Rebuild your credit with the Assent Platinum Secured card's low fees, flexible deposit options, and regular credit reports to all three bureaus.

Assent Platinum Secured card: Low Fees, Flexible Deposit, and Regular Credit Reports to Help Rebuild Your Credit.

Advertisement

The Assent Platinum Secured card is an ideal choice for those looking to rebuild their credit. Its low fees, flexible deposit options, and regular credit reports to all three bureaus can help users improve their credit score. The card also offers a low purchase APR, 0% introductory APR, and a refundable security deposit.

The Assent Platinum Secured card is an ideal choice for those looking to rebuild their credit. Its low fees, flexible deposit options, and regular credit reports to all three bureaus can help users improve their credit score. The card also offers a low purchase APR, 0% introductory APR, and a refundable security deposit.

You will remain in the same website

Are you looking for ways to build your credit score? If so, then it's time to look into a secured credit card, like the Assent Platinum Secured Credit Card. Meet its benefits below!

A credit score of 300 or higher is recommended to be eligible for the card. This is generally considered a poor credit score, which means you do not need to worry about your credit situation when you apply for this card. It is a card meant for individuals with poor credit, so virtually anyone can apply.

The Assent Platinum Secured card has an annual fee of $49.

The card charges a cash advance fee of $10 or 3%, whichever is greater, and a foreign transaction fee of 3%. Late payments may also incur a fee of up to $40, and returned payments may result in a fee of $29.

It may take up to three weeks to receive the card after approval. Users can pay a $19.95 fee for expedited processing, which will prioritize their application, but it will still take up to seven days to receive the card.

Excited about the Assent Platinum Secured card? Click the link below to access our application guide and apply for it in just a few minutes.

How to apply for the Assent Platinum Secured

Learn how to get a card that will help you improve your credit with a little help from our Assent Platinum Secured card application guide.

Are you seeking a way to enhance your credit rating? The Reflex® Platinum Mastercard® may be just what you need.

This card comes with a $1,000 starting credit line, which can increase to $2,000 if you make your payments on time.

It’s an ideal choice for those with poor or limited credit who want to improve their credit score and qualify for superior offers.

To discover all the details, click on the link below and start your journey toward better credit.

How to get your Reflex® Platinum Mastercard®

Get this card in just a few minutes and start building credit with a little help from our Reflex® Platinum Mastercard® application guide.

Trending Topics

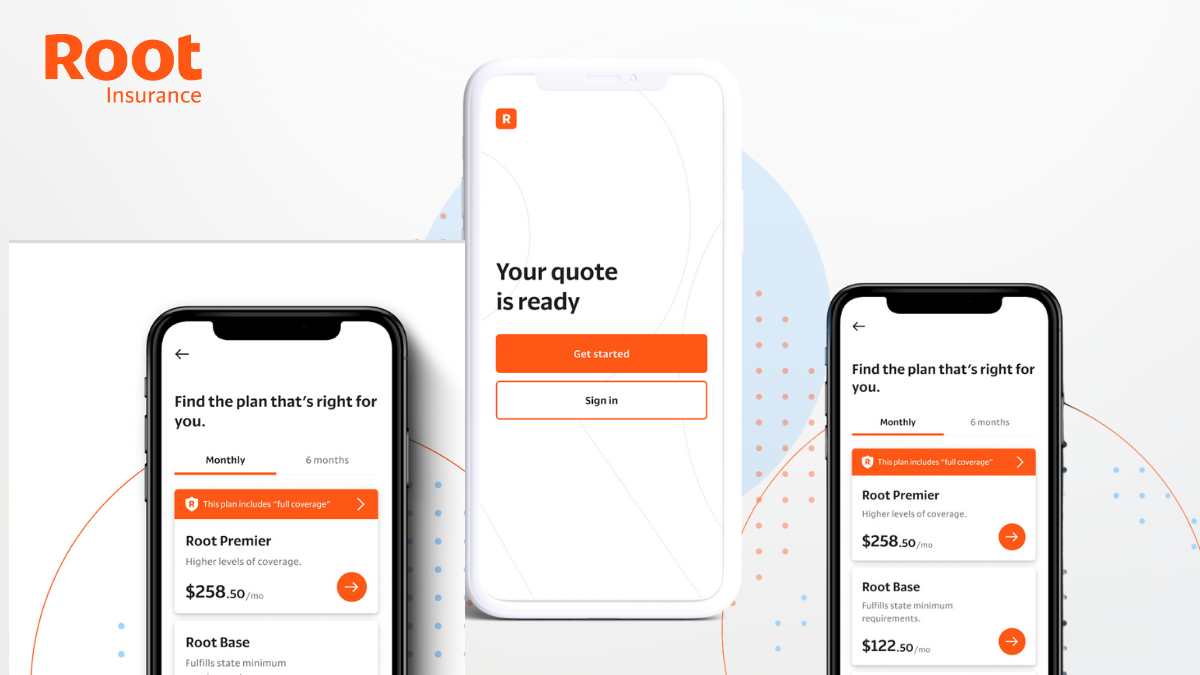

Root Car Insurance: Drive Smart, Save Big

Uncover the innovative approach of Root Car Insurance as we dive into its transparent pricing model and mobile app convenience.

Keep Reading

Discover which credit card has the best rewards for travel!

You can find the right credit card with the best rewards for travel by reading our list with the ones that can meet your travel needs!

Keep Reading

NetFirst Platinum Card review

Check out this NetFirst Platinum Card review to learn how you can get an unsecured merchandise credit line with no credit checks!

Keep ReadingYou may also like

Apply for the Capital One Walmart Rewards® Mastercard®

Check out this Capital One Walmart Rewards® Mastercard® application guide to learn how to apply for this card in just a few minutes

Keep Reading

Fashion on a Budget? Discover Mr Price Money Account!

Experience convenient online shopping and unbeatable value at Mr Price Money in South Africa. Shop with confidence!

Keep Reading

OpenSky® Secured Visa® Credit Card review: No Credit Check!

Looking for a card that'll help you build credit with no credit checks required? Check out this OpenSky® Secured Visa® Credit Card review.

Keep Reading