Establish a positive credit history and build towards financial stability with this secured credit card.

First Latitude Platinum Mastercard® Secured Credit Card: Cash Back Rewards and Credit Building Benefits.

Advertisement

The First Latitude Platinum Mastercard Secured Credit Card is an excellent choice for those looking to build or establish their credit history. With a low deposit requirement, 1% cash back rewards, and reporting to all three credit bureaus, this card can help cardholders take control of their credit and earn rewards for responsible use.

The First Latitude Platinum Mastercard Secured Credit Card is an excellent choice for those looking to build or establish their credit history. With a low deposit requirement, 1% cash back rewards, and reporting to all three credit bureaus, this card can help cardholders take control of their credit and earn rewards for responsible use.

You will remain in the same website

Check out some of the benefits you’ll get with the First Latitude Platinum Mastercard® Secured Credit Card

A secured credit card is a type of credit card that requires a cash deposit as collateral. The deposit amount typically equals the credit line.

The First Latitude Platinum Mastercard Secured Credit Card requires a minimum deposit of $100 to open the account. The deposit you make will serve as collateral for your credit line. The amount you deposit determines your credit limit, which can range from $100 to $2,000. If you make the minimum deposit of $100, your credit limit will be $100 (minus the $25 annual fee for the first year). After the first year, the annual fee will be $35. The deposit is fully refundable when you close the account, as long as you don’t have any outstanding charges or fees.

Many secured credit cards do not offer rewards, but the First Latitude Platinum Mastercard Secured Credit Card offers 1% cash back rewards on payments made to the account.

Yes, the card reports to all three major credit bureaus: Experian, Equifax, and TransUnion. How can I improve my credit score with a secured credit card?

The best way to improve your credit score with a secured credit card is to make small purchases and pay them off in full each month. This will demonstrate responsible use of credit and help build positive payment history. Additionally, keeping your credit utilization low (using less than 30% of your available credit) can also help improve your score over time.

Interested in the First Latitude Platinum Mastercard® Secured Credit Card? Our application guide will show you how to apply in just a few minutes. Click the link below.

Apply For The First Latitude Platinum Mastercard®!

In this First Latitude Platinum Mastercard® Secured Credit Card application guide you will learn how to get this card fast.

Are you not quite ready to apply for the aforementioned card? No problem. Take a look at an alternative before coming to a decision. Allow us to introduce the Sam’s Club Credit Plus Member Mastercard.

For those who frequently shop at Sam’s Club and desire to obtain rewards while saving money on fuel, this card might be the perfect choice.

This card provides a cashback program that offers up to 5% cashback on fuel, 3% cashback on dining and travel, and 1% cashback on all other purchases.

Would you like to learn more about this card’s perks? Click on the link below to access our comprehensive review.

Apply For Sam’s Club Credit Plus Member Mastercard

Ready to start earning cash back and saving on fuel? Then follow our Sam’s Club Credit Plus Member Mastercard application guide.

Trending Topics

Destiny Mastercard® review: no collateral needed!

In this Destiny Mastercard® review you will see how easy it is to get this card with no security deposit, and pre-qualification.

Keep Reading

Walmart Money Card review: Cashback & Fees Decoded

Discover the perks and costs of the Walmart Money Card in our review. From cashback rewards to fees, make an informed choice!

Keep Reading

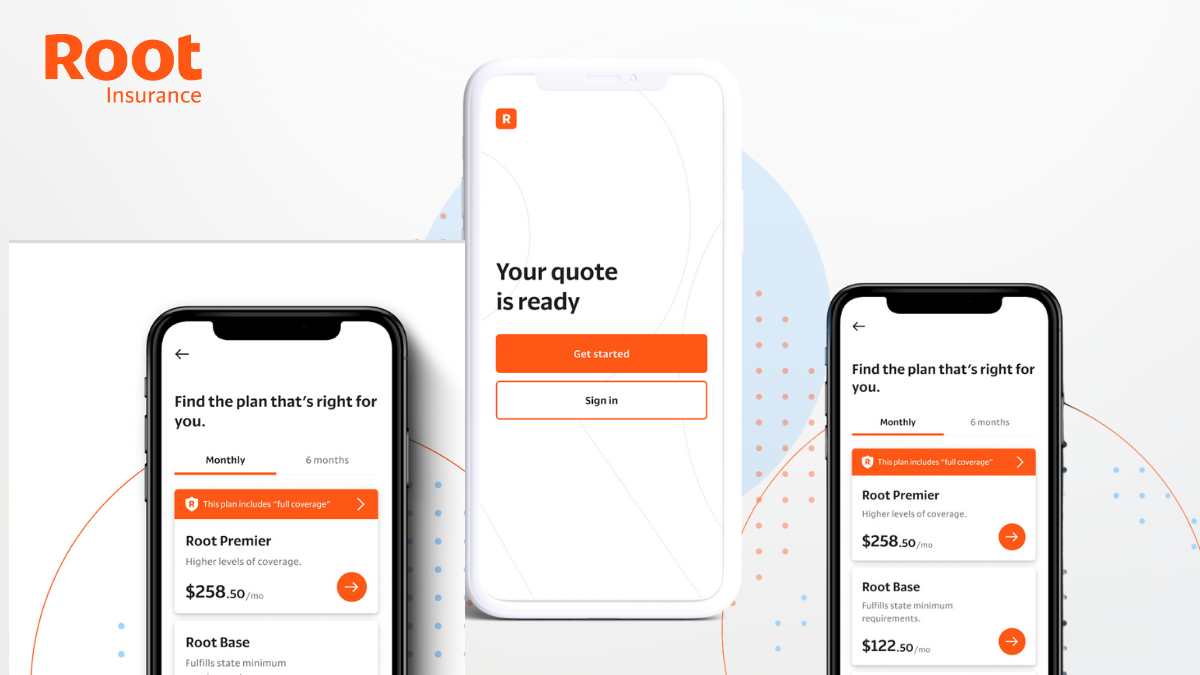

Root Car Insurance: Drive Smart, Save Big

Uncover the innovative approach of Root Car Insurance as we dive into its transparent pricing model and mobile app convenience.

Keep ReadingYou may also like

Score Big with the Best iOS Apps to Watch Sports Online!

Dive into the realm of sports streaming apps for iOS and check out the best iOS apps to watch sports online!

Keep Reading

Upgrade Triple Cash Rewards Card review: 3% Cash Back on Home, Auto, and Health Purchases

Check out this Upgrade Triple Cash Rewards Card review and learn about this card's 3% cash back on home, auto, and health purchases.

Keep Reading

Easy Guide to Amex Membership Rewards: points worth and eligible cards

Unlock a world of possibilities with AMEX Membership Rewards points. Learn how to earn, redeem, and maximize the value of your rewards!

Keep Reading