Loans (US)

MoneyKey review: Quick loans!

Considering a loan? Dive into MoneyKey Loans to understand the nuances of this financial service. From inclusive lending practices to potential pitfalls like state-specific APR rates!

Advertisement

MoneyKey review: Simple application!

In the complex landscape of financial solutions, finding a lending partner that aligns with your unique needs is crucial. So, you can read our MoneyKey Loans review!

In today’s blog post, we delve into the world of MoneyKey Loans, aiming to provide you with a comprehensive review that explores both the pros and cons of this lending option.

- APR: 279.50% to 307.10%;

- Loan Amount: Up to $2,500 in loan amounts;

- Loan Purpose: Installment loans, lines of credit, payday loans, and other loans for personal reasons;

- Credit Needed: You can find a loan that meets your needs even with a not-so-good credit score;

- Origination fee: There can be origination fees;

- Late Fee: You’ll need to pay late fees;

- Terms: Up to 18 months;

- Early Payoff Penalty: N/A.

MoneyKey: A Complete Overview

A flexible and easily accessible choice in the financial loan market is MoneyKey Loans.

Also, serving people with a range of financial difficulties, MoneyKey sets itself apart by providing loans to those with low scores.

Reasons you may want it

You can find incredible perks that this lender offers. Therefore, you can read the main perks of MoneyKey in out topics below!

Low credit acceptance

Those with negative credit have a helpful possibility to obtain cash with MoneyKey Loans.

Also, MoneyKey is aware that financial difficulties can impact credit records, in contrast to traditional lenders who frequently place a high value on credit ratings.

Up to $2,500

The flexibility MoneyKey Loans provides with regard to loan quantities is one of its primary features. You may be eligible for a loan of up to $2,500, depending on your financial circumstances.

Moreover, this flexibility guarantees that borrowers may customize their loans to fit their specific requirements.

Quick funding

MoneyKey is aware that, in cases of financial difficulty, timing is frequently crucial. Because it emphasizes timeliness, the lender strives to approve loans by 2:30 p.m. ET, Monday through Friday.

Moreover, MoneyKey is renowned for its speedy processing; if your loan is accepted within the allotted period, you might often receive your money the same business day.

Good amounts

MoneyKey lets users take out as little as $200 if they just need a small amount to cover a shortfall (the minimum in Mississippi is $550).

Also, this is a really useful alternative for those who are struggling and only need a little cash to get by.

Moreover, in situations when larger loans may not be necessary, MoneyKey’s capacity to borrow smaller amounts may be a practical and affordable alternative.

Also, this satisfies the diverse demands of its borrowers.

Why maybe you wouldn’t choose it

Although this lender offers some great perks, such as accepting those with low scores, it also has some downsides. Therefore, you can read the main cons of this lender below!

High APR rates

While MoneyKey Loans offers financial support, there are certain drawbacks to be aware of, especially when it comes to the annual percentage rate (APR) in some regions.

Also, extremely high Annual Percentage Rates (APR) may apply to borrowers in some areas, potentially raising the cost of borrowing significantly.

Not in all states

The fact that MoneyKey Loans are not widely available in the US is another significant disadvantage.

Also, the loan’s state-specific restrictions may be a significant detriment to citizens in states where MoneyKey does not provide its services.

Not so good for those who need high amounts

While MoneyKey Loans provide you flexibility in loan sizes, they might not be the best option for people who desire a sizable sum of money.

Therefore, you must look into other lenders if your needs exceed MoneyKey’s $2,500 maximum loan limit.

Hidden fees until the application

It’s important to remember that MoneyKey Loans might have high fees. Until the loan application is submitted and the borrower verifies that they are a client, MoneyKey retains its fees.

Moreover, origination fees and late payment penalties can significantly raise the overall cost of the loan and have a detrimental impact on borrowers’ ability to make ends meet.

Apply for MoneyKey

You can learn easy ways to apply for a loan through this lender. However, you need to know about the requirements before you start the application process. So, read some below!

- Be the legal age of the state where you live;

- Have a bank account;

- You’ll need to have a regular source of income.

