Although there’s no specific credit score requirement, applicants must earn at least R1,000 a month.

- APR: N/A.

- Annual Fee: N/A.

- Fees: N/A.

- Welcome Bonus: There’s no mention of a specific welcome bonus for the RCS Store Card.

- Rewards: Unlock a world of retail rewards with the RCS Store Card, including a cashback program, loyalty points, and exclusive discounts on handpicked purchases at participating stores.

RCS Store Card: a complete overview

Firstly, this dynamic card opens the doors to an expansive network of over 30,000 stores, allowing you to explore a wide range of retail categories, from fashion to tech and DIY.

With up to 55 days of interest-free shopping, it empowers you to make informed purchasing decisions. But it doesn’t stop there. In this full RCS Store Card review, you’ll discover all the additional perks!

Besides, account management is made effortless through the RCS App, which offers features such as monthly statements, transaction alerts, and flexible budget repayment plans. It’s easy and convenient.

However, it’s important to note that the card primarily offers benefits within the RCS Shopping Network. If you’re looking for a broader financial tool, you might consider alternatives.

Reasons you may want it

- Vast retail network of over 30,000 stores

- Enjoy up to 55 days of interest-free shopping

- Benefit from a cashback program and earn loyalty points

- Receive SMS notifications on all purchases to enhance security

- Customer Protection Insurance

- Conveniently manage your account through the RCS App

Why maybe you wouldn’t choose it

- The card’s benefits are primarily applicable within the RCS Shopping Network

- Doesn’t provide the same versatility as general-purpose credit cards

- Minimum salary requirement of R1,000

Apply for RCS Store Card: easy account management, and affordability!

From fashion to tech, groceries to DIY, the RCS Store Card empowers you with choices backed by the financial flexibility of up to 55 days of interest-free shopping. See how to apply below and enjoy!

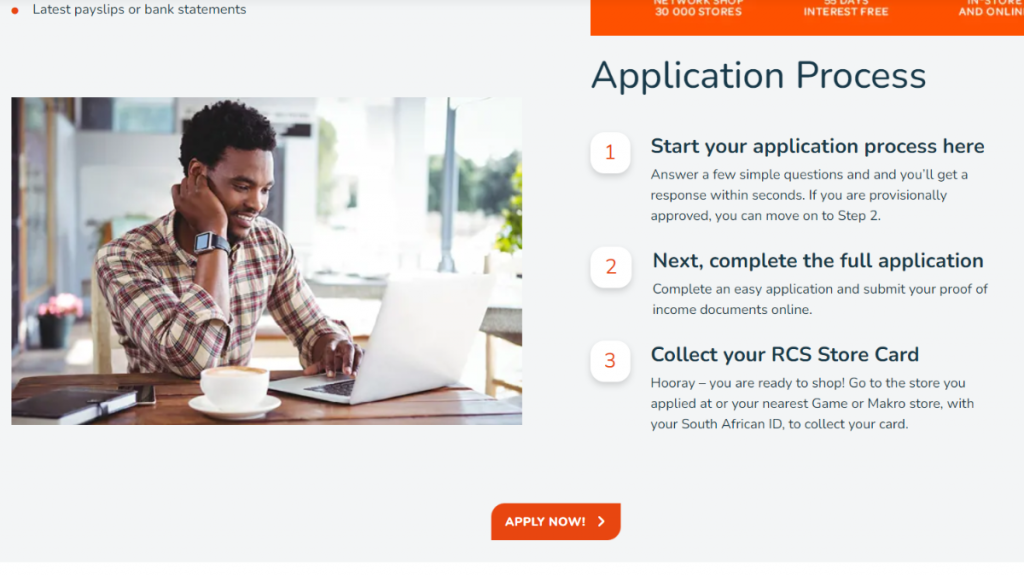

Online application process

So, review this easy guide and learn how to apply for the RCS Store Card! This credit card isn’t just about shopping, it’s your gateway to retail freedom!

- Check eligibility: Before you begin the online application, make sure you meet the eligibility criteria. This includes being 18 years or older, having a South African ID, being employed with a monthly income of R1,000 or more, and having proof of income documentation.

- Visit the official website: Then, open your web browser and go to the official website of RCS, where you’ll find the “Store Card” option on the main menu. When you click on it, you’ll access the RCS Store Card and can review its information.

- Start the application: Look for a button that says “Apply Now” and click to initiate the application process.

- Submit the application: Carefully review the information you’ve entered. Once you’re satisfied that everything is accurate, confirm your application.

- Approval: Once your full application is approved, you’ll be ready to collect your RCS Store Card. It’s that easy!

Another great option: Capitec Global One Credit Card!

If, after reading this complete review about the RCS Store Card, you still think this isn’t the right credit card for you, how about a different approach? Check out the Capitec Global One Credit Card!

With the Capitec Global One Credit Card, you get the convenience of a credit card and the benefits of a full-fledged banking solution. Uncover the features and benefits that come with this card now!

Capitec Global One Review

Discover the Capitec Global One Card in this review. Your key to financial freedom with a R500,000 credit limit and cash back rewards.

About the author / Vinicius Barbosa

Trending Topics

Bet Anytime, Anywhere: Download the 10bet mobile app today!

Find out how to download the 10bet mobile app and gain instant access to an extensive selection of sports betting markets.

Keep Reading

Fashion on a Budget? Discover Mr Price Money Account!

Experience convenient online shopping and unbeatable value at Mr Price Money in South Africa. Shop with confidence!

Keep Reading

OpenSky® Secured Visa® Credit Card review: No Credit Check!

Looking for a card that'll help you build credit with no credit checks required? Check out this OpenSky® Secured Visa® Credit Card review.

Keep ReadingYou may also like

Mastering English: Best Apps to Learn English

Discover top-rated apps to learn English! From interactive exercises to immersive platforms, explore the best tools!

Keep Reading

Build the road to financial success with these Credit Building Credit Cards!

Building credit will get easier with one of the best credit cards designed for this purpose! Get the right tool for building this road.

Keep Reading

FIT® Platinum Mastercard® review: Get a $400 line of credit!

Are you looking to boost your credit score to excellence? Check out this FIT® Platinum Mastercard® review and learn how you can do it!

Keep Reading