We recommend you the Capitec Global One Credit Card – exclusive rewards for you!

The Capitec Global One Card offers zero currency conversion fees and more!

Advertisement

Are you ready to take control of your financial journey? The Capitec Global One Credit Card is your ticket to a smarter, more convenient way of managing your money. It’s not just a credit card, it’s a powerful financial tool that adapts to your unique lifestyle. Apply online, in-branch, or through the app, and embark on a journey towards financial convenience and control.

Are you ready to take control of your financial journey? The Capitec Global One Credit Card is your ticket to a smarter, more convenient way of managing your money. It’s not just a credit card, it’s a powerful financial tool that adapts to your unique lifestyle. Apply online, in-branch, or through the app, and embark on a journey towards financial convenience and control.

You will remain in the same website

Are you ready to unlock a world of financial possibilities? The Capitec Global One Credit Card is your passport to a smarter way of managing your money. Read on to see the key benefits that make this credit card a standout choice!

In the world of personal finance, having a reliable credit card that complements your lifestyle can make all the difference. So, delve into the benefits and drawbacks of the Capitec Global One Credit Card, to make an informed decision!

Upsides and benefits of the Capitec Global One Credit Card

- Generous Credit Limit: With a credit limit of up to R500,000, this card provides the financial flexibility to make significant purchases and investments tailored to your needs.

- Cash Back Rewards: The Capitec Global One Credit Card offers a unique cashback system. You’ll receive a guaranteed 1% cash back on all your transactions. What’s more, when you meet your monthly banking goals, you can earn an extra 0.5% cash back. It’s like getting paid to manage your finances!

- Zero Currency Conversion Fees: Say goodbye to the nuisance of currency conversion fees when using your card for international transactions. Travel with ease, knowing you won’t be burdened by additional charges.

- Extended Interest-Free Period: Need a bit of financial breathing space? This card provides an interest-free period of up to 55 days, allowing you to manage your expenses with greater flexibility.

Drawbacks of the Capitec Global One Credit Card

- Initiation Fee: To get started, you’ll encounter an initiation fee of R100, which could be considered a minor upfront cost.

- Monthly Fee: There’s a monthly fee of R50 associated with the card. While this fee covers various features and services, it’s important to consider it in your financial planning.

- Variable Interest Rates: The interest rates for this card range from 11.75% to 22.25%, based on your credit profile.

- Minimum Salary Requirement: To be eligible for this credit card, a minimum salary of R5,000 is required for salaried individuals and R10,000 for self-employed clients.

The Capitec Global One Credit Card is a financial product offered by Capitec Bank, a South African financial institution known for its innovative and customer-centric approach. This credit card is designed to provide individuals with a range of features and benefits that aim to enhance their financial convenience and flexibility.

Yes, you can enjoy up to 55 days of interest-free credit, ensuring greater financial flexibility and potentially reduced interest costs. Besides, the card is designed for secure online shopping with trusted retailers, providing peace of mind for your online purchases. You’ll also receive free travel insurance coverage of up to R5 million for added security during your journeys.

No, there are no currency conversion fees when using the Capitec Global One Credit Card for international transactions. This feature makes it a convenient choice for travelers and individuals who frequently make purchases in foreign currencies, as it eliminates the additional charges typically associated with currency conversion.

Ready to transform the way you manage your finances? Unlock a world of financial flexibility and rewards with the Capitec Global One Credit Card. It’s your passport to convenience, control, and rewards!

Don’t miss the opportunity to discover how this credit card can enhance your financial well-being. Check out an in-depth review that reveals all the details about this amazing financial tool!

Capitec Global One Review

Discover the Capitec Global One Card in this review. Your key to financial freedom with a R500,000 credit limit and cash back rewards.

However, do you want to elevate your travel experiences to a new level of luxury? While the Capitec Global One Credit Card offers valuable perks, there’s a world of high-end travel benefits waiting to be explored.

If you’re seeking premium rewards, exclusive lounge access, and unparalleled travel experiences, explore our list now! Discover the finest credit card options available, and take your next journey to a level!