There can be some other requirements. So, read below to see how the application process works!

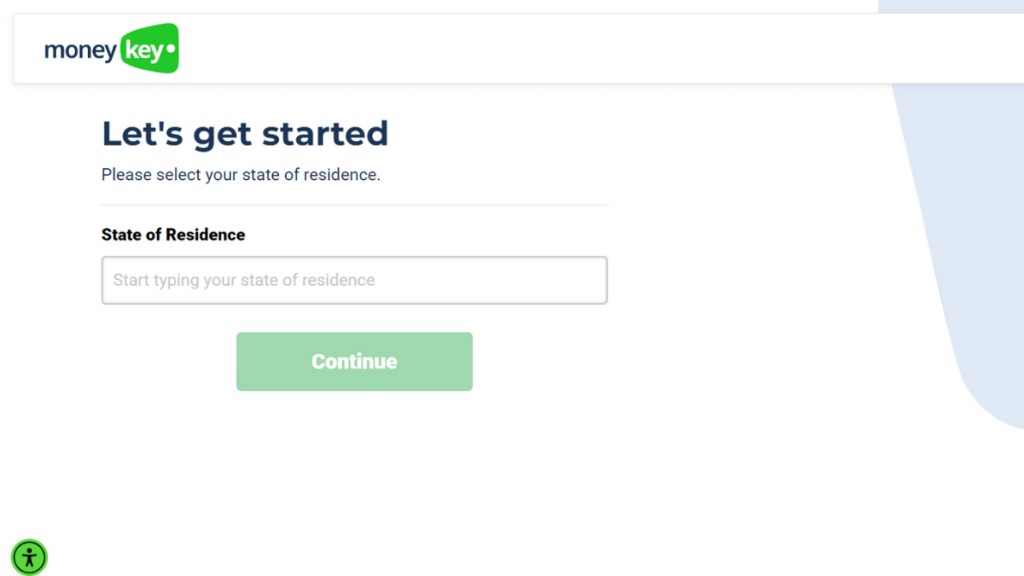

Online application process

To start the application process, you’ll need to go to the official website. Then, you’ll need to provide the personal information required and maybe some documents.

After all of this, you’ll be able to wait for a quick response on your application and maybe get your funds in as little as one business day.

Is there an app for applying?

There is not much information about the apps available to manage your loan with MoneyKey or to apply.

Therefore, you can use the official website to complete the application process.

Another great option: MoneyLion Loans

If you’re not so sure about getting a loan through MoneyKey loans, we can help you! So, you can try getting a loan through MoneyLion Loans!

Therefore, with this lender, you’ll be able to get up to $10,000 in loan amounts and much more!

So, you can read our blog post below to learn even more about this lender and find out how the application process works!

MoneyLion Loans review: No overdraft fees!

Discover the ins and outs of MoneyLion Loans in our comprehensive review! Explore the benefits of quick access to flexible repayment options!

About the author / Victória Lourenço

Trending Topics

Apply for the Unique Platinum Card

Learn how to apply for the Unique Platinum Card and get the confidence you need to build a strong score and a brighter financial future!

Keep Reading

Apply for the Petal® 1 Visa® Credit Card

Get access to rewards with the Petal® 1 Visa® Credit Card. Find out how to easily apply and learn more about this unique credit offering.

Keep Reading

Navigating Your Finances: A Review of the Brink’s Prepaid Mastercard®

Discover the pros and cons of Brink's Prepaid Mastercard® in our in-depth review. Is it the right financial tool for you? Find out now!

Keep ReadingYou may also like

Discover the Best Apps to Learn Spanish and Master the Language

Looking for the best apps to learn Spanish? Discover our top recommendations for the best apps to learn Spanish!

Keep Reading

The best ways to make money online!

Discover a world of opportunities with our blog post on the best ways to make money online! From freelancing to affiliate marketing!

Keep Reading

Extra Debit Card Review: the perfect card to start your credit journey

Do you want a practical and safe option to make your purchases without having to worry about interest rates? Read the Extra Debit Card review

Keep Reading