Are you looking for a smart and convenient way to build and establish a strong credit score?

With the Total Visa® Card, you’ll regain your buying power and enjoy all the best Visa® benefits while you increase your credit rating!

Advertisement

The Total Visa® Card offers a reliable and secure way to build your credit score while enjoying the convenience of a credit card. With manageable monthly payments and acceptance at millions of locations, this card is the perfect tool for anyone looking to improve their financial standing and start taking control of their financial future. See our full review to learn more!

The Total Visa® Card offers a reliable and secure way to build your credit score while enjoying the convenience of a credit card. With manageable monthly payments and acceptance at millions of locations, this card is the perfect tool for anyone looking to improve their financial standing and start taking control of their financial future. See our full review to learn more!

You will remain in the same website

Are you looking to build and maintain a strong credit history? The Total Visa® Card can provide you with the tools and resources necessary to help establish a strong foundation of credit. See some of its incredible features below!

To increase your Total Visa® Card credit limit, you can contact the card issuer’s customer service department and request a credit limit increase. Before doing so, make sure to have a good payment history and demonstrate responsible credit usage for at least 6 months, as this can increase your chances of approval. You may also be required to provide updated financial information, such as income or employment status, to support your request.

To check your Total Visa® Card balance, you can either log in to your online account on the card issuer’s website or mobile app or call the customer service number located on the back of your card. You can also check your balance by reviewing your monthly statement, which will show your current balance, available credit, and recent transactions.

The Total Visa® Card typically arrives within 7-10 business days after your application has been approved. However, delivery times may vary depending on your location and the shipping method used by the card issuer. If you need the card faster than 7 days, you can pay $35 for expedited shipping.

If you’d like to learn more about the features and special benefits of the Total Visa® Card as well as how you can apply for it, check the following link.

How to apply for the Total Visa® Card?

Looking for ways to boost your credit score? Find out how you can apply for the Total Visa® Card and get on the road to financial success!

But if you want to see a good alternative instead, see the link below for the QuicksilverOne Credit Card. We’ll look over its features and show you how to apply for it online.

How to apply for the QuicksilverOne Card?

Learn how to quickly apply for the QuicksilverOne Credit Card and take advantage of its amazing features and rewards!

Trending Topics

Revvi Card review: earn cash back to build credit

Check out our Revvi Card review to learn how you can build and establish a strong credit score while earning cash back rewards!

Keep Reading

Pre-approval for House Loan: House Hunting Made Easy!

Pre-approval is your essential first step in securing a house loan or mortgage and navigating the competitive real estate market effectively!

Keep Reading

Maximize Your Efficiency: Best Apps for Productivity

Discover the ultimate productivity arsenal! Explore the best apps for productivity, apps for task management, time tracking, and more!

Keep ReadingYou may also like

GoVa Loans Review: A Comprehensive Analysis of the Mortgage Lending Service!

Home financing redefined! Find out how GoVa Loans can make buying a home a stress-free experience in this comprehensive post!

Keep Reading

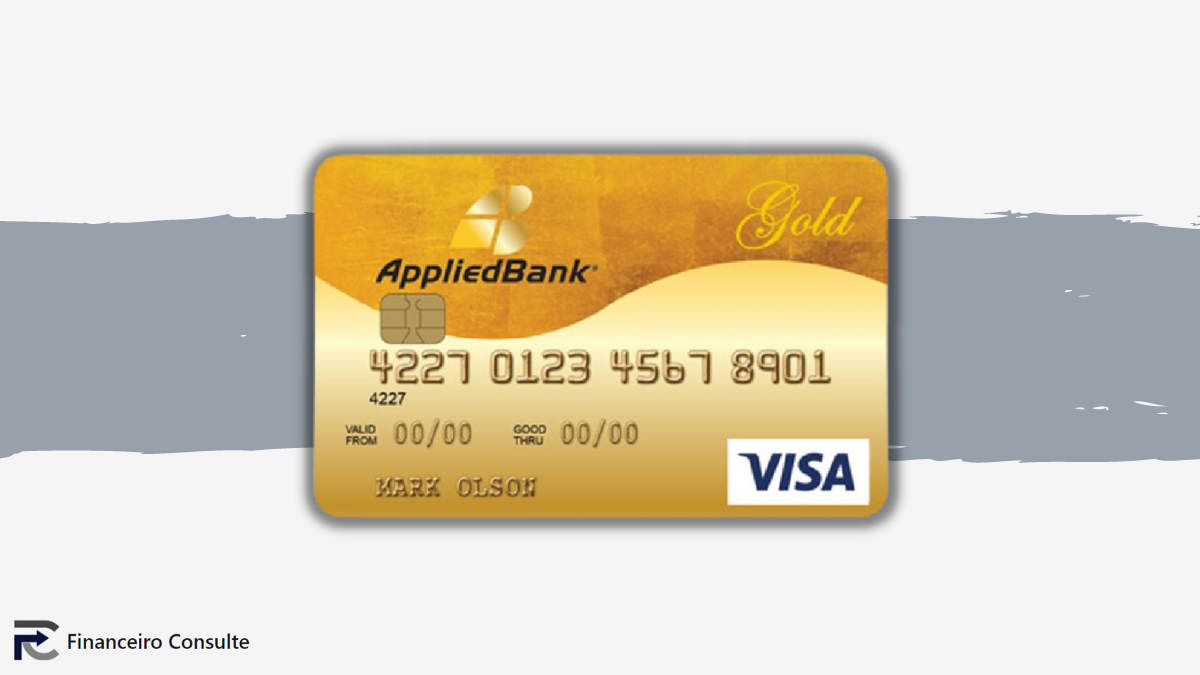

Apply for the Applied Bank® Gold Preferred® Secured Visa®

Get security and financial power even without credit history with Applied Bank® Gold Preferred® Secured Visa® apply.

Keep Reading

Top Credit Report Apps to Trust with Your Information

Unlock financial control and security with the best apps to check your credit report! Trustworthy, user-friendly, and secure. Learn more!

Keep Reading