Credit Card

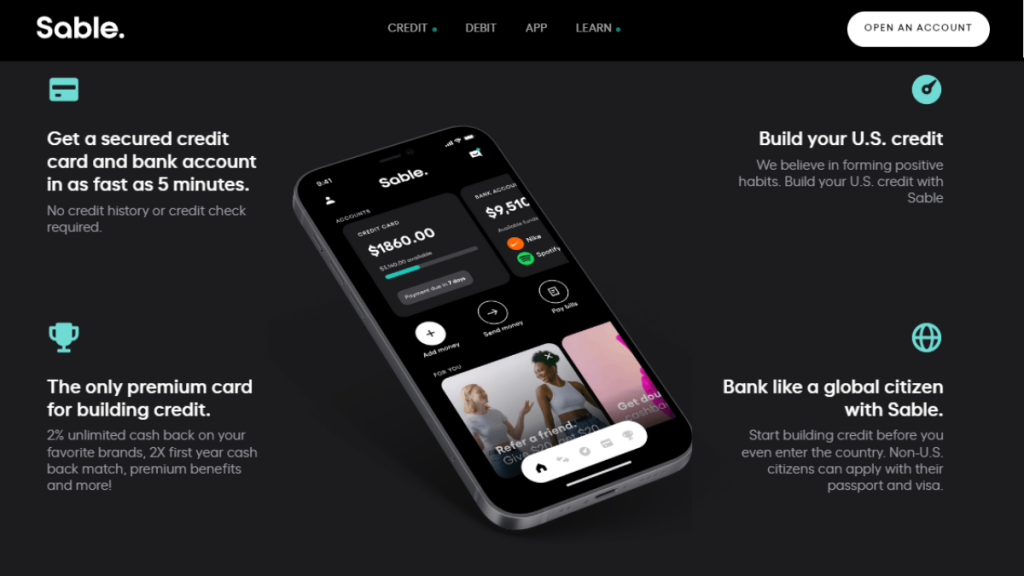

Sable Secured card review: Upgrade to a Traditional Credit Card in Just Four Months

With this card you will get 2% cash back on major streaming services and much more. Check out our Sable Secured card review.

Advertisement

Build Credit and Earn Cash Back with a No Credit Check, No Annual Fee Card That Offers Generous Rewards and Benefits

Looking for a card that can help you build credit, earn cash back, and offer generous rewards and benefits? Read our Sable Secured card review because it might just be what you need.

How to apply for the Sable Secured card?

Ready to start earning up to 2% cash back with a single credit card? Then just follow our Sable Secured card application guide and get yours.

- Credit Score: Poor to Bad (580-669)

- APR: 10.49% variable

- Annual Fee: $0

- Fees: 2% foreign transaction fee

- Welcome bonus: Sable will match all the cash back you’ve earned at the end of your first year.

- Rewards: Unlimited 2% cash back on purchases made with Amazon, Hulu, Netflix, Spotify, Uber Eats, and Whole Foods, as well as 1% everywhere else.

The Sable Secured card is an excellent option for those new to credit or trying to rebuild credit. Read on to find out why. If you want to learn more about it, just keep reading the review below.

Sable Secured card: a complete overview

Let’s dive into our Sable Secured card review. This is the best option for new-to-US and rebuilding credit consumers.

The Sable Secured Card is also an excellent option for those without a US credit history or social security number.

The card also provides up to 2% cash back, and there is no credit check, so there is no effect on the credit score.

Additionally, the application process is seamless, and getting approved is easy. The Sable Secured Card has no annual fee and offers a generous welcome bonus.

Also, you’ll earn unlimited 2% cash back on purchases with a number of companies. They include Amazon, Hulu, Netflix, Spotify, Uber Eats, and Whole Foods. You’ll also earn 1% everywhere else.

Beyond the cash-back rewards and annual match, Sable offers benefits when you use your card that you would traditionally find with an unsecured credit card.

Also, according to Sable’s website, secured cardholders can graduate to a traditional credit card. You can do that in as little as four months after opening your account.

In addition, sable reports to the credit bureaus monthly. So you can see your credit score effectively increase when you exhibit responsible behavior.

The Sable Secured Card has no annual fee nor late payment penalty fee. However, there is a 2% foreign transaction fee on purchases made outside the U.S.

The Sable Secured Card charges a 10.49% variable APR, which is considerably low compared to other credit cards.

So now let’s have a look at some reasons why you may or may not want to acquire this credit card.

Reasons you may want it

The Sable Secured card is a great choice if you don’t have a US credit history, have limited or bad credit, or even no US citizenship.

With no credit check requirements, cardholders can earn up to 2% cash back. Plus, the Sable Secured card offers benefits, including cell phone protection, rental car insurance, and extended warranty coverage.

The low annual fee and easy application process make it a cost-effective way to build or rebuild credit.

Also, secured cardholders can graduate to a traditional credit card in as little as four months after opening their account.

Why maybe you wouldn’t choose it

While the Sable Secured card has its advantages, there are some reasons why it may not be the right fit for everyone.

The 2% cash back has a cap for specific categories, which may not suit your spending habits. The credit line is also equal to the security deposit, so if you can’t put down a substantial deposit, you may not be able to charge high-cost items or many expenses.

There is also a 2% foreign transaction fee, which can add up for those who frequently travel or shop internationally.

Additionally, upgrading to an unsecured credit card requires meeting specific criteria, which may not be achievable for everyone.

Inside the application process for Sable Secured card

Want to apply for the Sable Secured card? Our application guide can walk you through the process in just a few minutes. Click the link below to get started today.

How to apply for the Sable Secured card?

Ready to start earning up to 2% cash back with a single credit card? Then just follow our Sable Secured card application guide and get yours.

About the author / Danilo Pereira

Trending Topics

Chime Visa® Debit Card review: Redefining Banking with Simplicity and Savings

Discover the banking revolution with the Chime Visa® Debit Card review! No branches, no problem—experience digital convenience at its finest.

Keep Reading

Navy Federal Visa Signature® Flagship Rewards review: earn points

Explore the Navy Federal Visa Signature® Flagship Rewards review card: high rewards, low APR, Amazon Prime perks & accessible membership.

Keep Reading

Fashion on a Budget? Discover Mr Price Money Account!

Experience convenient online shopping and unbeatable value at Mr Price Money in South Africa. Shop with confidence!

Keep ReadingYou may also like

Capital One Quicksilver Cash Rewards Credit Card review

In this Capital One Quicksilver Cash Rewards Credit Card review you will learn about this card's cashback rewards!

Keep Reading

American Home Shield Repair Insurance: Say Goodbye to Surprise Expenses

Get the full scoop on how American Home Shield Repair Insurance can save you time and money on home repairs.

Keep Reading

Apply for the Chase Bank: outstanding bank accounts

Find out how Chase Bank apply has helped more than 50 million customers achieve their financial goals. See more here.

Keep Reading