The Best Credit Cards for Luxury Travel

Travel in luxury without breaking the bank! Discover which credit cards offer the most rewarding experiences for discerning travelers and explore the world in style.

Trending Topics

Capital One Walmart Rewards® Mastercard® Review

Read this article to find out Capital One Walmart Rewards® Mastercard® review for you and start saving on your Walmart purchases today.

Keep Reading

Unlocking the Perks: A Comprehensive Review of the Boost Platinum Credit Card

Ready to boost your shopping game? We've got the scoop on the Boost Platinum Credit Card review. Find out if it's the perfect fit!

Keep Reading

MoneyKey review: Quick loans!

Explore the world of MoneyKey Loans in our latest review, uncovering how this lender breaks barriers by offering financial solutions!

Keep ReadingYou may also like

Apply for the NetFirst Platinum Card

Learn how to apply for the NetFirst Platinum Card and get an unsecured merchandise credit limit to use at My Horizon Outlet online store!

Keep Reading

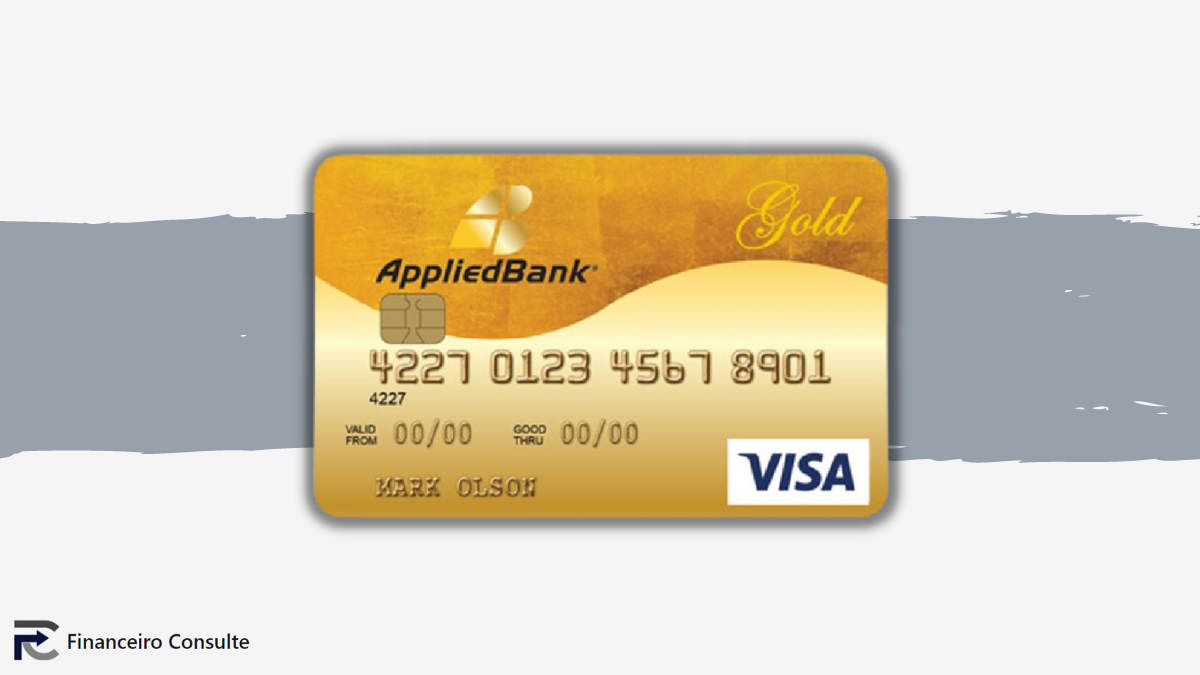

Apply for the Applied Bank® Gold Preferred® Secured Visa®

Get security and financial power even without credit history with Applied Bank® Gold Preferred® Secured Visa® apply.

Keep Reading

Watch NFL Games Online with these Apps!

Watch your favorite NFL teams go head-to-head online with these mobile apps. Stream games anytime, anywhere.

Keep Reading